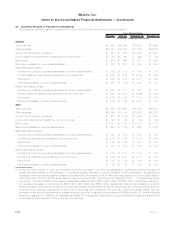

MetLife 2008 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

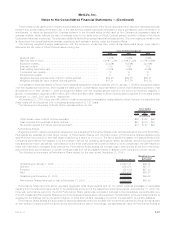

Island State Insurance Code, the Rhode Island Commissioner has broad discretion in determining whether the financial condition of a stock

property and casualty insurance company would support the payment of such dividends to its shareholders. MPC may not pay any

dividends in 2009 without prior regulatory approval for dividend payments with payment dates prior to December 12, 2009. Subsequent to

December 12, 2009, MPC can pay dividends totaling $9 million without requiring regulatory approval from the Rhode Island Commissioner.

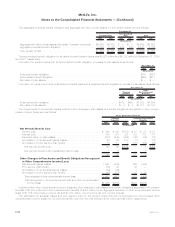

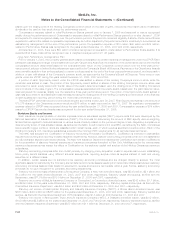

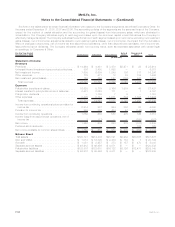

Other Comprehensive Income (Loss)

The following table sets forth the reclassification adjustments required for the years ended December 31, 2008, 2007 and 2006 in other

comprehensive income (loss) that are included as part of net income for the current year that have been reported as a part of other

comprehensive income (loss) in the current or prior year:

2008 2007 2006

Years Ended December 31,

(In millions)

Holding gains (losses) on investments arising during the year . . . . . . . . . . . . . . . . . . . . . . $(26,491) $(1,485) $(1,022)

Incometaxeffectofholdinggains(losses) .................................. 8,989 581 379

Reclassification adjustments:

Recognized holding (gains) losses included in current year income . . . . . . . . . . . . . . . . . 2,040 176 916

Amortization of premiums and accretion of discounts associated with investments . . . . . . . (926) (831) (600)

Incometaxeffect................................................... (377) 254 (117)

Allocation of holding losses on investments relating to other policyholder amounts . . . . . . . . . 4,809 676 581

Income tax effect of allocation of holding losses to other policyholder amounts . . . . . . . . . . . (1,621) (264) (215)

Unrealizedinvestmentlossofsubsidiaryatdateofsale .......................... 112 — —

Deferred income tax on unrealized investment loss of subsidiary at date of sale . . . . . . . . . . (60) — —

Netunrealizedinvestmentgains(losses),netofincometax ....................... (13,525) (893) (78)

Foreigncurrencytranslationadjustment .................................... (593) 290 46

Minimumpensionliabilityadjustment,netofincometax.......................... — — (18)

Definedbenefitplanadjustment,netofincometax ............................. (1,203) 563 —

Other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(15,321) $ (40) $ (50)

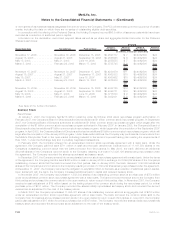

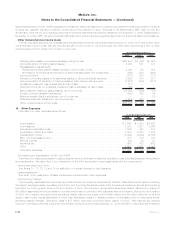

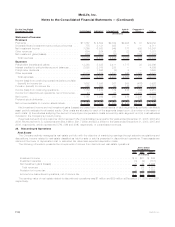

19. Other Expenses

Information on other expenses is as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Compensation..................................................... $ 3,549 $ 3,548 $3,422

Commissions ..................................................... 3,384 3,207 2,866

Interestanddebtissuecosts........................................... 1,086 987 812

AmortizationofDACandVOBA.......................................... 3,489 2,250 1,904

CapitalizationofDAC ................................................ (3,092) (3,064) (2,825)

Rent,netofsubleaseincome........................................... 477 373 345

Minorityinterest.................................................... (23) 23 23

Insurancetax ..................................................... 497 503 488

Other .......................................................... 2,557 2,602 2,502

Totalotherexpenses ................................................ $11,924 $10,429 $9,537

Amortization and Capitalization of DAC and VOBA

See Note 5 for deferred acquisition costs by segment and a rollforward of deferred acquisition costs including impacts of amortization

and capitalization. See also Note 9 for a description of the DAC amortization impact associated with the closed block.

Interest and Debt Issue Costs

See Notes 10, 11, 12, 13 and 14 for attribution of interest expense by debt issuance.

Lease Impairments

See Note 16 for description of lease impairments included within other expenses.

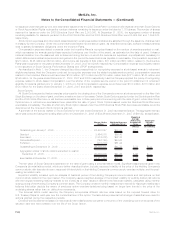

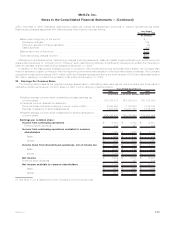

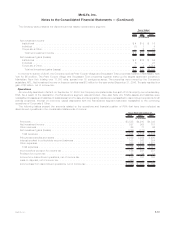

Restructuring Charges

The Company has initiated an enterprise-wide cost reduction and revenue enhancement initiative. This initiative is focused on reducing

complexity, leveraging scale, increasing productivity, and improving the effectiveness of the Company’s operations, as well as providing a

foundation for future growth. During the third quarter of 2008, the Company recognized a severance-related restructuring charge of

$73 million associated with the termination of certain employees in connection with this enterprise-wide initiative. During the fourth quarter

of 2008, the Company recorded further severance related restructuring costs of $36 million offset by an $8 million reduction to its third

quarter restructuring charge attributable to lower than anticipated costs for variable incentive compensation and for employees whose

severance status changed. Severance costs of $15 million were paid during the fourth quarter of 2008. Total restructuring charges

incurred in connection with this enterprise-wide initiative during the year ended December 31, 2008 were $101 million and were reflected

F-90 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)