MetLife 2008 Annual Report Download - page 49

Download and view the complete annual report

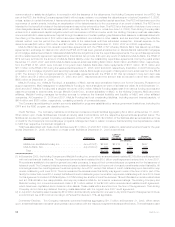

Please find page 49 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.commercial paper outstanding. Interest on uncertain tax positions was higher by $35 million as a result of an increase in published Internal

Revenue Service interest rates and a change in the method of estimating interest expense on tax contingencies associated with the

Company’s implementation of FIN 48. As a result of higher interest rates, interest credited on bank deposits increased by $5 million at

MetLife Bank. Corporate expenses are lower by $90 million primarily due to lower corporate support expenses of $67 million, which

included advertising, start-up costs for new products and information technology costs, and lower costs from reductions of MetLife

Foundation contributions of $23 million. Integration costs incurred in prior year were $25 million. Legal costs were lower by $11 million

primarily due to a reduction in 2007 of $35 million of legal liabilities resulting from the settlement of certain cases; lower other legal costs of

$3 million partially offset by higher amortization and valuation of an asbestos insurance recoverable of $27 million. Also included as a

component of total expenses was the elimination of intersegment amounts which were offset within total revenues.

Liquidity and Capital Resources

Extraordinary Market Conditions

Since mid-September 2008, the global financial markets have experienced unprecedented disruption, adversely affecting the business

environment in general, as well as financial services companies in particular. The U.S. Government, as well as governments in many foreign

markets in which the Company operates, have responded to address market imbalances and taken meaningful steps intended to

eventually restore market confidence. Continuing adverse financial market conditions could significantly affect the Company’s ability to

meet liquidity needs and obtain capital.

Liquidity Management. Based upon the strength of its franchise, diversification of its businesses and strong financial fundamentals,

management believes that the Company has ample liquidity and capital resources to meet business requirements under current market

conditions.

Processes for monitoring and managing liquidity risk, including liquidity stress models, have been enhanced to take into account the

extraordinary market conditions, including the impact on policyholder and counterparty behavior, the ability to sell various investment

assets and the ability to raise incremental funding from various sources. Management has taken steps to strengthen liquidity in light of its

assessment of the impact of market conditions and will continue to monitor the situation closely. Asset/Liability Management (“ALM”) needs

and opportunities are also being evaluated and managed in light of market conditions and, where appropriate, ALM strategies are adjusted

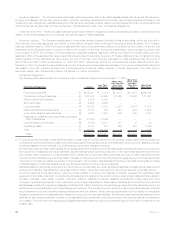

to achieve management goals and objectives. The Company’s short-term liquidity position (cash and cash equivalents and short term

investments, excluding cash collateral received under the Company’s securities lending program and in connection with derivative

instruments that has been reinvested in cash, cash equivalents, short-term investments and publicly-traded securities) was $26.7 billion

and $10.9 billion at December 31, 2008 and 2007, respectively. This higher than normal level of short-term liquidity was accumulated to

provide additional flexibility to address potential variations in cash needs while credit market conditions remained distressed. In 2009, we

anticipate short-term liquidity will be brought down in a prudent manner and invested according to the Company’s ALM discipline in

appropriate assets over time. There may be potential implications for earnings if the reinvestment process occurs over an extended period

of time due to challenging market conditions or asset availability. The asset portfolio will continue to be defensively positioned in 2009 with

an emphasis on higher credit quality, more liquid asset types. However, considering the continued, somewhat uncertain credit market

conditions, management plans to continue to maintain a slightly higher than normal level of short-term liquidity.

During this extraordinary market environment, management is continuously monitoring and adjusting its liquidity and capital plans for the

Holding Company and its subsidiaries in light of changing needs and opportunities. The dislocation in the credit markets has limited the

access of financial institutions to long-term debt and hybrid capital. While, in general, yields on benchmark U.S. Treasury securities were

historically low during 2008, related spreads on debt instruments, in general, and those of financial institutions, specifically, were as high as

they have been in MetLife’s history as a public company.

Liquidity Needs of the Insurance Business. With respect to the Company’s insurance businesses, Individual and Institutional segments

tend to behave differently under these extraordinary market conditions. In the Company’s Individual segment, which includes individual life

and annuity products, lapses and surrenders occur in the normal course of business in many product areas. These lapses and surrenders

have not deviated materially from management expectations during the financial crisis. For both fixed and variable annuities, net flows were

positive and lapse rates declined.

Within the Institutional segment, the retirement & savings business consists of general account values of $101 billion at December 31,

2008. Approximately, $97 billion of that amount is comprised of pension closeouts, other fixed annuity contracts without surrender or

withdrawal options, as well as global GICs that have stated maturities and cannot be put back to the Company prior to maturity. As a result,

the surrenders or withdrawals are fairly predictable and even during this difficult environment they have not deviated materially from

management expectations.

With regard to Institutional’s retirement & savings liabilities where customers have limited liquidity rights at December 31, 2008, there

were $3 billion of funding agreements that could be put back to the Company after a period of notice. While the notice requirements vary,

the shortest is 90 days, and that applies to only $1 billion of these liabilities. The remainder of the notice periods are between 6 and

13 months, so even on the small portion of the portfolio where there is ability to accelerate withdrawal, the exposure is relatively limited.

Withrespecttocreditratingsdowngradetriggersthatpermitearlytermination, less than $1 billion of the retirement & savings liabilities were

subject to such triggers. In addition, such early terminations payments are subject to 90 day prior notice. Management controls the liquidity

exposure that can arise from these various product features.

Securities Lending. The Company’s securities lending business has been affected by the extraordinary market environment. In this

activity, blocks of securities, which are included in fixed maturity and short-term investments, are loaned to third parties, primarily major

brokerage firms and commercial banks. The Company generally requires a minimum of 102% of the current estimated fair value of the

loaned securities to be obtained at inception of a loan, and maintained at a level greater than or equal to 100% for duration of the loan.

During the extraordinary market events occurring in the fourth quarter of 2008, the Company, in limited instances, accepted collateral less

than 102% at the inception of certain loans, but never less than 100%, of the market value of loaned such loaned securities. These loans

involved U.S. Treasury bills, which are considered to have limited variation in their market value during the term of the loan. Securities with a

46 MetLife, Inc.