MetLife 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under stressful market and economic conditions, liquidity broadly deteriorates which could negatively impact the Company’s ability to

sell investment assets. If the Company requires significant amounts of cash on short notice in excess of normal cash requirements, the

Company may have difficulty selling investment assets in a timely manner, be forced to sell them for less than the Company otherwise

would have been able to realize, or both. In addition, in the event of such forced sale, accounting rules require the recognition of a loss and

may require the impairment of other such securities based upon the Company’s ability to hold such securities which, may negatively impact

the Company’s financial statements.

In extreme circumstances, all general account assets — other than those which may have been pledged to a specific purpose — within

a statutory legal entity are available to fund obligations of the general account within that legal entity. A disruption in the financial markets

could limit the Holding Company’s access to or cost of liquidity. See “Extraordinary Market Conditions.”

Liquidity and Capital Sources

CashFlowsfromOperations. The Company’s principal cash inflows from its insurance activities come from insurance premiums,

annuity considerations and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder

and policyholder withdrawal. See “Extraordinary Market Conditions” and “Liquidity and Capital Uses — Contractual Obligations.”

Cash Flows from Investments. The Company’s principal cash inflows from its investment activities come from repayments of principal,

proceeds from maturities and sales of invested assets and net investment income. The primary liquidity concerns with respect to these

cash inflows are the risk of default by debtors and market volatilities. The Company closely monitors and manages these risks through its

credit risk management process. During the latter half of 2008, the Company increased its short-term liquidity position in response to the

extraordinary market conditions. The Company’s short-term liquidity position defined as cash, cash equivalents and short-term invest-

ments excluding both cash collateral received under the Company’s securities lending program that has been reinvested in cash, cash

equivalents, short-term investments and collateral received from counterparties in connection with derivative instruments was $26.7 billion

and $10.9 billion at December 31, 2008 and 2007, respectively. See “— Investments — Current Environment.”

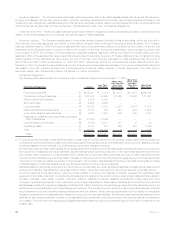

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include

cash, cash equivalents, short-term investments and publicly-traded securities excluding (i) cash collateral received under the Company’s

securities lending program that has been reinvested in cash, cash equivalents, short-term investments and publicly-traded securities;

(ii) cash collateral received from counterparties in connection with derivative instruments; (iii) cash, cash equivalents, short-term invest-

ments and securities on deposit with regulatory agencies; and (iv) securities held in trust in support of collateral financing arrangements

and pledged in support of debt and funding agreements. At December 31, 2008 and 2007, the Company had $139.4 billion and

$163.8 billion in liquid assets, respectively. For further discussion of invested assets on deposit with regulatory agencies, held in trust in

support of collateral financing arrangements and pledged in support of debt and funding agreements. See “— Investments — Assets on

Deposit, Held in Trust and Pledged as Collateral.”

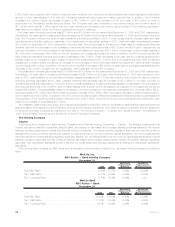

Global Funding Sources. Liquidity is also provided by a variety of short-term instruments, including repurchase agreements and

commercial paper. Capital is provided by a variety of long-term instruments, including medium- and long-term debt, junior subordinated

debt securities, capital securities and stockholders’ equity. The diversity of the Company’s funding sources enhances flexibility, limits

dependence on any one source of funds and generally lowers the cost of funds. See “Extraordinary Market Conditions.”

During the turbulent market conditions of 2008, the Company has utilized various means of short-term and long-term financing

including:

• The Company is participating in certain economic stabilization programs established by various government institutions. The Federal

Reserve Bank of New York’s Commercial Paper Funding Facility (“CPFF”) is intended to improve liquidity in short-term funding markets

by increasing the availability of term commercial paper funding to issuers and by providing greater assurance to both issuers and

investors that firms will be able to rollover their maturing commercial paper. MetLife Short Term Funding LLC, the issuer of commercial

paper under a program supported by funding agreements issued by Metropolitan Life Insurance Company and MetLife Insurance

Company of Connecticut, was accepted in October 2008 for the CPFF and may issue a maximum amount of $3.8 billion under the

CPFF. At December 31, 2008, MetLife Short Term Funding LLC had used $1,650 million of its available capacity under the CPFF, and

such amount was deposited under the related funding agreements. MetLife Funding, Inc. was accepted in November 2008 for the

Federal Reserve Bank of New York’s CPFF and may issue a maximum amount of $1 billion under the CPFF. No drawdown by MetLife

Funding, Inc. has taken place under this facility as of the date hereof. In December 2008, MetLife, Inc. elected to continue to

participate in the debt guarantee component of the Federal Deposit Insurance Corporation’s (“FDIC”) Temporary Liquidity Guarantee

Program (the “FDIC Program”). Under the terms of the FDIC Program, the FDIC will guarantee through June 2012 (or maturity, if

earlier) the payment of certain newly-issued senior unsecured debt of MetLife, Inc. and any eligible affiliates. The Company also

notified the FDIC that it elected the option of excluding specified senior unsecured debt maturing after June 30, 2012 from the

guarantee before reaching the limits on the amount of guaranteed debt under the FDIC Program ($398 million for MetLife, Inc. and

$178 million for MetLife Bank, N.A. which may issue guaranteed debt under its limit, as well as unused amounts under MetLife, Inc.’s

limit). The Company opted out of the component of the FDIC Program that guarantees non-interest bearing deposit transaction

accounts. Management cannot predict how the markets may react to these elections or to any debt issued subject to the terms of the

FDIC Program.

MetLife, Inc. and MetLife Funding, Inc. each have commercial paper programs. The commercial paper markets have effectively

closed to certain issuers, depending upon their ratings. Depending on market conditions, we may issue shorter maturities than we

would otherwise like.

• MetLife Bank, N.A. has pledged loans and securities with the Federal Reserve Bank of New York to have the capacity to borrow at the

Discount Window or under the Term Auction Facility. At December 31, 2008, MetLife Bank had borrowed $950 million under the Term

Auction Facility for various short-term maturities. In addition, as a member of the Federal Home Loan Bank of New York (“FHLB of

NY”), MetLife Bank has entered into repurchase agreements with FHLB of NY on a short-term and long-term basis, with a total liability

for repurchase agreements with the FHLB of NY of $1.8 billion at December 31, 2008. Management expects MetLife Bank to take

49MetLife, Inc.