MetLife 2008 Annual Report Download - page 162

Download and view the complete annual report

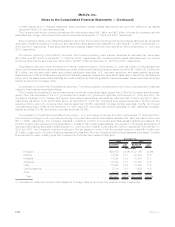

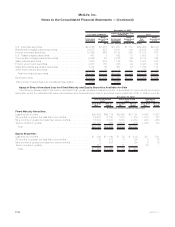

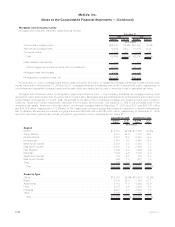

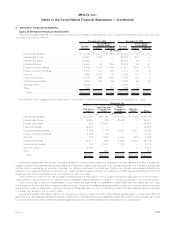

Please find page 162 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net investment income from other limited partnership interests, including hedge funds, represents distributions from other limited

partnership interests accounted for under the cost method and equity in earnings from other limited partnership interests accounted for

under the equity method. Overall for 2008, the net amount recognized by the Company was a loss of ($170) million resulting principally

from losses on equity method investments. Such earnings and losses recognized for other limited partnership interests are impacted by

volatility in the equity and credit markets. Net investment income from trading securities includes interest and dividends earned on trading

securities in addition to the net realized and unrealized gains (losses) recognized on trading securities and the short sale agreements

liabilities. In 2008, unrealized losses recognized on trading securities, due to the volatility in the equity and credit markets, were in excess

of interest and dividends earned.

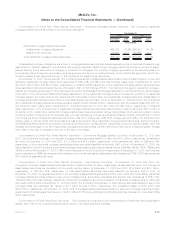

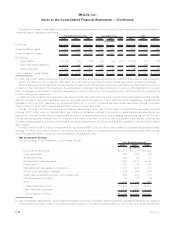

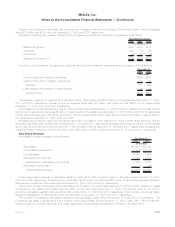

Securities Lending

The Company participates in securities lending programs whereby blocks of securities, which are included in fixed maturity securities

and short-term investments are loaned to third parties, primarily major brokerage firms and commercial banks. The Company generally

obtains collateral in an amount equal to 102% of the estimated fair value of the securities loaned. Securities with a cost or amortized cost of

$20.8 billion and $41.1 billion and an estimated fair value of $22.9 billion and $42.1 billion were on loan under the program at

December 31, 2008 and 2007, respectively. Securities loaned under such transactions may be sold or repledged by the transferee.

The Company was liable for cash collateral under its control of $23.3 billion and $43.3 billion at December 31, 2008 and 2007,

respectively. Of this $23.3 billion of cash collateral at December 31, 2008, $5.1 billion was on open terms, meaning that the related loaned

security could be returned to the Company on the next business day requiring return of cash collateral, and $14.7 billion and $3.5 billion,

respectively, were due within 30 days and 60 days. Of the $5.0 billion of estimated fair value of the securities related to the cash collateral

on open at December 31, 2008, $4.4 billion were U.S. Treasury and agency securities which, if put to the Company, can be immediately

sold to satisfy the cash requirements. The remainder of the securities on loan are primarily U.S. Treasury and agency securities, and very

liquid residential mortgage-backed securities. The estimated fair value of the reinvestment portfolio acquired with the cash collateral was

$19.5 billion at December 31, 2008, and consisted principally of fixed maturity securities (including residential mortgage-backed, asset-

backed, U.S. corporate and foreign corporate securities).

Security collateral of $279 million and $40 million on deposit from counterparties in connection with the securities lending transactions

at December 31, 2008 and 2007, respectively may not be sold or repledged and is not reflected in the consolidated financial statements.

