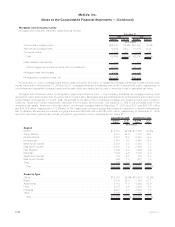

MetLife 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total rate of return swaps (“TRRs”) are swaps whereby the Company agrees with another party to exchange, at specified intervals, the

difference between the economic risk and reward of an asset or a market index and LIBOR, calculated by reference to an agreed notional

principal amount. No cash is exchanged at the outset of the contract. Cash is paid and received over the life of the contract based on the

terms of the swap. These transactions are entered into pursuant to master agreements that provide for a single net payment to be made by

the counterparty at each due date. TRRs can be used as hedges or to synthetically create investments and are included in the other

classification in the preceding table.

Hedging

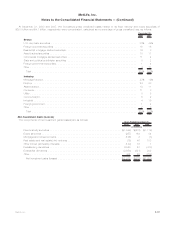

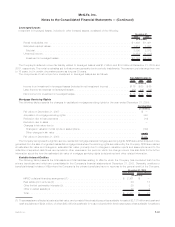

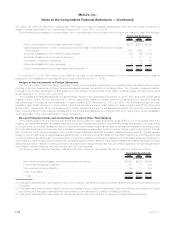

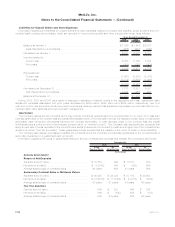

The following table presents the notional amount and the estimated fair value of derivatives by type of hedge designation at:

Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

Fair Value Fair Value

December 31, 2008 December 31, 2007

(In millions)

Fairvalue........................... $ 10,234 $ 1,805 $ 703 $ 10,006 $ 650 $ 99

Cashflow........................... 4,068 463 387 4,717 161 321

Foreign operations . . . . . . . . . . . . . . . . . . . . . 1,834 33 50 1,674 11 114

Non-qualifying . . . . . . . . . . . . . . . . . . . . . . . . 181,952 10,005 2,902 207,175 3,214 2,062

Total............................. $198,088 $12,306 $4,042 $223,572 $4,036 $2,596

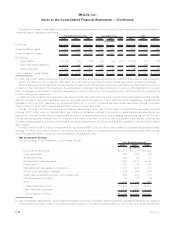

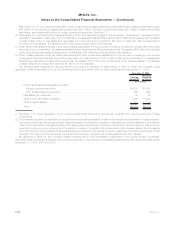

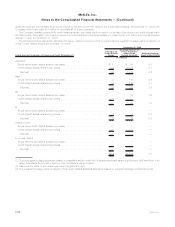

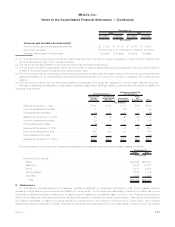

The following table presents the settlement payments recorded in income for the:

2008 2007 2006

Years Ended December 31,

(In millions)

Qualifying hedges:

Netinvestmentincome ............................................... $ 19 $ 29 $ 49

Interestcreditedtopolicyholderaccountbalances ............................. 105 (34) (35)

Otherexpenses.................................................... (9) 1 3

Non-qualifying hedges:

Netinvestmentincome ............................................... 1 (5) —

Netinvestmentgains(losses)........................................... 49 278 296

Otherrevenues.................................................... 3 — —

Total.......................................................... $168 $269 $313

Fair Value Hedges

The Company designates and accounts for the following as fair value hedges when they have met the requirements of SFAS 133:

(i) interest rate swaps to convert fixed rate investments to floating rate investments; (ii) interest rate swaps to convert fixed rate liabilities to

floating rate liabilities; and (iii) foreign currency swaps to hedge the foreign currency fair value exposure of foreign currency denominated

investments and liabilities.

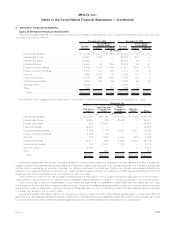

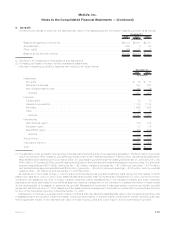

The Company recognized net investment gains (losses) representing the ineffective portion of all fair value hedges as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Changesinthefairvalueofderivatives..................................... $245 $334 $276

Changesinthefairvalueoftheitemshedged ................................ (248) (326) (276)

Netineffectivenessoffairvaluehedgingactivities.............................. $ (3) $ 8 $ —

All components of each derivative’s gain or loss were included in the assessment of hedge effectiveness. There were no instances in

which the Company discontinued fair value hedge accounting due to a hedged firm commitment no longer qualifying as a fair value hedge.

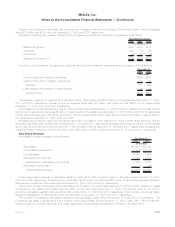

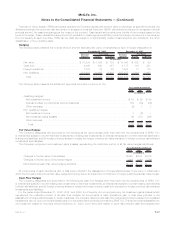

Cash Flow Hedges

The Company designates and accounts for the following as cash flow hedges when they have met the requirements of SFAS 133:

(i) interest rate swaps to convert floating rate investments to fixed rate investments; (ii) interest rate swaps to convert floating rate liabilities

to fixed rate liabilities; and (iii) foreign currency swaps to hedge the foreign currency cash flow exposure of foreign currency denominated

investments and liabilities.

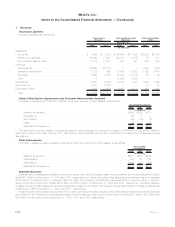

For the years ended December 31, 2008, 2007, and 2006, the Company did not recognize any net investment gains (losses) which

represented the ineffective portion of all cash flow hedges. All components of each derivative’s gain or loss were included in the

assessment of hedge effectiveness. In certain instances, the Company discontinued cash flow hedge accounting because the forecasted

transactions did not occur on the anticipated date or in the additional time period permitted by SFAS 133. The net amounts reclassified into

net investment losses for the years ended December 31, 2008, 2007 and 2006 related to such discontinued cash flow hedges were

F-47MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)