MetLife 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

upon regulatory approval. The 2007 Trust Securities, will be exchanged into a like amount of Holding Company junior subordinated

debentures on December 15, 2037, the scheduled redemption date; mandatorily under certain circumstances; and at any time upon the

Holding Company exercising its option to redeem the securities. The 2007 Trust Securities will be exchanged for junior subordinated

debentures prior to repayment and the Holding Company is ultimately responsible for repayment of the junior subordinated debentures.

The Holding Company’s other rights and obligations as it relates to the deferral of interest, redemption, replacement capital obligation and

RCC associated with the issuance of the Trust Securities are more fully described in “The Company — Liquidity and Capital Sources —

Debt Issuances.”

As described more fully in “The Company — Liquidity and Capital Sources — Debt Issuances”:

• In December 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRC’s reinsurance

of the closed block liabilities, entered into an agreement with an unaffiliated financial institution under which the Holding Company is

entitled to the interest paid by MRC on the surplus notes of 3-month LIBOR plus 0.55% in exchange for the payment of 3-month

LIBOR plus 1.12%, payable quarterly.

Under this agreement, the Holding Company may also be required to pledge collateral or make payments to the unaffiliated financial

institution related to any decline in the estimated fair value of the surplus notes and in connection with any early termination of this

agreement. During the year ended December 31, 2008, the Holding Company paid $800 million to the unaffiliated financial institution

related to a decline in the estimated fair value of the surplus notes. This payment reduced the amount under the agreement on which

the Holding Company’s interest payment is due but did not reduce the outstanding amount of the surplus notes. In addition, the

Holding Company had pledged collateral of $230 million to the unaffiliated financial institution at December 31, 2008. No collateral

was pledged at December 31, 2007. The Holding Company’s net cost of 0.57% has been allocated to MRC. For the year ended

December 31, 2008, this amount was $14 million. For the year ended December 31, 2007 this amount was immaterial.

• In May 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRSC’s reinsurance of

universal life secondary guarantees, entered into an agreement with an unaffiliated financial institution under which the Holding

Company is entitled to the return on the investment portfolio held by a trust established in connection with this collateral financing

arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial institution of 3-month LIBOR plus

0.70%, payable quarterly. The Holding Company may also be required to make payments to the unaffiliated financial institution, for

deposit into the trust, related to any decline in the fair value of the assets held by the trust, as well as amounts outstanding upon

maturity or early termination of the collateral financing arrangement. As a result of this agreement, the Holding Company effectively

assumed the $2.4 billion liability under the collateral financing agreement along with a beneficial interest in the trust holding the

associated assets. The Holding Company simultaneously contributed to MRSC its beneficial interest in the trust, along with any return

to be received on the investment portfolio held by the trust. For the year ended December 31, 2008, the Holding Company paid

$320 million to the unaffiliated financial institution as a result of the decline in the fair value of the assets in the trust. All of the

$320 million was deposited into the trust. In January 2009, the Holding Company paid an additional $360 million to the unaffiliated

financial institution as a result of the continued decline in the fair value of the assets in trust which was also deposited into the trust. In

addition, the Holding Company may be required to pledge collateral to the unaffiliated financial institution under this agreement. At

December 31, 2008, the Holding Company had pledged $86 million under the agreement. No collateral had been pledged under the

agreement as December 31, 2007. Interest expense incurred by the Holding Company under the collateral financing arrangement for

the years ended December 31, 2008 and 2007 was $107 million and $84 million, respectively. The allocation of these financing costs

to MRSC is included in other revenues and recorded as an additional investment in MRSC.

In December 2006, the Holding Company issued junior subordinated debentures with a face amount of $1.25 billion. See “The

Company — Liquidity and Capital Sources — Debt Issuances” for further information.

In September 2006, the Holding Company issued $204 million of affiliated long-term debt with an interest rate of 6.07% maturing in

2016.

In March 2006, the Holding Company issued $10 million of affiliated long-term debt with an interest rate of 5.70% maturing in 2016.

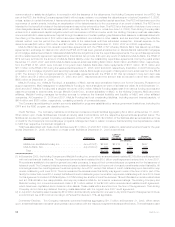

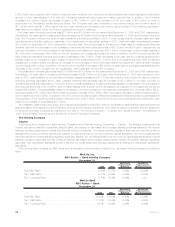

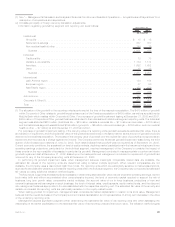

The following table summarizes the Holding Company’s outstanding senior notes series, excluding any premium or discount, at

December 31, 2008:

Date Principal Interest Rate Maturity

(In millions)

August 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,035 6.82% 2018

June 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,000 5.00% 2015

June 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,000 5.70% 2035

June 2005(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 585 5.25% 2020

December 2004(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 512 5.38% 2024

June 2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350 5.50% 2014

June 2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 750 6.38% 2034

November 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 500 5.00% 2013

November 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200 5.88% 2033

December 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 400 5.38% 2012

December 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 600 6.50% 2032

November 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 750 6.13% 2011

(1) This amount represents the translation of pounds sterling into U.S. dollars using the noon buying rate on December 31, 2008 of $1.4619

as announced by the Federal Reserve Bank of New York.

61MetLife, Inc.