MetLife 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

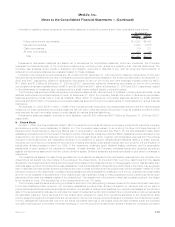

Issuance Costs

In connection with the offering of common equity units, the Holding Company incurred $55.3 million of issuance costs of which

$5.8 million related to the issuance of the junior subordinated debentures underlying common equity units which funded the Series A and

Series B trust preferred securities and $49.5 million related to the expected issuance of the common stock under the stock purchase

contracts. The $5.8 million in debt issuance costs were capitalized, included in other assets, and amortized using the effective interest

method over the period from issuance date of the common equity units to the initial and subsequent stock purchase date. The remaining

$49.5 million of costs related to the common stock issuance under the stock purchase contracts and were recorded as a reduction of

additional paid-in capital.

Earnings Per Common Share

The stock purchase contracts are reflected in diluted earnings per common share using the treasury stock method. The stock purchase

contracts were included in diluted earnings per common share for the years ended December 31, 2008, 2007 and 2006 as shown in

Note 20.

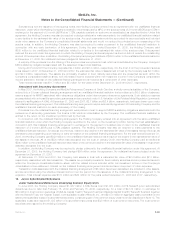

Remarketing of Junior Subordinated Debentures and Settlement of Stock Purchase Contracts

On August 15, 2008, the Holding Company closed the successful remarketing of the Series A portion of the junior subordinated

debentures underlying the common equity units. The Series A junior subordinated debentures were modified as permitted by their terms to

be 6.817% senior debt securities Series A, due August 15, 2018. The Holding Company did not receive any proceeds from the

remarketing. Most common equity unit holders chose to have their junior subordinated debentures remarketed and used the remarketing

proceeds to settle their payment obligations under the applicable stock purchase contract. For those common equity unit holders that

elected not to participate in the remarketing and elected to use their own cash to satisfy the payment obligations under the stock purchase

contract, the terms of the debt are the same as the remarketed debt. The initial settlement of the stock purchase contracts occurred on

August 15, 2008, providing proceeds to the Holding Company of $1,035 million in exchange for shares of the Holding Company’s common

stock. The Holding Company delivered 20,244,549 shares of its common stock held in treasury at a value of $1,064 million to settle the

stock purchase contracts.

On February 17, 2009, the Holding Company closed the successful remarketing of the Series B portion of the junior subordinated

debentures underlying the common equity units. The Series B junior subordinated debentures were modified as permitted by their terms to

be 7.717% senior debt securities Series B, due February 15, 2019. The Holding Company did not receive any proceeds from the

remarketing. Most common equity unit holders chose to have their junior subordinated debentures remarketed and used the remarketing

proceeds to settle their payment obligations under the applicable stock purchase contract. For those common equity unit holders that

elected not to participate in the remarketing and elected to use their own cash to satisfy the payment obligations under the stock purchase

contract, the terms of the debt are the same as the remarketed debt. The subsequent settlement of the stock purchase contracts occurred

on February 17, 2009, providing proceeds to the Holding Company of $1,035 million in exchange for shares of the Holding Company’s

common stock. The Holding Company delivered 24,343,154 shares of its newly issued common stock at a value of $1,035 million to settle

the stock purchase contracts. See also Notes 10, 12, 18 and 25.

14. Shares Subject to Mandatory Redemption and Company-Obligated Mandatorily Redeemable Securities of Subsid-

iary Trusts

GenAmerica Capital I. In June 1997, GenAmerica Corporation (“GenAmerica”) issued $125 million of 8.525% capital securities

through a wholly-owned subsidiary trust, GenAmerica Capital I. In October 2007, GenAmerica redeemed these securities which were due

to mature on June 30, 2027. As a result of this redemption, the Company recognized additional interest expense of $10 million. Interest

expense on these instruments is included in other expenses and was $20 million and $11 million for the years ended December 31, 2007

and 2006, respectively.

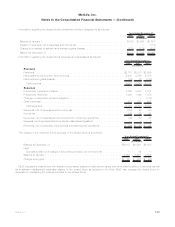

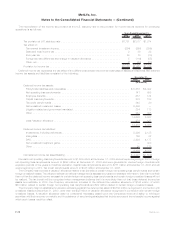

15. Income Tax

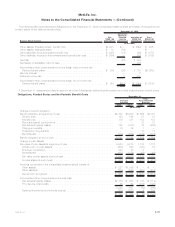

The provision for income tax from continuing operations is as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Current:

Federal ..................................................... $ 216 $ 424 $ 615

Stateandlocal ................................................ 10 15 39

Foreign ..................................................... 372 200 144

Subtotal..................................................... 598 639 798

Deferred:

Federal ..................................................... 1,078 1,015 164

Stateandlocal ................................................ (6) 31 2

Foreign ..................................................... (90) (25) 52

Subtotal..................................................... 982 1,021 218

Provisionforincometax............................................ $1,580 $1,660 $1,016

F-69MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)