MetLife 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment advisor and taxpayer. Further, state insurance regulatory authorities and other federal and state authorities regularly make

inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and other laws and regulations.

It is not possible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable

ranges of potential losses except as noted elsewhere herein in connection with specific matters. In some of the matters referred to herein,

very large and/or indeterminate amounts, including punitive and treble damages, are sought. Although in light of these considerations, it is

possible that an adverse outcome in certain cases could have a material adverse effect upon the Company’s financial position, based on

information currently known by the Company’s management, in its opinion, the outcome of such pending investigations and legal

proceedings are not likely to have such an effect. However, given the large and/or indeterminate amounts sought in certain of these matters

and the inherent unpredictability of litigation, it is possible that an adverse outcome in certain matters could, from time to time, have a

material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly or annual periods.

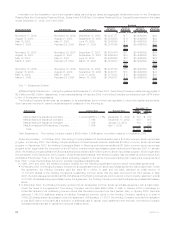

Fair Value. The estimated fair value of the Company’s fixed maturity securities, equity securities, trading securities, short-term

investments, derivatives, and embedded derivatives along with their fair value hierarchy, are described and disclosed in Note 24 of the

Notes to the Consolidated Financial Statements and “— Investments.”

Unprecedented credit and equity market conditions have resulted in difficulty in valuing certain asset classes due to inactive or

disorderly markets and less observable market data. See “Extraordinary Market Conditions.” Rapidly changing market conditions and less

liquid markets could materially change the valuation of securities within our consolidated financial statements and period-to-period

changes in value could vary significantly. The ultimate value at which securities may be sold could differ significantly from the valuations

reported within the consolidated financial statements and could impact our liquidity.

Further, recent events have prompted accounting standard setters and law makers to study the definition and application of fair value

accounting. It appears likely that further disclosures regarding the application of, and amounts carried at, fair value will be required.

See also “— Quantitative and Qualitative Disclosures About Market Risk.”

Other. Based on management’s analysis of its expected cash inflows from operating activities, the dividends it receives from

subsidiaries, that are permitted to be paid without prior insurance regulatory approval and its portfolio of liquid assets and other anticipated

cash flows, management believes there will be sufficient liquidity to enable the Company to make payments on debt, make cash dividend

payments on its common and preferred stock, pay all operating expenses, and meet its cash needs. The nature of the Company’s diverse

product portfolio and customer base lessens the likelihood that normal operations will result in any significant strain on liquidity.

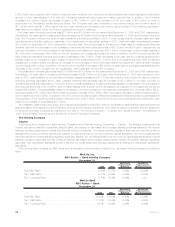

Consolidated Cash Flows. Net cash provided by operating activities increased by $0.8 billion to $10.7 billion for the year ended

December 31, 2008 as compared to $9.9 billion for the year ended December 31, 2007. Cash flows from operations represent net income

earned adjusted for non-cash charges and changes in operating assets and liabilities. The net cash generated from operating activities is

used to meet the Company’s liquidity needs, such as debt and dividend payments, and provides cash available for investing activities.

Cash flows from operations are affected by the timing of receipt of premiums and other revenues as well as the payment of the Company’s

insurance liabilities. In 2008 cash flows from operations includes the impact of the Company entering the mortgage origination and

servicing business.

Net cash provided by operating activities increased by $3.3 billion to $9.9 billion for the year ended December 31, 2007 as compared

to $6.6 billion for the year ended December 31, 2006 primarily due to higher net investment income and premiums, fees and other

revenues.

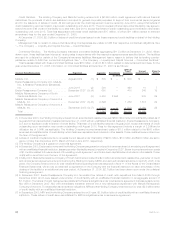

Net cash provided by financing activities was $6.2 billion and $3.9 billion for the years ended December 31, 2008 and 2007,

respectively. Accordingly, net cash provided by financing activities increased by $2.3 billion for the year ended December 31, 2008 as

compared to the prior year. In 2008 the Company reduced securities lending activities in line with market conditions, which resulted in a

decrease of $20.0 billion in the cash collateral received in connection with the securities lending program. Partially offsetting this decrease

was a net increase of $15.8 billion in policyholder account balances, which primarily reflected the Company’s increased level of funding

agreements with the FHLB of NY and with MetLife Short Term Funding LLC, an issuer of commercial paper (See “Extraordinary Market

Conditions” and “Liquidity and Capital Sources — Global Funding Sources”). The Company also experienced a $6.9 billion increase in

cash collateral received under derivatives transactions, primarily as a result of the improvement in estimated fair value of the derivatives.

The cash collateral received under derivatives transactions is invested in cash, cash equivalents and other short-term investments, which

partly explains the major increase in this category of liquid assets. The Company increased short-term debt by $2.0 billion in 2008

compared with a decrease of $0.8 billion in 2007, which primarily reflected new activity at MetLife Bank, which borrowed $1.0 billion from

the Federal Reserve Bank of New York under the Term Auction Facility and entered into $0.7 billion of short-term borrowing from the FHLB

of NY in order to fund mortgage origination activity acquired by the Company in 2008 and provide a cost effective substitute for cash

collateral received in connection with securities lending. In 2008 the net cash paid related to collateral financing arrangements was

$0.5 billion resulting from the incurrence of price returns, which compares to $4.9 billion of cash provided by collateral financing

arrangement transactions completed in 2007, as market conditions in 2008 reduced the availability and attractiveness of such financing. In

2008, there was a net issuance of $0.7 billion of long-term debt and junior subordinated debentures, compared to a net issuance in 2007

of $1.1 billion. Finally, in order to strengthen its capital base, in 2008 the Company reduced its level of common stock repurchase activity

by $0.5 billion compared with 2007 only repurchasing $1.3 billion of common stock in 2008 as compared to $1.8 billion in 2007 and issued

$3.3 billion of stock compared with no issuance in 2007. The Company also paid dividends on the preferred stock and common stock of

$0.7 billion which was comparable to the dividends paid in 2007.

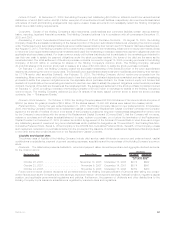

Net cash provided by financing activities was $3.9 billion and $15.4 billion for the years ended December 31, 2007 and 2006,

respectively. Accordingly, net cash provided by financing activities decreased by $11.5 billion for the year ended December 31, 2007 as

compared to the prior year. Net cash provided by financing activities decreased primarily because cash collateral received in connection

with securities lending activity and other transactions was a decrease in cash $1.7 billion lower for the year ended December 31, 2007 as

compared to the prior year where cash increased by $11.3 billion due to an expansion of the securities lending program in 2006. In 2007

the Company benefited from a $4.0 billion increase in cash from the issuance of collateral financing arrangements as favorable

opportunities to execute such transactions arose. Also in 2007, cash provided by the Company’s debt financing program decreased

57MetLife, Inc.