MetLife 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accounting for equity method investments, including how an equity method investment should initially be measured, how it should be

tested for impairment, and how changes in classification from equity method to cost method should be treated. EITF 08-6 is effective

prospectively for fiscal years beginning on or after December 15, 2008. The Company does not expect the adoption of EITF 08-6 to have a

material impact on the Company’s consolidated financial statements.

In November 2008, the FASB ratified the consensus on EITF Issue No. 08-7, Accounting for Defensive Intangible Assets (“EITF 08-7”).

EITF 08-7 requires that an acquired defensive intangible asset (i.e., an asset an entity does not intend to actively use, but rather, intends to

prevent others from using) be accounted for as a separate unit of accounting at time of acquisition, not combined with the acquirer’s

existing intangible assets. In addition, the EITF concludes that a defensive intangible asset may not be considered immediately abandoned

following its acquisition or have indefinite life. The Company will apply the guidance of EITF 08-7 prospectively to its intangible assets

acquired after fiscal years beginning on or after December 15, 2008.

In April 2008, the FASB issued FSP No. FAS 142-3, Determination of the Useful Life of Intangible Assets (“FSP 142-3”). FSP 142-3

amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a

recognized intangible asset under SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). This change is intended to improve

the consistency between the useful life of a recognized intangible asset under SFAS 142 and the period of expected cash flows used to

measure the fair value of the asset under SFAS 141(r) and other GAAP. FSP 142-3 is effective for financial statements issued for fiscal years

beginning after December 15, 2008, and interim periods within those fiscal years. The requirement for determining useful lives and related

disclosures will be applied prospectively to intangible assets acquired as of, and subsequent to, the effective date.

Derivative Financial Instruments

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities —An Amendment of

FASB Statement No. 133 (“SFAS 161”). SFAS 161 requires enhanced qualitative disclosures about objectives and strategies for using

derivatives, quantitative disclosures about fair value amounts of and gains and losses on derivative instruments, and disclosures about

credit-risk-related contingent features in derivative agreements. SFAS 161 is effective for financial statements issued for fiscal years and

interim periods beginning after November 15, 2008. The Company will provide all of the material required disclosures in the appropriate

future interim and annual periods.

Other Pronouncements

In December 2008, the FASB issued FSP No. FAS 132(r)-1, Employers’ Disclosures about Postretirement Benefit Plan Assets

(“FSP 132(r)-1”). FSP 132(r)-1 amends SFAS No. 132(r), Employers’ Disclosures about Pensions and Other Postretirement Benefits to

enhance the transparency surrounding the types of assets and associated risks in an employer’s defined benefit pension or other

postretirement plan. The FSP requires an employer to disclose information about the valuation of plan assets similar to that required under

SFAS 157. FSP 132(r)-1 is effective for fiscal years ending after December 15, 2009. The Company will provide all of the material required

disclosures in the appropriate future annual period.

In September 2008, the FASB ratified the consensus on EITF Issue No. 08-5, Issuer’s Accounting for Liabilities Measured at Fair Value

with a Third-Party Credit Enhancement (“EITF 08-5”). EITF 08-5 concludes that an issuer of a liability with a third-party credit enhancement

should not include the effect of the credit enhancement in the fair value measurement of the liability. In addition, EITF 08-5 requires

disclosures about the existence of any third-party credit enhancement related to liabilities that are measured at fair value. EITF 08-5 is

effective beginning in the first reporting period after December 15, 2008 and will be applied prospectively, with the effect of initial

application included in the change in fair value of the liability in the period of adoption. The Company does not expect the adoption of

EITF 08-5 to have a material impact on the Company’s consolidated financial statements.

In June 2008, the FASB ratified the consensus on EITF Issue No. 07-5, Determining Whether an Instrument (or Embedded Feature) Is

Indexed to an Entity’s Own Stock (“EITF 07-5”). EITF 07-5 provides a framework for evaluating the terms of a particular instrument and

whether such terms qualify the instrument as being indexed to an entity’s own stock. EITF 07-5 is effective for financial statements issued

for fiscal years beginning after December 15, 2008 and must be applied by recording a cumulative effect adjustment to the opening

balance of retained earnings at the date of adoption. The Company does not expect the adoption of EITF 07-5 to have a material impact on

its consolidated financial statements.

In February 2008, the FASB issued FSP No. FAS 140-3, Accounting for Transfers of Financial Assets and Repurchase Financing

Transactions (“FSP 140-3”). FSP 140-3 provides guidance for evaluating whether to account for a transfer of a financial asset and

repurchase financing as a single transaction or as two separate transactions. FSP 140-3 is effective prospectively for financial statements

issued for fiscal years beginning after November 15, 2008. The Company does not expect the adoption of FSP 140-3 to have a material

impact on its consolidated financial statements.

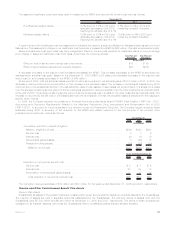

Investments

Investment Risks. The Company’s primary investment objective is to optimize, net of income tax, risk-adjusted investment income and

risk-adjusted total return while ensuring that assets and liabilities are managed on a cash flow and duration basis. The Company is exposed

to four primary sources of investment risk:

• credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and

interest;

• interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates;

• liquidity risk, relating to the diminished ability to sell certain investments in times of strained market conditions; and

• market valuation risk.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real

estate properties. The Company also manages credit risk, market valuation risk and liquidity risk through industry and issuer diversification

and asset allocation. For real estate and agricultural assets, the Company manages credit risk and market valuation risk through

geographic, property type and product type diversification and asset allocation. The Company manages interest rate risk as part of its

asset and liability management strategies; product design, such as the use of market value adjustment features and surrender charges;

and proactive monitoring and management of certain non-guaranteed elements of its products, such as the resetting of credited interest

82 MetLife, Inc.