MetLife 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or acquisition of the contracts. The future gross margins are dependent principally on investment returns, policyholder dividend scales,

mortality, persistency, expenses to administer the business, creditworthiness of reinsurance counterparties, and certain economic

variables, such as inflation. For participating contracts (dividend paying traditional contracts within the closed block) future gross margins

are also dependent upon changes in the policyholder dividend obligation. Of these factors, the Company anticipates that investment

returns, expenses, persistency, and other factor changes and policyholder dividend scales are reasonably likely to impact significantly the

rate of DAC and VOBA amortization. Each reporting period, the Company updates the estimated gross margins with the actual gross

margins for that period. When the actual gross margins change from previously estimated gross margins, the cumulative DAC and VOBA

amortization is re-estimated and adjusted by a cumulative charge or credit to current operations. When actual gross margins exceed those

previously estimated, the DAC and VOBA amortization will increase, resulting in a current period charge to earnings. The opposite result

occurs when the actual gross margins are below the previously estimated gross margins. Each reporting period, the Company also

updates the actual amount of business in-force, which impacts expected future gross margins. When expected future gross margins are

below those previously estimated, the DAC and VOBA amortization will increase, resulting in a current period charge to earnings. The

opposite result occurs when the expected future gross margins are above the previously estimated expected future gross margins. Total

DAC and VOBA amortization during a particular period may increase or decrease depending upon the relative size of the amortization

change resulting from the adjustment to DAC and VOBA for the update of actual gross margins and the re-estimation of expected future

gross margins. Each period, the Company also reviews the estimated gross margins for each block of business to determine the

recoverability of DAC and VOBA balances.

The Company amortizes DAC and VOBA related to fixed and variable universal life contracts and fixed and variable deferred annuity

contracts over the estimated lives of the contracts in proportion to actual and expected future gross profits. The amortization includes

interest based on rates in effect at inception or acquisition of the contracts. The amount of future gross profits is dependent principally

upon returns in excess of the amounts credited to policyholders, mortality, persistency, interest crediting rates, expenses to administer the

business, creditworthiness of reinsurance counterparties, the effect of any hedges used, and certain economic variables, such as inflation.

Of these factors, the Company anticipates that investment returns, expenses, and persistency are reasonably likely to impact significantly

the rate of DAC and VOBA amortization. Each reporting period, the Company updates the estimated gross profits with the actual gross

profits for that period. When the actual gross profits change from previously estimated gross profits, the cumulative DAC and VOBA

amortization is re-estimated and adjusted by a cumulative charge or credit to current operations. When actual gross profits exceed those

previously estimated, the DAC and VOBA amortization will increase, resulting in a current period charge to earnings. The opposite result

occurs when the actual gross profits are below the previously estimated gross profits. Each reporting period, the Company also updates

the actual amount of business remaining in-force, which impacts expected future gross profits. When expected future gross profits are

below those previously estimated, the DAC and VOBA amortization will increase, resulting in a current period charge to earnings. The

opposite result occurs when the expected future gross profits are above the previously estimated expected future gross profits. Total DAC

and VOBA amortization during a particular period may increase or decrease depending upon the relative size of the amortization change

resulting from the adjustment to DAC and VOBA for the update of actual gross profits and the re-estimation of expected future gross profits.

Each period, the Company also reviews the estimated gross profits for each block of business to determine the recoverability of DAC and

VOBA balances.

Separate account rates of return on variable universal life contracts and variable deferred annuity contracts affect in-force account

balances on such contracts each reporting period which can result in significant fluctuations in amortization of DAC and VOBA. Returns

that are higher than the Company’s long-term expectation produce higher account balances, which increases the Company’s future fee

expectations and decreases future benefit payment expectations on minimum death and living benefit guarantees, resulting in higher

expected future gross profits. The opposite result occurs when returns are lower than the Company’s long-term expectation. The

Company’s practice to determine the impact of gross profits resulting from returns on separate accounts assumes that long-term

appreciation in equity markets is not changed by short-term market fluctuations, but is only changed when sustained interim deviations are

expected. The Company monitors these changes and only changes the assumption when its long-term expectation changes. The effect of

an increase/(decrease) by 100 basis points in the assumed future rate of return is reasonably likely to result in a decrease/(increase) in the

DAC and VOBA balances of approximately $110 million with an offset to the Company’s unearned revenue liability of approximately

$20 million for this factor. During 2008, the Company did not change its long-term expectation of equity market appreciation.

The Company also reviews periodically other long-term assumptions underlying the projections of estimated gross margins and profits.

These include investment returns, policyholder dividend scales, interest crediting rates, mortality, persistency, and expenses to administer

business. Management annually updates assumptions used in the calculation of estimated gross margins and profits which may have

significantly changed. If the update of assumptions causes expected future gross margins and profits to increase, DAC and VOBA

amortization will decrease, resulting in a current period increase to earnings. The opposite result occurs when the assumption update

causes expected future gross margins and profits to decrease.

Over the last several years, the Company’s most significant assumption updates resulting in a change to expected future gross margins

and profits and the amortization of DAC and VOBA have been updated due to revisions to expected future investment returns, expenses,

in-force or persistency assumptions and policyholder dividends on contracts included within the Individual segment. During 2008, the

amount of net investment gains (losses) as well as the level of separate account balances also resulted in significant changes to expected

future gross margins and profits impacting amortization of DAC and VOBA. The Company expects these assumptions to be the ones most

reasonably likely to cause significant changes in the future. Changes in these assumptions can be offsetting and the Company is unable to

predict their movement or offsetting impact over time.

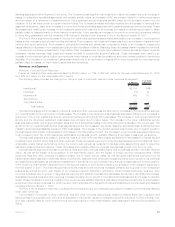

Note 5 of the Notes to the Consolidated Financial Statements provides a rollforward of DAC and VOBA for the Company for each of the

years ended December 31, 2008, 2007 and 2006 as well as a breakdown of DAC and VOBA by segment and reporting unit at

December 31, 2008 and 2007. At December 31, 2008 and 2007, DAC and VOBA for the Company was $20.1 billion and $17.8 billion,

respectively. A substantial portion, approximately 80%, of the Company’s DAC and VOBA is associated with the Individual segment which

had DAC and VOBA of $16.5 billion and $14.0 billion, respectively, at December 31, 2008 and 2007. Amortization of DAC and VOBA

associated with the variable & universal life and the annuities reporting units within the Individual segment are significantly impacted by

movements in equity markets. The following chart illustrates the effect on DAC and VOBA within the Company’s Individual segment of

changing each of the respective assumptions as well as updating estimated gross margins or profits with actual gross margins or profits

16 MetLife, Inc.