MetLife 2008 Annual Report Download - page 131

Download and view the complete annual report

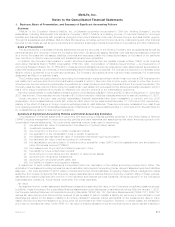

Please find page 131 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a third party with the same credit standing. SFAS 157 requires that fair value be a market-based measurement in which the fair value is

determined based on a hypothetical transaction at the measurement date, considered from the perspective of a market participant. When

quoted prices are not used to determine fair value, SFAS 157 requires consideration of three broad valuation techniques: (i) the market

approach, (ii) the income approach, and (iii) the cost approach. The approaches are not new, but SFAS 157 requires that entities determine

the most appropriate valuation technique to use, given what is being measured and the availability of sufficient inputs. SFAS 157 prioritizes

the inputs to fair valuation techniques and allows for the use of unobservable inputs to the extent that observable inputs are not available.

The Company has categorized its assets and liabilities measured at estimated fair value into a three-level hierarchy, based on the priority of

the inputs to the respective valuation technique. The fair value hierarchy gives the highest priority to quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). An asset or liability’s classification within the

fair value hierarchy is based on the lowest level of significant input to its valuation. SFAS 157 defines the input levels as follows:

Level 1 Unadjusted quoted prices in active markets for identical assets or liabilities. The Company defines active markets based on

average trading volume for equity securities. The size of the bid/ask spread is used as an indicator of market activity for fixed

maturity securities.

Level 2 Quoted prices in markets that are not active or inputs that are observable either directly or indirectly. Level 2 inputs include

quoted prices for similar assets or liabilities other than quoted prices in Level 1; quoted prices in markets that are not active; or

other inputs that are observable or can be derived principally from or corroborated by observable market data for substantially

the full term of the assets or liabilities.

Level 3 Unobservable inputs that are supported by little or no market activity and are significant to the estimated fair value of the assets

or liabilities. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants

would use in pricing the asset or liability. Level 3 assets and liabilities include financial instruments whose values are determined

using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the

determination of estimated fair value requires significant management judgment or estimation.

The measurement and disclosures under SFAS 157 in the accompanying financial statements and footnotes exclude certain items such

as nonfinancial assets and nonfinancial liabilities initially measured at estimated fair value in a business combination, reporting units

measured at estimated fair value in the first step of a goodwill impairment test and indefinite-lived intangible assets measured at estimated

fair value for impairment assessment. The effective date for these items was deferred to January 1, 2009.

Prior to adoption of SFAS 157, estimated fair value was determined based solely upon the perspective of the reporting entity. Therefore,

methodologies used to determine the estimated fair value of certain financial instruments prior to January 1, 2008, while being deemed

appropriate under existing accounting guidance, may not have produced an exit value as defined in SFAS 157.

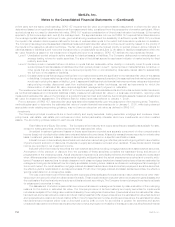

Investments

The Company’s principal investments are in fixed maturity and equity securities, trading securities, mortgage and consumer loans,

policy loans, real estate, real estate joint ventures and other limited partnership interests, short-term investments, and other invested

assets. The accounting policies related to each are as follows:

Fixed Maturity and Equity Securities. The Company’s fixed maturity and equity securities are classified as available-for-sale,

except for trading securities, and are reported at their estimated fair value.

Unrealized investment gains and losses on these securities are recorded as a separate component of other comprehensive

income (loss), net of policyholder related amounts and deferred income taxes. All security transactions are recorded on a trade date

basis. Investment gains and losses on sales of securities are determined on a specific identification basis.

Interest income on fixed maturity securities is recorded when earned using an effective yield method giving effect to amortization

of premiums and accretion of discounts. Dividends on equity securities are recorded when declared. These dividends and interest

income are recorded in net investment income.

Included within fixed maturity securities are loan-backed securities including mortgage-backed and asset-backed securities.

Amortization of the premium or discount from the purchase of these securities considers the estimated timing and amount of

prepayments of the underlying loans. Actual prepayment experience is periodically reviewed and effective yields are recalculated

when differences arise between the prepayments originally anticipated and the actual prepayments received and currently antic-

ipated. Prepayment assumptions for single class and multi-class mortgage-backed and asset-backed securities are estimated by

management using inputs obtained from third party specialists, including broker-dealers, and based on management’s knowledge of

the current market. For credit-sensitive mortgage-backed and asset-backed securities and certain prepayment-sensitive securities,

the effective yield is recalculated on a prospective basis. For all other mortgage-backed and asset-backed securities, the effective

yield is recalculated on a retrospective basis.

The cost or amortized cost of fixed maturity and equity securities is adjusted for impairments in value deemed to be other-than-

temporary in the period in which the determination is made. These impairments are included within net investment gains (losses) and

the cost basis of the fixed maturity and equity securities is reduced accordingly. The Company does not change the revised cost basis

for subsequent recoveries in value.

The assessment of whether impairments have occurred is based on management’s case-by-case evaluation of the underlying

reasons for the decline in estimated fair value. The Company’s review of its fixed maturity and equity securities for impairments

includes an analysis of the total gross unrealized losses by three categories of securities: (i) securities where the estimated fair value

had declined and remained below cost or amortized cost by less than 20%; (ii) securities where the estimated fair value had declined

and remained below cost or amortized cost by 20% or more for less than six months; and (iii) securities where the estimated fair value

had declined and remained below cost or amortized cost by 20% or more for six months or greater. An extended and severe

unrealized loss position on a fixed maturity security may not have any impact on the ability of the issuer to service all scheduled interest

F-8 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)