MetLife 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Disposition of Texas Life Insurance Company

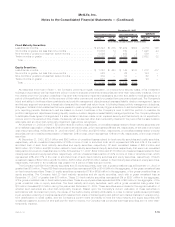

MetLife, Inc. has entered into an agreement to sell Cova Corporation (“Cova”), the parent company of Texas Life Insurance Company, to

a third party in the fourth quarter of 2008. The transaction is expected to close in early 2009. As a result of the sale agreement, the

Company recognized gains from discontinued operations of $37 million, net of income tax, in the fourth quarter of 2008. The gain was

comprised of recognition of tax benefits of $65 million relating to the excess of outside tax basis of Cova over its financial reporting basis,

offset by other than temporary impairments of $28 million, net of income tax, relating to Cova’s investments. The Company has reclassified

the assets and liabilities of Cova as held-for-sale and its operations into discontinued operations for all periods presented in the

consolidated financial statements. See also Note 23.

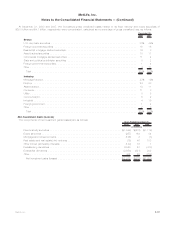

2008 Acquisitions

During 2008, the Company made five acquisitions for $783 million. As a result of these acquisitions, MetLife’s Institutional segment

increased its product offering of dental and vision benefit plans, MetLife Bank within Corporate & Other entered the mortgage origination

and servicing business and the International segment increased its presence in Mexico and Brazil. The acquisitions were each accounted

for using the purchase method of accounting, and accordingly, commenced being included in the operating results of the Company upon

their respective closing dates. Total consideration paid by the Company for these acquisitions consisted of $763 million in cash and

$20 million in transaction costs. The net fair value of assets acquired and liabilities assumed totaled $527 million, resulting in goodwill of

$256 million. Goodwill increased by $122 million, $73 million and $61 million in the International segment, Institutional segment and

Corporate & Other, respectively. The goodwill is deductible for tax purposes. VOCRA, VOBA and other intangibles increased by

$137 million, $7 million and $6 million, respectively, as a result of these acquisitions. Further information on VOBA, goodwill and VOCRA

is provided in Notes 5, 6 and 7, respectively.

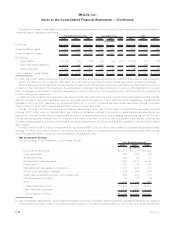

2007 Acquisition and Disposition

On June 28, 2007, the Company acquired the remaining 50% interest in a joint venture in Hong Kong, MetLife Fubon Limited (“MetLife

Fubon”),for$56millionincash,resultinginMetLifeFubonbecoming a consolidated subsidiary of the Company. The transaction was

treated as a step acquisition, and at June 30, 2007, total assets and liabilities of MetLife Fubon of $839 million and $735 million,

respectively, were included in the Company’s consolidated balance sheet. The Company’s investment for the initial 50% interest in MetLife

Fubon was $48 million. The Company used the equity method of accounting for such investment in MetLife Fubon. The Company’s share

of the joint venture’s results for the six months ended June 30, 2007, was a loss of $3 million. The fair value of the assets acquired and the

liabilities assumed in the step acquisition at June 30, 2007, was $427 million and $371 million, respectively. No additional goodwill was

recorded as a part of the step acquisition. As a result of this acquisition, additional VOBA and VODA of $45 million and $5 million,

respectively, were recorded and both have a weighted average amortization period of 16 years. In June 2008, the Company revised the

valuation of certain long-term liabilities, VOBA, and VODA based on new information received. As a result, the fair value of acquired

insurance liabilities and VOBA were reduced by $5 million and $12 million, respectively, offset by an increase in VODA of $7 million. The

revised VOBA and VODA have a weighted average amortization period of 11 years. Further information on VOBA and VODA is described in

Notes 5 and 7, respectively.

On June 1, 2007, the Company completed the sale of its Bermuda insurance subsidiary, MetLife International Insurance, Ltd. (“MLII”), to

athirdpartyfor$33millionincashconsideration,resultinginagainupondisposalof$3million,netofincometax.ThenetassetsofMLIIat

disposal were $27 million. A liability of $1 million was recorded with respect to a guarantee provided in connection with this disposition.

Further information on guarantees is described in Note 16.

Other Acquisitions and Dispositions

On July 1, 2005, the Company completed the acquisition of Travelers for $12.1 billion. The acquisition was accounted for using the

purchase method of accounting. The net fair value of assets acquired and liabilities assumed totaled $7.8 billion, resulting in goodwill of

$4.3 billion. The initial consideration paid by the Company in 2005 for the acquisition consisted of $10.9 billion in cash and

22,436,617 shares of the Company’s common stock with a market value of $1.0 billion to Citigroup and $100 million in other transaction

costs. The Company revised the purchase price as a result of the finalization by both parties of their review of the June 30, 2005 financial

statements and final resolution as to the interpretation of the provisions of the acquisition agreement which resulted in a payment of

additional consideration of $115 million by the Company to Citigroup in 2006.

See Note 23 for information on the disposition of the annuities and pension businesses of MetLife Insurance Limited (“MetLife Australia”)

and SSRM Holdings, Inc.

F-28 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)