MetLife 2008 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company files income tax returns with the U.S. federal government and various state and local jurisdictions, as well as foreign

jurisdictions. The Company is under continuous examination by the Internal Revenue Service (“IRS”) and other tax authorities in jurisdictions

in which the Company has significant business operations. The income tax years under examination vary by jurisdiction. With a few

exceptions, the Company is no longer subject to U.S. federal, state and local, or foreign income tax examinations by tax authorities for

years prior to 2000. In 2005, the IRS commenced an examination of the Company’s U.S. income tax returns for 2000 through 2002 that is

anticipated to be completed in 2009.

As a result of the implementation of FIN 48 on January 1, 2007, the Company recognized a $35 million increase in the liability for

unrecognized tax benefits and a $9 million decrease in the interest liability for unrecognized tax benefits, as well as a $17 million increase in

the liability for unrecognized tax benefits and a $5 million increase in the interest liability for unrecognized tax benefits which are included in

liabilities of subsidiaries held-for-sale. The corresponding reduction to the January 1, 2007 balance of retained earnings was $37 million,

net of $11 million of minority interest included in liabilities of subsidiaries held-for-sale. The Company’s total amount of unrecognized tax

benefits upon adoption of FIN 48 was $932 million. The Company reclassified, at adoption, $602 million of current income tax payables to

the liability for unrecognized tax benefits included within other liabilities. The Company also reclassified, at adoption, $295 million of

deferred income tax liabilities, for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such

deductibility, to the liability for unrecognized tax benefits. Because of the impact of deferred tax accounting, other than interest and

penalties, the disallowance of the shorter deductibility period would not affect the annual effective tax rate but would accelerate the

payment of cash to the taxing authority to an earlier period. The total amount of unrecognized tax benefits as of January 1, 2007 that would

affect the effective tax rate, if recognized, was $654 million. The Company also had $210 million of accrued interest, included within other

liabilities, as of January 1, 2007. The Company classifies interest accrued related to unrecognized tax benefits in interest expense, while

penalties are included within income tax expense.

At December 31, 2007, the Company’s total amount of unrecognized tax benefits was $840 million and the total amount of

unrecognized tax benefits that would affect the effective tax rate, if recognized, was $565 million. The total amount of unrecognized

tax benefits decreased by $92 million from the date of adoption primarily due to settlements reached with the IRS with respect to certain

significant issues involving demutualization, post-sale purchase price adjustments and reinsurance offset by additions for tax positions of

the current year. As a result of the settlements, items within the liability for unrecognized tax benefits, in the amount of $177 million, were

reclassified to current and deferred income taxes, as applicable, and a payment of $156 million was made in December of 2007, with

$6 million to be paid in 2009 and the remaining $15 million to be paid in future years.

At December 31, 2008, the Company’s total amount of unrecognized tax benefits was $766 million and the total amount of

unrecognized tax benefits that would affect the effective tax rate, if recognized, was $567 million. The total amount of unrecognized

tax benefits decreased by $74 million from December 31, 2007 primarily due to settlements reached with the IRS with respect to certain

significant issues involving demutualization, leasing and tax credits offset by additions for tax positions of the current year. As a result of the

settlements, items within the liability for unrecognized tax benefits, in the amount of $153 million, were reclassified to current and deferred

income taxes, as applicable. Of the $153 million reclassified to current and deferred income taxes, $20 million was paid in 2008 and

$133 million will be paid in 2009.

The Company’s liability for unrecognized tax benefits will change in the next 12 months pending the outcome of remaining issues

associated with the current IRS audit including tax-exempt income and tax credits. Management is working to resolve the remaining audit

items directly with IRS auditors, as well as through available accelerated IRS resolution programs and may protest any unresolved issues

through the IRS appeals process and, possibly, litigation, the timing and extent of which is uncertain. At this time, a reasonable estimate of

the range of a payment or change in the liability is between $40 million and $50 million; however, the Company continues to believe that the

ultimate resolution of the issues will not result in a material effect on its consolidated financial statements, although the resolution of income

tax matters could impact the Company’s effective tax rate for a particular future period.

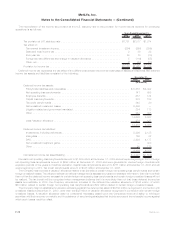

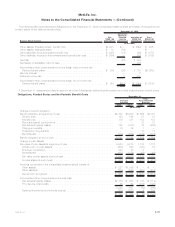

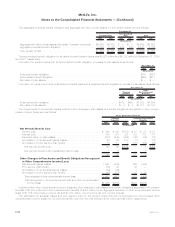

A reconciliation of the beginning and ending amount of unrecognized tax benefits for the years ended December 31, 2008 and

December 31, 2007, is as follows:

2008 2007

December 31,

(In millions)

Balanceasofbeginningoftheperiod............................................ $840 $932

Additionsfortaxpositionsofprioryears.......................................... 11 73

Reductionsfortaxpositionsofprioryears......................................... (51) (53)

Additionsfortaxpositionsofcurrentyear ......................................... 147 77

Reductionsfortaxpositionsofcurrentyear........................................ (22) (8)

Settlementswithtaxauthorities................................................ (153) (177)

Lapsesofstatutesoflimitations ............................................... (6) (4)

Balanceasofendoftheperiod ............................................... $766 $840

During the year ended December 31, 2007, the Company recognized $81 million in interest expense associated with the liability for

unrecognized tax benefits. At December 31, 2007, the Company had $218 million of accrued interest associated with the liability for

unrecognized tax benefits. The $8 million increase, from the date of adoption, in accrued interest associated with the liability for

unrecognized tax benefits resulted from an increase of $81 million of interest expense and a $73 million decrease primarily resulting from

the aforementioned IRS settlements. During 2007, the $73 million resulting from IRS settlements was reclassified to current income tax

payable and will be paid in 2009.

F-71MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)