MetLife 2008 Annual Report Download - page 25

Download and view the complete annual report

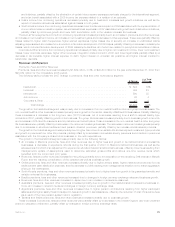

Please find page 25 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Investment Income

Net investment income decreased by $1,767 million, or 10%, to $16,296 million for the year ended December 31, 2008 from

$18,063 million for the comparable 2007 period. Management attributes $3,141 million of this change to a decrease in yields, partially

offset by an increase of $1,374 million due to growth in average invested assets. Average invested assets are calculated on cost basis

without unrealized gains and losses. The decrease in net investment income attributable to lower yields was primarily due to lower returns

on other limited partnership interests, real estate joint ventures, short-term investments, fixed maturity securities, and mortgage loans,

partially offset by improved securities lending results. Management anticipates that the significant volatility in the equity, real estate and

credit markets will continue in 2009 which could continue to impact net investment income and yields on other limited partnership interests

and real estate joint ventures. The decrease in net investment income attributable to lower yields was partially offset by increased net

investment income attributable to an increase in average invested assets on an amortized cost basis, primarily within short-term

investments, mortgage loans, other limited partnership interests, and real estate joint ventures.

Interest Margin

Interest margin, which represents the difference between interest earned and interest credited to policyholder account balances

decreased in the Individual segment for the year ended December 31, 2008 as compared to the prior year. The decrease in interest margin

within the Individual segment was primarily attributable to a decline in net investment income due to lower returns on other limited

partnership interests, real estate joint ventures, other invested assets including derivatives, and short term investments, all of which were

partially offset by higher securities lending results. Interest margins decreased in the retirement & savings and non-medical health & other

businesses, but increased within the group life business, all within the Institutional segment. Interest earned approximates net investment

income on investable assets attributed to the segment with minor adjustments related to the consolidation of certain separate accounts

and other minor non-policyholder elements. Interest credited is the amount attributed to insurance products, recorded in policyholder

benefits and claims, and the amount credited to policyholder account balances for investment-type products, recorded in interest credited

to policyholder account balances. Interest credited on insurance products reflects the current period impact of the interest rate

assumptions established at issuance or acquisition. Interest credited to policyholder account balances is subject to contractual terms,

including some minimum guarantees. This tends to move gradually over time to reflect market interest rate movements and may reflect

actions by management to respond to competitive pressures and, therefore, generally does not introduce volatility in expense.

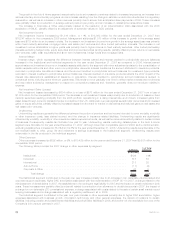

Net Investment Gains (Losses)

Net investment losses decreased by $2,390 million to a gain of $1,812 million for the year ended December 31, 2008 from a loss of

$578 million for the comparable 2007 period. The decrease in net investment losses is due to an increase in gains on derivatives partially

offset by losses primarily on fixed maturity and equity securities. Derivative gains were driven by gains on freestanding derivatives that were

partially offset by losses on embedded derivatives primarily associated with variable annuity riders. Gains on freestanding derivatives

increased by $6,499 million and were primarily driven by: i) gains on certain interest rate swaps, floors, and swaptions which were

economic hedges of certain investment assets and liabilities, ii) gains from foreign currency derivatives primarily due to the U.S. dollar

strengthening as well as, iii) gains primarily from equity options, financial futures and interest rate swaps hedging the embedded

derivatives. The gains on these equity options, financial futures, and interest rate swaps substantially offset the change in the underlying

embedded derivative liability that is hedged by these derivatives. Losses on the embedded derivatives increased by $2,329 million and

were driven by declining interest rates and poor equity market performance throughout the year. These embedded derivative losses include

a $2,994 million gain resulting from the effect of the widening of the Company’s own credit spread which is required to be used in the

valuation of these variable annuity rider embedded derivatives under SFAS 157 which became effective January 1, 2008. The remaining

change in net investment losses of $1,780 million is principally attributable to an increase in losses on fixed maturity and equity securities,

and, to a lesser degree, an increase in losses on mortgage and consumer loans and other limited partnership interests offset by an

increase in foreign currency transaction gains. The increase in losses on fixed maturity and equity securities is primarily attributable to an

increase in impairments associated with financial services industry holdings which experienced losses as a result of bankruptcies, FDIC

receivership, and federal government assisted capital infusion transactions in the third and fourth quarters of 2008. Losses on fixed

maturity and equity securities were also driven by an increase in credit related impairments on communication and consumer sector

security holdings, losses on asset-backed securities as well as an increase in losses on fixed maturity security holdings where the

Company either lacked the intent to hold, or due to extensive credit widening, the Company was uncertain of its intent to hold these fixed

maturity securities for a period of time sufficient to allow recovery of the market value decline.

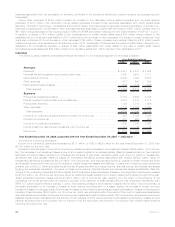

Underwriting

Underwriting results are generally the difference between the portion of premium and fee income intended to cover mortality, morbidity

or other insurance costs, less claims incurred, and the change in insurance-related liabilities. Underwriting results are significantly

influenced by mortality, morbidity or other insurance-related experience trends, as well as the reinsurance activity related to certain blocks

of business. Consequently, results can fluctuate from year to year. Underwriting results, including catastrophes, in the Auto & Home

segment were unfavorable for the year ended December 31, 2008, as the combined ratio, including catastrophes, increased to 91.2%

from 88.4% for the year ended December 31, 2007. Underwriting results, excluding catastrophes, in the Auto & Home segment were

favorable for the year ended December 31, 2008, as the combined ratio, excluding catastrophes, decreased to 83.1% from 86.3% for the

year ended December 31, 2007. Underwriting results were less favorable in the non-medical health & other, retirement & savings and

group life businesses in the Institutional segment. Underwriting results were unfavorable in the life products in the Individual segment.

Other Expenses

Other expenses increased by $1,495 million, or 14%, to $11,924 million for the year ended December 31, 2008 from $10,429 million

for the comparable 2007 period.

22 MetLife, Inc.