MetLife 2008 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

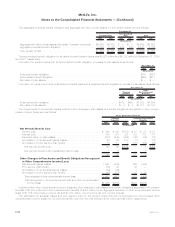

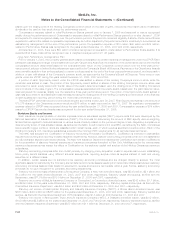

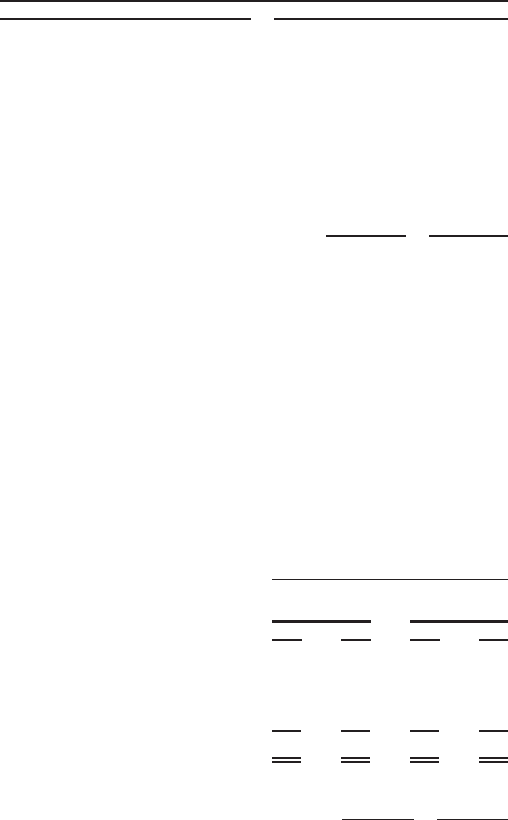

The assumed healthcare cost trend rates used in measuring the APBO and net periodic benefit cost were as follows:

2008 2007

December 31,

Pre-Medicare eligible claims . . . . . . . . . . . . . . . . . . . 8.8% down to 5.8% in 2018 and

gradually decreasing until 2079

reaching the ultimate rate of 4.1%

8.5% down to 5% in 2014 and

remaining constant thereafter

Medicare eligible claims . . . . . . . . . . . . . . . . . . . . . . 8.8% down to 5.8% in 2018 and

gradually decreasing until 2079

reaching the ultimate rate of 4.1%

10.5% down to 5% in 2018 and

remaining constant thereafter

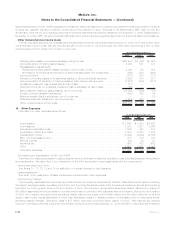

Assumed healthcare cost trend rates may have a significant effect on the amounts reported for healthcare plans. A one-percentage

point change in assumed healthcare cost trend rates would have the following effects:

One Percent

Increase One Percent

Decrease

(In millions)

Effectontotalofserviceandinterestcostcomponents.............................. $ 6 $ (6)

Effectofaccumulatedpostretirementbenefitobligation .............................. $76 $(86)

Plan Assets

The Subsidiaries have issued group annuity and life insurance contracts supporting approximately 99% of all pension and other

postretirement benefit plans assets.

The account values of the group annuity and life insurance contracts issued by the Subsidiaries and held as assets of the pension and

other postretirement benefit plans were $6,451 million and $7,565 million at December 31, 2008 and 2007, respectively. The majority of

such account values are held in separate accounts established by the Subsidiaries. Total revenue from these contracts recognized in the

consolidated statements of income was $42 million, $47 million and $48 million for the years ended December 31, 2008, 2007 and 2006,

respectively, and includes policy charges, net investment income from investments backing the contracts and administrative fees. Total

investment income (loss), including realized and unrealized gains and losses, credited to the account balances were ($1,090) million,

$603 million and $818 million for the years ended December 31, 2008, 2007 and 2006, respectively. The terms of these contracts are

consistent in all material respects with those the Subsidiaries offer to unaffiliated parties that are similarly situated.

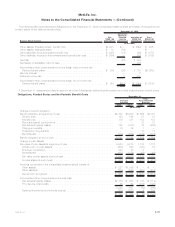

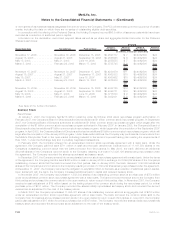

The weighted-average allocations of pension plan and other postretirement benefit plan assets were as follows:

2008 2007 2008 2007

Pension

Benefits

Other

Postretirement

Benefits

December 31,

Asset Category

Equitysecurities................................................... 28% 38% 27% 37%

Fixedmaturitysecurities.............................................. 51 44 71 58

Other(RealEstateandAlternativeInvestments)............................... 21 18 2 5

Total......................................................... 100% 100% 100% 100%

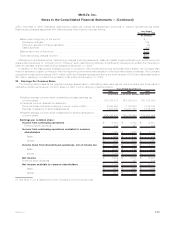

The weighted-average target allocations of pension plan and other postretirement benefit plan assets for 2009 are as follows:

Pension Other

Asset Category

Equitysecurities......................................................... 25%-45% 30%-45%

Fixedmaturitysecurities.................................................... 35%-55% 55%-85%

Other(RealEstateandAlternativeInvestments)..................................... 5%-32% 0%-10%

Target allocations of assets are determined with the objective of maximizing returns and minimizing volatility of net assets through

adequate asset diversification. Adjustments are made to target allocations based on an assessment of the impact of economic factors and

market conditions.

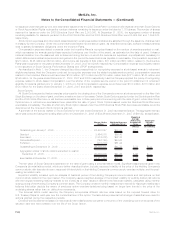

Cash Flows

It is the Subsidiaries’ practice to make contributions to the qualified pension plans to comply with minimum funding requirements of

ERISA. In accordance with such practice, no contributions were required for the years ended December 31, 2008 or 2007. No

contributions will be required for 2009. The Subsidiaries made discretionary contributions of $300 million to the qualified pension plans

during the year ended December 31, 2008 and did not make discretionary contributions for the year ended December 31, 2007. The

Subsidiaries expect to make additional discretionary contributions of $150 million in 2009.

Benefit payments due under the non-qualified pension plans are funded from the Subsidiaries’ general assets as they become due

under the provision of the plans. These payments totaled $43 million and $48 million for the years ended December 31, 2008 and 2007,

respectively. These payments are expected to be at approximately the same level in 2009.

Other postretirement benefits represent a non-vested, non-guaranteed obligation of the Subsidiaries and current regulations do not

require specific funding levels for these benefits. While the Subsidiaries have partially funded such plans in advance, it has been the

F-82 MetLife, Inc.

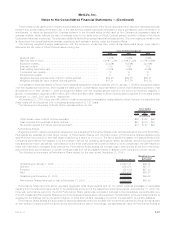

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)