MetLife 2008 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

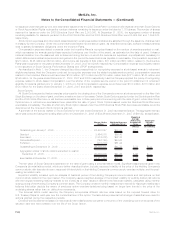

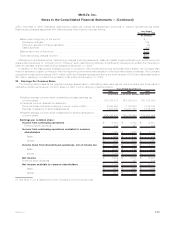

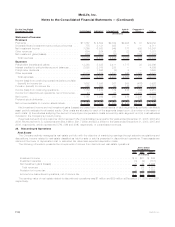

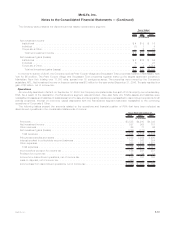

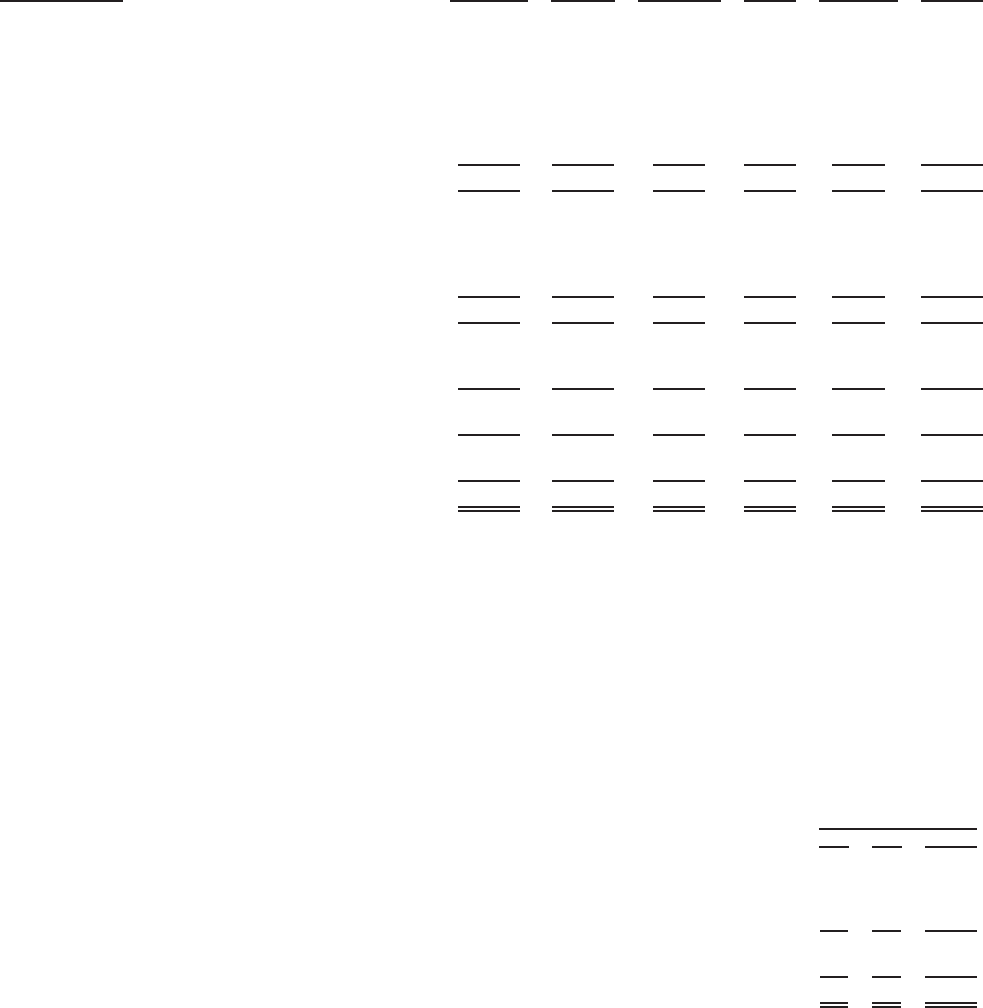

For the Year Ended

December 31, 2006 Institutional Individual International Auto &

Home Corporate &

Other Total

(In millions)

