MetLife 2008 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

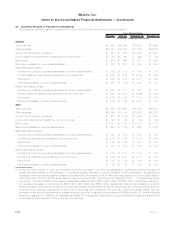

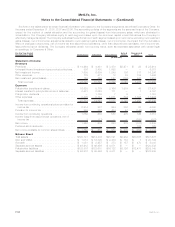

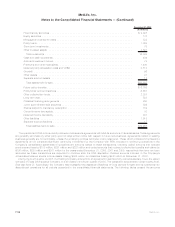

December 31, 2007

(In millions)

Fixedmaturitysecurities................................................... $ 9,398

Equitysecurities ........................................................ 137

Mortgageandconsumerloans............................................... 832

Policyloans........................................................... 1,059

Short-terminvestments.................................................... 75

Otherinvestedassets .................................................... 4,897

Totalinvestments ...................................................... 16,398

Cashandcashequivalents ................................................. 404

Accruedinvestmentincome................................................. 78

Premiumsandotherreceivables.............................................. 1,440

DeferredpolicyacquisitioncostsandVOBA ...................................... 3,513

Goodwill ............................................................. 96

Otherassets .......................................................... 91

Separateaccountassets .................................................. 17

Totalassetsheld-for-sale................................................. $22,037

Futurepolicybenefits..................................................... $ 6,159

Policyholderaccountbalances............................................... 6,657

Otherpolicyholderfunds................................................... 2,297

Long-termdebt......................................................... 528

Collateralfinancingarrangements............................................. 850

Juniorsubordinateddebtsecurities............................................ 399

Sharessubjecttomandatoryredemption ........................................ 159

Currentincometaxpayable................................................. 33

Deferredincometaxliability................................................. 941

Otherliabilities ......................................................... 1,918

Separateaccountliabilities ................................................. 17

Totalliabilitiesheld-for-sale................................................ $19,958

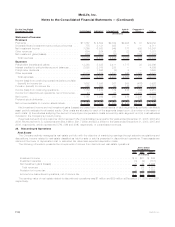

The operations of RGA include direct policies and reinsurance agreements with MetLife and some of its subsidiaries. These agreements

are generally terminable by either party upon 90 days written notice with respect to future new business. Agreements related to existing

business generally are not terminable, unless the underlying policies terminate or are recaptured. These direct policies and reinsurance

agreements do not constitute significant continuing involvement by the Company with RGA. Included in continuing operations in the

Company’s consolidated statements of operations are amounts related to these transactions, including ceded amounts that reduced

premiums and fees by $158 million, $251 million and $228 million and ceded amounts that reduced policyholder benefits and claims by

$136 million, $290 million and $207 million for the years ended December 31, 2008, 2007 and 2006, respectively that have not been

eliminated as these transactions are expected to continue after the RGA disposition. Related amounts included in the Company’s

consolidated balance sheets include assets totaling $805 million, and liabilities totaling $542 million at December 31, 2007.

During the fourth quarter of 2008, the Holding Company entered into an agreement to sell its wholly-owned subsidiary, Cova, the parent

company of Texas Life Insurance Company, to a third party in the fourth quarter of 2008. The transaction is expected to close in early 2009.

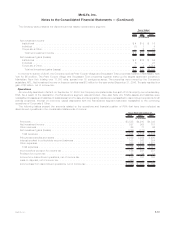

(See also Note 2). Accordingly, the Company has reclassified the assets and liabilities of Cova as held-for-sale and its operations into

discontinued operations for all periods presented in the consolidated financial statements. The following tables present the amounts

F-98 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)