MetLife 2008 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

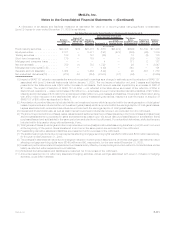

A rollforward of all assets and liabilities measured at estimated fair value on a recurring basis using significant unobservable

(Level 3) inputs for year ended December 31, 2008 is as follows:

Balance,

December 31,

2007

Impact of

SFAS 157 and

SFAS 159

Adoption(1)

Balance,

Beginning

of Period Earnings(2, 3)

Other

Comprehensive

Income (Loss)

Purchases,

Sales,

Issuances and

Settlements(4)

Transfer In

and/or Out

of Level 3(5)

Balance,

End of

Period

Total Realized/Unrealized

Gains (Losses) included in:

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

(In millions)

Fixed maturity securities . . . . . . . . . . $23,326 $ (8) $23,318 $ (881) $(6,272) $(596) $1,839 $17,408

Equity securities . . . . . . . . . . . . . . . 2,371 — 2,371 (197) (478) (288) (29) 1,379

Tradingsecurities.............. 183 8 191 (26) — 18 (8) 175

Short-term investments . . . . . . . . . . 179 — 179 — — (79) — 100

Mortgage and consumer loans . . . . . — — — 4 — 171 2 177

Net derivatives(6) . . . . . . . . . . . . . . 789 (1) 788 1,729 — 29 1 2,547

Mortgage servicing rights(7),(8) . . . . . — — — (149) — 340 — 191

Separate account assets(9) . . . . . . . 1,464 — 1,464 (129) — 90 333 1,758

Net embedded derivatives(10) . . . . . . (278) 24 (254) (2,500) (81) (94) — (2,929)

(1) Impact of SFAS 157 adoption represents the amount recognized in earnings as a change in estimate upon the adoption of SFAS 157

associated with Level 3 financial instruments held at January 1, 2008. The net impact of adoption on Level 3 assets and liabilities

presented in the table above was a $23 million increase to net assets. Such amount was also impacted by an increase to DAC of

$17 million. The impact of adoption of SFAS 157 on RGA — not reflected in the table above as a result of the reflection of RGA in

discontinued operations — was a net increase of $2 million (i.e., a decrease in Level 3 net embedded derivative liabilities of $17 million

offset by a DAC decrease of $15 million) for a total impact of $42 million on Level 3 assets and liabilities. This impact of $42 million along

with a $12 million reduction in the estimated fair value of Level 2 freestanding derivatives, results in a total net impact of adoption of

SFAS 157 of $30 million as described in Note 1.

(2) Amortization of premium/discount is included within net investment income which is reported within the earnings caption of total gains/

losses. Impairments are included within net investment gains (losses) which is reported within the earnings caption of total gains/losses.

Lapses associated with embedded derivatives are included with the earnings caption of total gains/losses.

(3) Interest and dividend accruals, as well as cash interest coupons and dividends received, are excluded from the rollforward.

(4) The amount reported within purchases, sales, issuances and settlements is the purchase/issuance price (for purchases and issuances)

and the sales/settlement proceeds (for sales and settlements) based upon the actual date purchased/issued or sold/settled. Items

purchased/issued and sold/settled in the same period are excluded from the rollforward. For embedded derivatives, attributed fees are

included within this caption along with settlements, if any.

(5) Total gains and losses (in earnings and other comprehensive income (loss)) are calculated assuming transfers in (out) of Level 3 occurred

at the beginning of the period. Items transferred in and out in the same period are excluded from the rollforward.

(6) Freestanding derivative assets and liabilities are presented net for purposes of the rollforward.

(7) The additions and reductions (due to loan payments) affecting mortgage servicing rights were $350 million and ($10) million respectively,

for the year ended December 31, 2008.

(8) The changes in estimated fair value due to changes in valuation model inputs or assumptions, and other changes in estimated fair value

affecting mortgage servicing rights were ($149) million and $0, respectively, for the year ended December 31, 2008.

(9) Investment performance related to separate account assets is fully offset by corresponding amounts credited to contractholders whose

liability is reflected within separate account liabilities.

(10) Embedded derivative assets and liabilities are presented net for purposes of the rollforward.

(11) Amounts presented do not reflect any associated hedging activities. Actual earnings associated with Level 3, inclusive of hedging

activities, could differ materially.

F-111MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)