MetLife 2008 Annual Report Download - page 231

Download and view the complete annual report

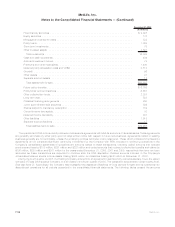

Please find page 231 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company ceded the risk associated with certain of the GMIB and GMAB riders described in the preceding paragraph. These

reinsurance contracts contain embedded derivatives which are included in premiums and other receivables with changes in estimated fair

value reported in net investments gains (losses) or policyholder benefit and claims depending on the income statement classification of the

direct risk. The value of the embedded derivatives on the ceded risk is determined using a methodology consistent with that described

previously for the riders directly written by the Company.

The estimated fair value of the embedded equity and bond indexed derivatives contained in certain guaranteed investment contracts is

determined using market standard swap valuation models and observable market inputs, including an adjustment for the Company’s own

credit that takes into consideration publicly available information relating to the Company’s debt as well as its claims paying ability. The

estimated fair value of these embedded derivatives are included, along with their guaranteed investment contract host, within policyholder

account balances with changes in estimated fair value recorded in net investment gains (losses). Changes in equity and bond indices,

interest rates and the Company’s credit standing may result in significant fluctuations in the estimated fair value of these embedded

derivatives that could materially affect net income.

The accounting for embedded derivatives is complex and interpretations of the primary accounting standards continue to evolve in

practice. If interpretations change, there is a risk that features previously not bifurcated may require bifurcation and reporting at estimated

fair value in the consolidated financial statements and respective changes in estimated fair value could materially affect net income.

Assets and Liabilities of Subsidiaries Held-For-Sale — The carrying value of the assets and liabilities of subsidiaries held-for-sale

reflects those assets and liabilities which were previously determined to be financial instruments and which were reflected in other financial

statement captions in the table above in previous periods but have been reclassified to this caption to reflect the discontinued nature of the

operations. The estimated fair value of the assets and liabilities of subsidiaries held-for-sale have been determined on a basis consistent

with the asset type as described herein.

Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities, Bridge Loans, and Private Corporate Bond Invest-

ments — The estimated fair values for mortgage loan commitments and commitments to fund bank credit facilities, bridge loans and private

corporate bond investments reflected in the above table represent the difference between the discounted expected future cash flows using

interest rates that incorporate current credit risk for similar instruments on the reporting date and the principal amounts of the original

commitments.

F-108 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)