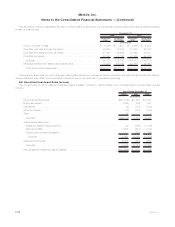

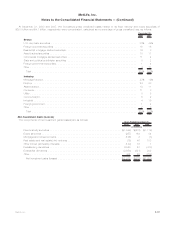

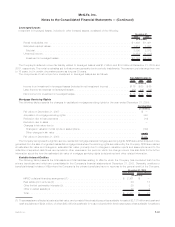

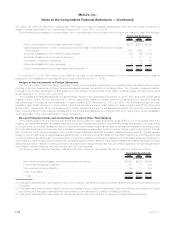

Assets on Deposit, Held in Trust and Pledged as Collateral

The Company had investment assets on deposit with regulatory agencies with an estimated fair value of $1.3 billion and $1.8 billion at

December 31, 2008 and 2007, respectively, consisting primarily of fixed maturity and equity securities. The Company also held in trust

cash and securities, primarily fixed maturity and equity securities with an estimated fair value of $9.3 billion and $5.9 billion at December 31,

2008 and 2007, respectively, to satisfy collateral requirements. The Company has also pledged certain fixed maturity securities in support

of the collateral financing arrangements described in Note 11.

The Company has pledged fixed maturity securities and mortgage loans in support of its debt and funding agreements with the Federal

Home Loan Bank of New York (“FHLB of NY”) and the Federal Home Loan Bank of Boston (“FHLB of Boston”) of $22.2 billion and $7.0 billion

at December 31, 2008 and 2007, respectively. The Company has also pledged certain agricultural real estate mortgage loans in

connection with funding agreements with the Federal Agricultural Mortgage Corporation with a carrying value of $2.9 billion at both

December 31, 2008 and 2007. The Company has also pledged qualifying mortgage loans and securities in connection with collateralized

borrowings from the Federal Reserve Bank of New York’s Term Auction Facility with an estimated fair value of $1.6 billion at December 31,

2008. The nature of these Federal Home Loan Bank, Federal Agricultural Mortgage Corporation and Federal Reserve Bank of New York

arrangements are described in Notes 7 and 10.

Certain of the Company’s invested assets are pledged as collateral for various derivative transactions as described in Note 4. Certain of

the Company’s trading securities are pledged to secure liabilities associated with short sale agreements in the trading securities portfolio

as described in the following section.

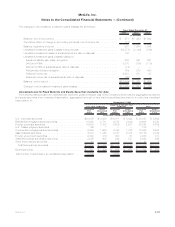

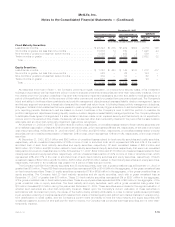

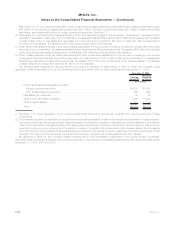

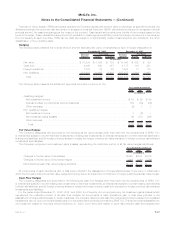

Trading Securities

The Company has a trading securities portfolio to support investment strategies that involve the active and frequent purchase and sale

of securities, the execution of short sale agreements and asset and liability matching strategies for certain insurance products. Trading

securities and short sale agreement liabilities are recorded at estimated fair value with subsequent changes in estimated fair value

recognized in net investment income.

At December 31, 2008 and 2007, trading securities at estimated fair value were $946 million and $779 million, respectively, and

liabilities associated with the short sale agreements in the trading securities portfolio, which were included in other liabilities, were

$57 million and $107 million, respectively. The Company had pledged $346 million and $407 million of its assets, at estimated fair value,

primarily consisting of trading securities, as collateral to secure the liabilities associated with the short sale agreements in the trading

securities portfolio at December 31, 2008 and 2007, respectively.

Interest and dividends earned on trading securities in addition to the net realized and unrealized gains (losses) recognized on the trading

securities and the related short sale agreement liabilities included within net investment income totaled ($193) million, $50 million and

$71 million for the years ended December 31, 2008, 2007 and 2006, respectively. Included within unrealized gains (losses) on such

trading securities and short sale agreement liabilities are changes in estimated fair value of ($174) million, ($4) million and $26 million for the

years ended December 31, 2008, 2007 and 2006, respectively.

F-39MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)