MetLife 2008 Annual Report Download - page 10

Download and view the complete annual report

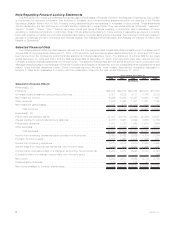

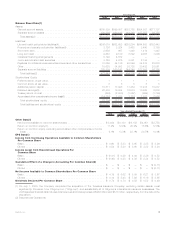

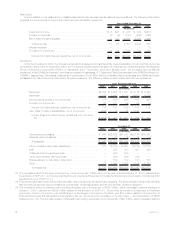

Please find page 10 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A decrease in interest credited to policyholder account balances of $438 million, net of income tax, resulted from a decline in average

crediting rates, which was largely due to the impact of lower short-term interest rates in the current period, offset by an increase from

growth in the average policyholder account balance, primarily the result of continued growth in the global GIC and funding agreement

products all of which occurred within the Institutional segment. There was also a decrease in interest credited in the International segment

as a result of a reduction in unit-linked policyholder liabilities reflecting the losses of the trading portfolio backing these liabilities.

Year Ended December 31, 2007 compared with the Year Ended December 31, 2006

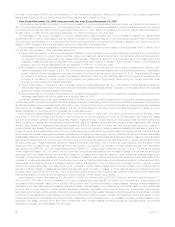

The Company reported $4,180 million in net income available to common shareholders and earnings per diluted common share of

$5.48 for the year ended December 31, 2007 compared to $6,159 million in net income available to common shareholders and earnings

per diluted common share of $7.99 for the year ended December 31, 2006. Net income available to common shareholders decreased by

$1,979 million, or 32%, for the year ended December 31, 2007 compared to the 2006 period.

The decrease in net income available to common shareholders was primarily due to a decrease in income from discontinued operations

of $3,168 million, net of income tax. This decrease in income from discontinued operations was principally driven by a gain on the sale of

the Peter Cooper Village and Stuyvesant Town properties in Manhattan, New York, that was recognized during the year ended Decem-

ber 31, 2006. Also contributing to the decrease was lower net investment income and net investment gains (losses) from discontinued

operations related to real estate properties sold or held-for-sale during the year ended December 31, 2007 as compared to the year ended

December 31, 2006. Lower income from discontinued operations related to the sale of MetLife Insurance Limited (“MetLife Australia”)

annuities and pension businesses to a third party in the third quarter of 2007 and lower income from discontinued operations related to the

sale of SSRM Holdings, Inc. (“SSRM”) resulting from a reduction in additional proceeds from the sale received during the year ended

December 31, 2007 as compared to the year December 31, 2006. This decrease was partially offset by higher income from discontinued

operations related to RGA, which was reclassified to discontinued operations in the third quarter of 2008 as a result of a tax-free split-off.

RGA’s income was higher in 2007, primarily due to an increase in premiums, net of an increase in policyholder benefits and claims, due to

additional in-force business from facultative and automatic treaties and renewal premiums on existing blocks of business combined with an

increase in net investment income, net of interest credited to policyholder account balances, due to higher invested assets. These

increases in RGA’s income were offset by an increase in net investment losses resulting from a decline in the estimated fair value of

embedded derivatives associated with the reinsurance of annuity products on a funds withheld basis.

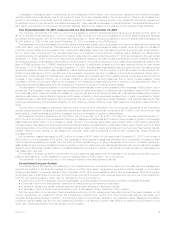

The decrease in net income available to common shareholders was also driven by an increase in other expenses of $580 million, net of

income tax. The increase in other expenses was primarily due to higher amortization of deferred policy acquisition costs (“DAC”) resulting

from business growth, lower net investment losses in the current year and the net impact of revisions to management’s assumption used to

determine estimated gross profits and margins in both years. In addition, other expenses increased due to higher compensation, higher

interest expense on debt and interest on tax contingencies, the net impact of revisions to certain liabilities in both periods, asset write-offs,

higher general spending and expenses related to growth initiatives, partially offset by lower legal costs and integration costs incurred in

2006.

The net effect of increases in premiums, fees and other revenues of $1,046 million, net of income tax, across all of the Company’s

operating segments and increases in policyholder benefit and claims and policyholder dividends of $610 million, net of income tax, was

attributable to overall business growth and increased net income available to common shareholders.

Net investment income increased by $1,180 million, net of income tax, or 11%, to $11,741 million for the year ended December 31,

2007 from $10,561 million for the comparable 2006 period. Management attributes $700 million of this increase to growth in the average

asset base and $480 million to an increase in yields. Growth in the average asset base was primarily within fixed maturity securities,

mortgage loans, real estate joint ventures and other limited partnership interests. Higher yields was primarily due to higher returns on fixed

maturity securities, other limited partnership interests excluding hedge funds, equity securities and improved securities lending results,

partially offset by lower returns on real estate joint ventures, cash, cash equivalents and short-term investments, hedge funds and

mortgage loans.

Net investment losses decreased by $522 million to a loss of $376 million for the year ended December 31, 2007 from a loss of

$898 million for the comparable 2006 period. The decrease in net investment losses was primarily due to a reduction of losses on fixed

maturity securities resulting principally from the 2006 portfolio repositioning in a rising interest rate environment, increased gains from

asset-based foreign currency transactions due to a decline in the U.S. dollar year over year against several major currencies and increased

gains on equity securities, partially offset by increased losses from the mark-to-market on derivatives and reduced gains on real estate and

real estate joint ventures.

An increase in interest credited to policyholder account balances associated with an increase in the average policyholder account

balance decreased net income available to common shareholders by $365 million, net of income tax.

The remainder of the variance is due to the change in effective tax rates between periods.

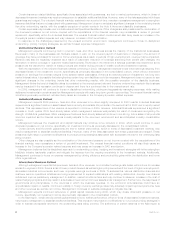

Consolidated Company Outlook

The marketplace is still reacting and adapting to the unusual economic events that took place over the past year and management

expects the volatility in the financial markets to continue in 2009. As a result, management expects a modest increase, on a constant

exchange rate basis, in premiums, fees and other revenues in 2009, with mixed results across the various businesses. While the Company

continues to gain market share in a number of product lines, premiums, fees and other revenues have and may continue to be impacted by

the U.S. and global recession, which may be reflected by, but is not limited to:

• Lower fee income from separate account businesses, including variable annuity and life products in Individual Business.

• A potential reduction in payroll linked revenue from Institutional group insurance customers.

• A decline in demand for certain International and Institutional retirement & savings products.

• A decrease in Auto & Home premiums resulting from a depressed housing market and auto industry.

With the expectation of the turbulent financial markets continuing in 2009, management expects continued downward pressure on net

income, specifically net investment income, as management expects lower returns from other limited partnerships, real estate joint

ventures, and securities lending. In addition, the resulting impact of the financial markets on net investment gains (losses) and unrealized

investment gains (losses) can and will vary greatly and therefore, it is difficult to predict. Also difficult to determine is the impact of own

credit, as it varies significantly and this exposure is not hedged.

7MetLife, Inc.