Statement of Income:

Revenues

Premiums................................ $11,867 $ 4,502 $2,722 $2,924 $ 37 $22,052

Universal life and investment-type product policy fees . . . 775 3,131 805 — — 4,711

Net investment income . . . . . . . . . . . . . . . . . . . . . . . 7,260 6,863 949 177 998 16,247

Otherrevenues ............................ 684 524 28 22 43 1,301

Netinvestmentgains(losses) ................... (630) (591) (10) 3 (154) (1,382)

Totalrevenues ........................... 19,956 14,429 4,494 3,126 924 42,929

Expenses

Policyholder benefits and claims . . . . . . . . . . . . . . . . . 13,368 5,335 2,411 1,717 38 22,869

Interest credited to policyholder account balances . . . . . . 2,593 2,018 288 — — 4,899

Policyholderdividends........................ — 1,696 (3) 5 — 1,698

Otherexpenses............................ 2,313 3,485 1,531 846 1,362 9,537

Total expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,274 12,534 4,227 2,568 1,400 39,003

Income (loss) from continuing operations before provision

(benefit)forincometax...................... 1,682 1,895 267 558 (476) 3,926

Provision(benefit)forincometax................. 563 653 95 142 (437) 1,016

Income (loss) from continuing operations . . . . . . . . . . . . 1,119 1,242 172 416 (39) 2,910

Income from discontinued operations, net of income tax . . 48 22 28 — 3,285 3,383

Netincome............................... 1,167 1,264 200 416 3,246 6,293

Preferredstockdividends...................... — — — — 134 134

Net income available to common shareholders . . . . . . . . $ 1,167 $ 1,264 $ 200 $ 416 $3,112 $ 6,159

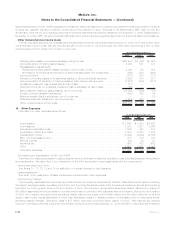

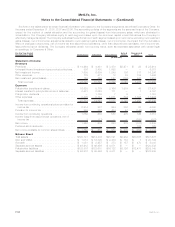

Net investment income and net investment gains (losses) are based upon the actual results of each segment’s specifically identifiable

asset portfolio adjusted for allocated equity. Other costs are allocated to each of the segments based upon: (i) a review of the nature of

such costs; (ii) time studies analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates

included in the Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues for the years ended December 31, 2008, 2007 and

2006. Revenues from U.S. operations were $44.6 billion, $41.7 billion and $38.4 billion for the years ended December 31, 2008, 2007 and

2006, respectively, which represented 87%, 88% and 90%, respectively, of consolidated revenues.

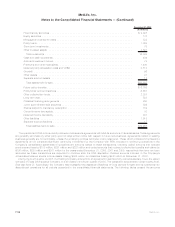

23. Discontinued Operations

Real Estate

The Company actively manages its real estate portfolio with the objective of maximizing earnings through selective acquisitions and

dispositions. Income related to real estate classified as held-for-sale or sold is presented in discontinued operations. These assets are

carried at the lower of depreciated cost or estimated fair value less expected disposition costs.

The following information presents the components of income from discontinued real estate operations:

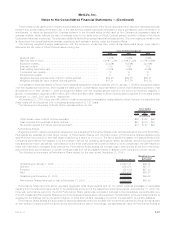

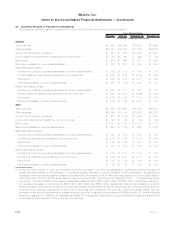

2008 2007 2006

Years Ended

December 31,

(In millions)

Investmentincome........................................................ $ 6 $21 $ 243

Investmentexpense ....................................................... (3) (9) (151)

Netinvestmentgains(losses)................................................. 8 13 4,795

Totalrevenues ......................................................... 11 25 4,887

Provisionforincometax .................................................... 4 11 1,725

Incomefromdiscontinuedoperations,netofincometax................................ $ 7 $14 $3,162

The carrying value of real estate related to discontinued operations was $1 million and $39 million at December 31, 2008 and 2007,

respectively.

F-96 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)