MetLife 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenues

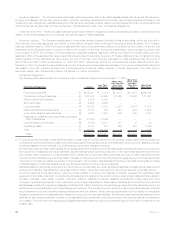

Total revenues, excluding net investment gains (losses), decreased by $497 million, or 33%, to $1,029 million for the year ended

December 31, 2008 from $1,526 million for the prior year.

This decrease was primarily due to a decrease in net investment income excluding MetLife Bank of $644 million, mainly due to reduced

yields on other limited partnership interests including hedge funds and real estate and real estate joint ventures partially offset by higher

securities lending results. This decrease in yields was partially offset by a higher asset base related to the investment of proceeds from

issuances of junior subordinated debt in December 2007 and April 2008, collateral financing arrangements to support statutory reserves in

May 2007 and December 2007, common stock in October 2008, and funding agreements with FHLB of NY in November 2008 partially

offset by repurchases of outstanding common stock, the prepayment of shares subject to mandatory redemption in October 2007 and the

reduction of commercial paper outstanding. A fractional repositioning of the portfolio from short-term investments resulted in higher

leveraged lease income. Net investment income on MetLife Bank increased $42 million from higher asset base and mortgage loan

production primarily from acquisitions in 2008. Other revenues increased $112 million primarily related to MetLife Bank loan origination and

servicing fees of $126 million from acquisitions in 2008, an adjustment in the prior year of surrender values on COLI policies of $13 million,

and income from counterparties on collateral pledged in 2008 of $6 million, partially offset by $37 million lower revenue from a prior year

resolution of an indemnification claim associated with the 2000 acquisition of GALIC. Also included as a component of total revenues was

the elimination of intersegment amounts which was offset within total expenses.

Expenses

Total expenses increased by $498 million, or 34%, to $1,953 million for the year ended December 31, 2008 from $1,455 million for the

prior year.

Corporate expenses were higher by $333 million primarily due to higher MetLife Bank costs of $164 million for compensation, rent, and

mortgage loan origination and servicing expenses primarily related to acquisitions in 2008, higher post employment related costs of

$101 million in the current year associated with the implementation of an enterprise-wide cost reduction and revenue enhancement

initiative, higher corporate support expenses of $72 million, which included incentive compensation, rent, advertising, and information

technology costs. Corporate expenses also increased from lease impairments of $38 million for company use space that is currently

vacant, and higher costs from MetLife Foundation contributions of $18 million, partially offset by a reduction in deferred compensation

expenses of $60 million. Interest expense was higher by $158 million due to the issuances of junior subordinated debt in December 2007

and April 2008 and collateral financing arrangements in May 2007 and December 2007, partially offset by rate reductions on variable rate

collateral financing arrangements in 2008, the prepayment of shares subject to mandatory redemption in October 2007 and the reduction

of commercial paper outstanding. Legal costs were higher by $72 million primarily due to asbestos insurance costs of $38 million, which

included $35 million for the commutation of three asbestos-related excess insurance policies and $3 million for amortization and valuation

of those policies prior to the commutation, $29 million higher for decreases in prior year legal liabilities partially offset by current year

decreases resulting from the resolution of certain matters, and an increase in other legal fees of $5 million. Interest credited to policyholder

account balances was $7 million in the current year as a result of issuance of funding agreements with FHLB of NY in November 2008.

Interest on uncertain tax positions was lower by $41 million as a result of a settlement payment to the IRS in December 2007 and a

decrease in published IRS interest rates. Interest credited on bankholder deposits decreased by $33 million at MetLife Bank due to lower

interest rates, partially offset by higher bankholder deposits. Also included as a component of total expenses was the elimination of

intersegment amounts which were offset within total revenues.

Year Ended December 31, 2007 compared with the Year Ended December 31, 2006 — Corporate & Other

Income from Continuing Operations

Income from continuing operations increased by $284 million, to a gain of $245 million for the year ended December 31, 2007 from a

loss of $39 million for 2006. Included in this increase were lower net investment losses of $129 million, net of income tax. Excluding the

impact of net investment gains (losses), income from continuing operations increased by $155 million.

The increase in income from continuing operations was primarily attributable to higher net investment income, lower corporate

expenses, higher other revenues, integration costs incurred in 2006, and lower legal cost of $274 million, $59 million, $19 million,

$17 million, and $7 million, respectively, each of which were net of income tax. This was partially offset by higher interest expense on debt,

higher interest on uncertain tax positions, and higher interest credited to bankholder deposits of $86 million, $23 million, and $3 million

respectively, each of which were net of income tax. Tax benefits decreased by $102 million over the comparable period in 2006 due to the

Company’s implementation of FIN 48, the difference of finalizing the Company’s 2006 tax return in 2007 when compared to finalizing the

Company’s 2005 tax return in 2006 and the difference between the actual and the estimated tax rate allocated to the various segments.

Revenues

Total revenues, excluding net investment gains (losses), increased by $448 million, or 42%, to $1,526 million for the year ended

December 31, 2007 from $1,078 million for 2006. This increase was primarily due to increased net investment income of $421 million,

mainly on fixed maturity securities, driven by a higher asset base related to the reinvestment of proceeds from the sale of the Peter Cooper

Village and Stuyvesant Town properties during the fourth quarter of 2006 and the investment of proceeds from issuances of junior

subordinated debt in December 2006 and December 2007 and collateral financing arrangements to support statutory reserves in May

2007 and December 2007. Net investment income also increased on other limited partnerships, real estate and real estate joint ventures,

and mortgage loans. Other revenues increased by $29 million primarily related to the resolution of an indemnification claim associated with

the 2000 acquisition of GALIC, offset by an adjustment of surrender values on COLI policies. Also included as a component of total

revenues was the elimination of intersegment amounts which was offset within total expenses.

Expenses

Total expenses increased by $55 million, or 4%, to $1,455 million for the year ended December 31, 2007 from $1,400 million for 2006.

Interest expense was higher by $133 million due to the issuances of junior subordinated debt in December 2006 and December 2007 and

collateral financing arrangements in May 2007 and December 2007, respectively, and from settlement fees on the prepayment of shares

subject to mandatory redemption in October 2007, partially offset by the maturity of senior notes in December 2006 and the reduction of

45MetLife, Inc.