MetLife 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increases in losses was a decrease of $63 million in catastrophe losses, which includes $15 million of favorable loss development from

2006 catastrophes.

Policyholder dividends decreased by $1 million in 2007 as compared to 2006.

Other expenses decreased by $17 million primarily related to lower information technology and advertising costs, partially offset by

minor changes in a variety of expense categories.

Underwriting results, excluding catastrophes, in the Auto & Home segment were favorable for the year ended December 31, 2007,

although lower than the comparable period of 2006, as the combined ratio, excluding catastrophes, increased to 86.3% from 82.8% for the

year ended December 31, 2006.

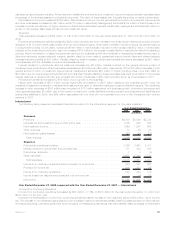

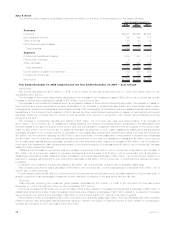

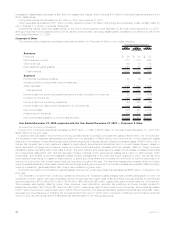

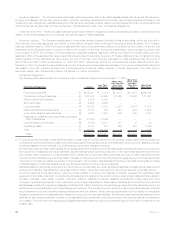

Corporate & Other

The following table presents consolidated financial information for Corporate & Other for the years indicated:

2008 2007 2006

Years Ended December 31,

(In millions)

Revenues

Premiums..................................................... $ 28 $ 35 $ 37

Netinvestmentincome............................................. 817 1,419 998

Otherrevenues ................................................. 184 72 43

Netinvestmentgains(losses) ........................................ 947 45 (154)

Totalrevenues................................................. 1,976 1,571 924

Expenses

Policyholderbenefitsandclaims ...................................... 48 46 38

Interestcreditedtopolicyholderaccountbalances........................... 7 — —

Otherexpenses ................................................. 1,898 1,409 1,362

Totalexpenses ................................................ 1,953 1,455 1,400

Income (loss) from continuing operations before provision (benefit) for income tax . . . . . . 23 116 (476)

Provisionforincometax............................................ (143) (129) (437)

Income(loss)fromcontinuingoperations................................. 166 245 (39)

Income(loss)fromdiscontinuedoperations,netofincometax ................... (293) 195 3,285

Netincome(loss) ................................................ (127) 440 3,246

Preferredstockdividends........................................... 125 137 134

Netincome(loss)availabletocommonshareholders ......................... $ (252) $ 303 $3,112

Year Ended December 31, 2008 compared with the Year Ended December 31, 2007 — Corporate & Other

Income from Continuing Operations

Income from continuing operations decreased by $79 million, or 32%, to $166 million for the year ended December 31, 2008 from

$245 million for the prior year.

Included in this decrease in income from continuing operations is an increase in net investment gains of $586 million, net of income tax.

The increase in net investment gains arises principally from the elimination of $993 million, net of income tax, of net investment losses

arising from the transfer of fixed maturity securities between segments. This was partially offset by increased losses of $263 million, net of

income tax, primarily due to net investment losses on fixed maturity securities and derivatives, and, to a much lesser degree, losses on

equity securities, mortgage and consumer loans, and other limited partnership interests which are partially offset by foreign currency

transaction gains originating within Corporate & Other. The fixed maturity and equity security losses include losses on sales of securities

and impairments associated with financial services industry holdings which experienced losses as a result of bankruptcies, FDIC

receivership, and federal government assisted capital infusion transactions in the third and fourth quarters of 2008, as well as other

credit related impairments or losses on fixed maturity or equity securities where the Company did not intend to hold the securities until

recovery in conjunction with overall market declines occurring throughout the year. The derivative losses were primarily driven by foreign

currency swaps caused by unfavorable interest rate and foreign exchange movements. The derivative losses were partially offset by foreign

currency transaction gains associated with foreign denominated long-term debt.

Excluding the impact of net investment gains (losses), income from continuing operations decreased by $665 million, compared to the

prior year.

The decrease in income from continuing operations excluding net investment gains (losses) was primarily attributable to lower net

investment income, higher corporate expenses, higher interest expense, higher legal costs and higher interest credited to policyholder

account balances of $391 million $216 million, $104 million, $46 million and $5 million, respectively, each of which were net of income tax.

This decrease was partially offset by higher other revenues, lower interest on uncertain tax positions, and lower interest credited to

bankholder deposits of $73 million, $27 million and $21 million, respectively, each of which were net of income tax. Tax benefits decreased

by $17 million over the prior year primarily due to a $16 million recognition of a deferred tax liability related to the RGA split-off and $1 million

decrease from the difference of finalizing the Company’s 2007 tax return in 2008 when compared to finalizing the Company’s 2006 tax

return in 2007 and the actual and the estimated tax rate allocated to the various segments.

44 MetLife, Inc.