MetLife 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reduced the interest rate risk by $254 million. Partially offsetting the decline was an increase in the interest rate risk from the use of

derivatives employed by the Company by $2,151 million, primarily related to financial futures and interest rate swaps. Changes in the

duration of the Company’s portfolio also attributed $1,312 million to partially offset the decline in interest rate risk. The inclusion of certain

reinsurance recoverables within premiums and other receivables also increased the interest rate risk by $216 million. The remainder of the

fluctuation is attributable to numerous immaterial items.

In addition to the analysis above, as part of its asset liability management program, the Company also performs an analysis of the

sensitivity to changes in interest rates, including both insurance liabilities and financial instruments. At December 31, 2008, a hypothetical

instantaneous 10% decrease in interest rates applied to the Company’s liabilities, insurance and associated asset portfolios would reduce

the estimated fair value of equity by $962 million.

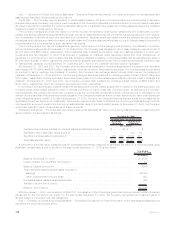

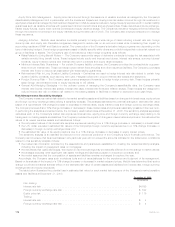

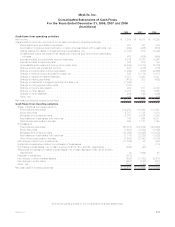

Sensitivity Analysis; Foreign Currency Exchange Rates. The table below provides additional detail regarding the potential loss in

estimated fair value of the Company’s portfolio due to a 10% change in foreign currency exchange rates at December 31, 2008 by type of

asset or liability:

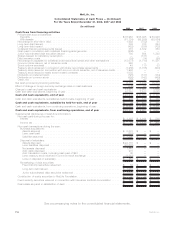

Notional

Amount Estimated

Fair Value(1)

Assuming a

10% Increase

in the Foreign

Exchange Rate

December 31, 2008

(In millions)

Assets

Fixedmaturitysecurities ............................................. $188,251 $(1,586)

Tradingsecurities.................................................. 946 (4)

Mortgage and consumer loans:

Held-for-investment............................................... 48,133 (311)

Held-for-sale ................................................... 2,010 (13)

Mortgageandconsumerloans,net ................................... 50,143 (324)

Policyloans ..................................................... 11,952 (40)

Short-terminvestments.............................................. 13,878 (69)

Cashandcashequivalents............................................ 24,207 (90)

Totalassets ..................................................... $(2,113)

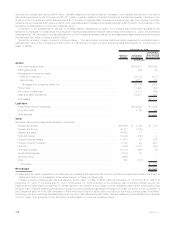

Liabilities

Policyholderaccountbalances ......................................... $102,902 $1,426

Long-termdebt ................................................... 8,155 60

Totalliabilities .................................................... $1,486

Other

Derivative instruments (designated hedges or otherwise)

Interestrateswaps................................................. $34,060 $ 3,149 $ (18)

Interestratefloors ................................................. 48,517 1,748 —

Interestratecaps.................................................. 24,643 11 —

Financialfutures................................................... 19,908 (160) 2

Foreigncurrencyswaps.............................................. 19,438 87 (26)

Foreigncurrencyforwards ............................................ 5,167 24 239

Options ........................................................ 8,450 3,127 (90)

Financialforwards ................................................. 28,176 296 (6)

Creditdefaultswaps................................................ 5,219 83 —

SyntheticGICs ................................................... 4,260 — —

Other.......................................................... 250 (101) —

Totalother..................................................... $ 101

Net change ...................................................... $ (526)

(1) Estimated fair value presented in the table above represents the estimated fair value of all financial instruments within this financial

statement caption not necessarily those solely subject to foreign exchange risk.

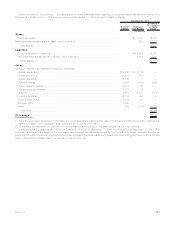

Foreign currency exchange rate risk decreased by $185 million, or 26%, to $526 million at December 31, 2008 from $711 million at

December 31, 2007. From December 31, 2007 to December 31, 2008 a decline in the exchange rate of the Euro, British pound, the

Mexican and Chilean pesos versus the U.S. Dollar resulted in the decline of the foreign currency exchange risk on fixed maturity securities

by $446 million. Partially offsetting the decline in foreign currency exchange risk was the exclusion of certain items due to the completion of

the Company’s split-off of its 52% ownership in RGA which accounted for $296 million reduction to the foreign currency risk. In addition,

the foreign currency exchange risk associated with long-term debt declined by $80 million due the weakening of the British pound against

the U.S. dollar. The remainder of the fluctuation is attributable to numerous immaterial items.

116 MetLife, Inc.