MetLife 2008 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary

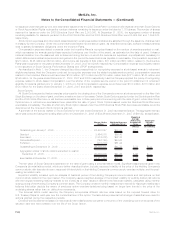

Putative or certified class action litigation and other litigation and claims and assessments against the Company, in addition to those

discussed previously and those otherwise provided for in the Company’s consolidated financial statements, have arisen in the course of

the Company’s business, including, but not limited to, in connection with its activities as an insurer, employer, investor, investment advisor

and taxpayer. Further, state insurance regulatory authorities and other federal and state authorities regularly make inquiries and conduct

investigations concerning the Company’s compliance with applicable insurance and other laws and regulations.

It is not possible to predict the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted previously in connection with specific matters. In some of the matters referred to previously, very large

and/or indeterminate amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible

that an adverse outcome in certain cases could have a material adverse effect upon the Company’s financial position, based on information

currently known by the Company’s management, in its opinion, the outcomes of such pending investigations and legal proceedings are not

likely to have such an effect. However, given the large and/or indeterminate amounts sought in certain of these matters and the inherent

unpredictability of litigation, it is possible that an adverse outcome in certain matters could, from time to time, have a material adverse effect

on the Company’s consolidated net income or cash flows in particular quarterly or annual periods.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by

impaired, insolvent or failed insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular

state on the basis of the proportionate share of the premiums written by member insurers in the lines of business in which the impaired,

insolvent or failed insurer engaged. Some states permit member insurers to recover assessments paid through full or partial premium tax

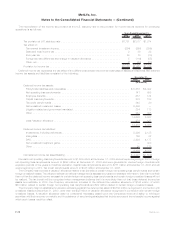

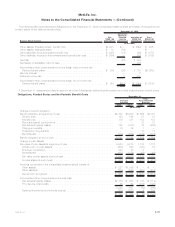

offsets. Assets and liabilities held for insolvency assessments are as follows:

2008 2007

December 31,

(In millions)

Other Assets:

Premiumtaxoffsetforfutureundiscountedassessments ............................... $50 $40

Premiumtaxoffsetscurrentlyavailableforpaidassessments............................. 7 6

Receivableforreimbursementofpaidassessments(1)................................. 7 7

$64 $53

Other Liabilities:

Insolvencyassessments .................................................... $83 $74

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

Assessments levied against the Company were $2 million, ($1) million and $2 million for the years ended December 31, 2008, 2007 and

2006, respectively.

Argentina

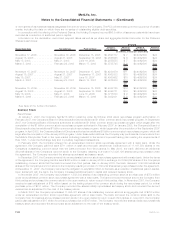

The Argentine economic, regulatory and legal environment, including interpretations of laws and regulations by regulators and courts, is

uncertain. Potential legal or governmental actions related to pension reform, fiduciary responsibilities, performance guarantees and tax

rulings could adversely affect the results of the Company.

Upon acquisition of Citigroup’s insurance operations in Argentina, the Company established insurance and contingent liabilities, most

significantly related to death and disability policy coverages and to litigation against the government’s 2002 Pesification Law. These

liabilities were established based upon the Company’s interpretation of Argentine law at the time and the Company’s best estimate of its

obligations under laws applicable at the time.

In 2006, a decree was issued by the Argentine Government regarding the taxability of pesification related gains resulting in the

$8 million, net of income tax, reduction of certain tax liabilities during the year ended December 31, 2006.

In 2007, pension reform legislation in Argentina was enacted which relieved the Company of its obligation to provide death and disability

policy coverages and resulted in the elimination of related insurance liabilities. The reform reinstituted the government’s pension plan

system and allowed for pension participants to transfer their future contributions to the government pension plan system.

Although it no longer receives compensation, the Company continued to be responsible for managing the funds of those participants

that transferred to the government system. This change resulted in the establishment of a liability for future servicing obligations and the

elimination of the Company’s obligations under death and disability policy coverages. The impact of the 2007 Argentine pension reform

was an increase to net income of $114 million, net of income tax, due to the reduction of the insurance liabilities and other balances

associated with the death and disability coverages of $197 million, net of income tax, which exceeded the establishment of the liability for

future service obligations of $83 million, net of income tax, during the year ended December 31, 2007. During the first quarter of 2008, the

future servicing obligation was reduced by $23 million, net of income tax, when information regarding the level of participation in the

governmentpensionplanbecamefullyavailable.

In October 2008, the Argentine government announced its intention to nationalize private pensions and, in December 2008, the

Argentine government nationalized the private pension system seizing the underlying investments of participants which were being

managed by the Company (“Nationalization”). With this action, the Company’s pension business in Argentina ceased to exist and the

F-76 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)