MetLife 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

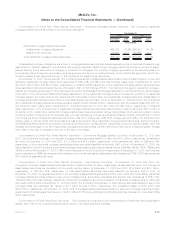

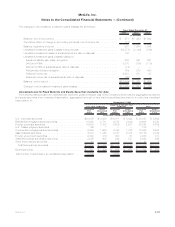

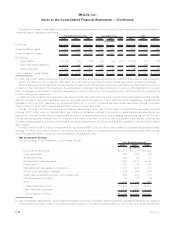

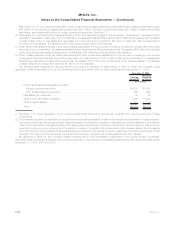

At December 31, 2008 and 2007, the Company’s gross unrealized losses related to its fixed maturity and equity securities of

$29.8 billion and $4.7 billion, respectively, were concentrated, calculated as a percentage of gross unrealized loss, as follows:

2008 2007

December 31,

Sector:

U.S.corporatesecurities ..................................................... 33% 44%

Foreigncorporatesecurities ................................................... 19 16

Residentialmortgage-backedsecurities............................................ 16 8

Asset-backedsecurities...................................................... 13 11

Commercialmortgage-backedsecurities ........................................... 11 4

Stateandpoliticalsubdivisionsecurities ........................................... 3 2

Foreigngovernmentsecurities.................................................. 1 4

Other.................................................................. 4 11

Total ................................................................. 100% 100%

Industry:

Mortgage-backed.......................................................... 27% 12%

Finance ................................................................ 24 33

Asset-backed............................................................. 13 11

Consumer............................................................... 11 3

Utility.................................................................. 8 8

Communication ........................................................... 5 2

Industrial................................................................ 4 19

Foreigngovernment......................................................... 1 4

Other.................................................................. 7 8

Total ................................................................. 100% 100%

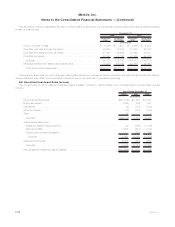

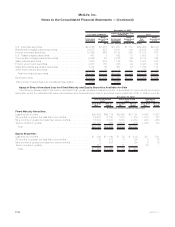

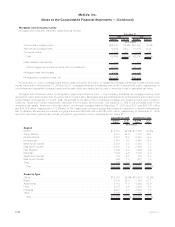

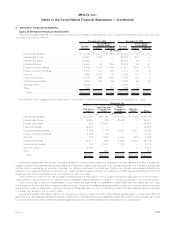

Net Investment Gains (Losses)

The components of net investment gains (losses) are as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,949) $(615) $(1,119)

Equitysecurities................................................. (257) 164 84

Mortgageandconsumerloans........................................ (136) 3 (8)

Realestateandrealestatejointventures................................. (18) 46 102

Otherlimitedpartnershipinterests ..................................... (140) 16 1

Freestandingderivatives............................................ 6,560 61 (410)

Embeddedderivatives ............................................. (2,650) (321) 202

Other........................................................ 402 68 (234)

Net investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,812 $(578) $(1,382)

F-37MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)