MetLife 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

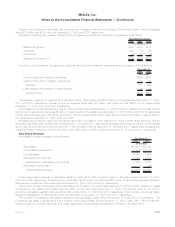

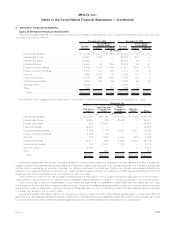

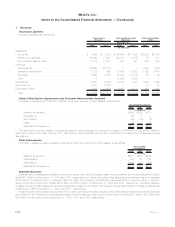

4. Derivative Financial Instruments

Types of Derivative Financial Instruments

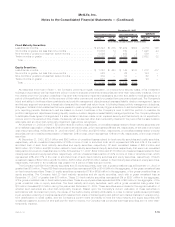

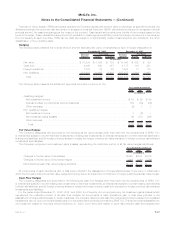

The following table presents the notional amount and current market or estimated fair value of derivative financial instruments, excluding

embedded derivatives, held at:

Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

Current Market

or Fair Value Current Market

or Fair Value

December 31, 2008 December 31, 2007

(In millions)

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . $ 34,060 $ 4,617 $1,468 $ 62,410 $ 784 $ 768

Interestratefloors ..................... 48,517 1,748 — 48,937 621 —

Interestratecaps...................... 24,643 11 — 45,498 50 —

Financialfutures....................... 19,908 45 205 12,302 89 57

Foreign currency swaps . . . . . . . . . . . . . . . . . . 19,438 1,953 1,866 21,201 1,480 1,719

Foreign currency forwards . . . . . . . . . . . . . . . . 5,167 153 129 4,177 76 16

Options ............................ 8,450 3,162 35 6,565 713 1

Financialforwards ..................... 28,176 465 169 11,937 122 2

Credit default swaps . . . . . . . . . . . . . . . . . . . . 5,219 152 69 6,625 58 33

SyntheticGICs ....................... 4,260 — — 3,670 — —

Other.............................. 250 — 101 250 43 —

Total............................. $198,088 $12,306 $4,042 $223,572 $4,036 $2,596

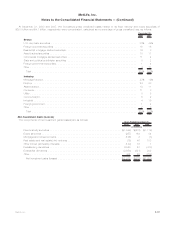

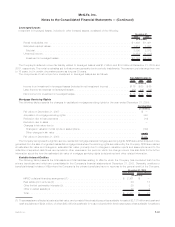

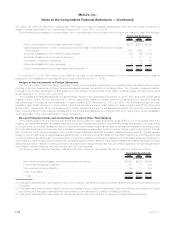

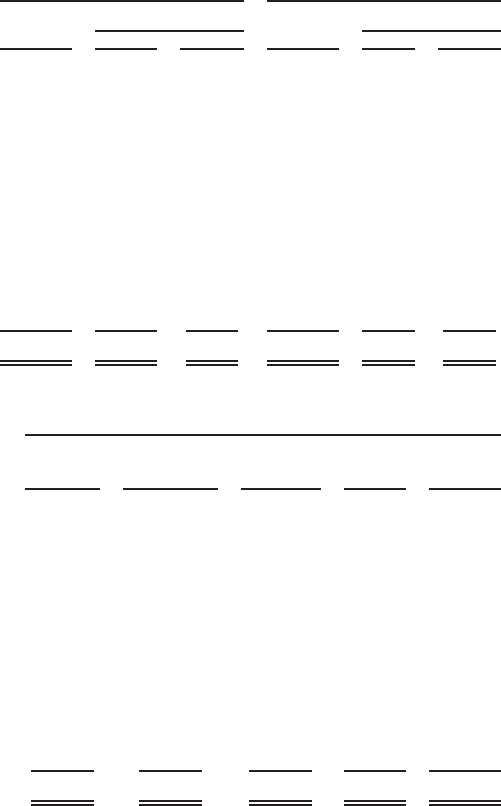

The following table presents the notional amount of derivative financial instruments by maturity at December 31, 2008:

One Year or

Less

After One Year

Through Five

Years

After Five

Years

Through Ten

Years After Ten

Years Total

Remaining Life

(In millions)

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . . . $ 2,295 $12,632 $12,809 $ 6,324 $ 34,060

Interestratefloors........................ 15,294 325 32,898 — 48,517

Interestratecaps........................ 590 24,053 — — 24,643

Financialfutures......................... 19,908 — — — 19,908

Foreign currency swaps . . . . . . . . . . . . . . . . . . . . 3,204 7,180 5,981 3,073 19,438

Foreigncurrencyforwards .................. 5,068 99 — — 5,167

Options .............................. 128 2,239 5,419 664 8,450

Financialforwards........................ 16,617 995 8,226 2,338 28,176

Credit default swaps . . . . . . . . . . . . . . . . . . . . . . 163 3,340 1,716 — 5,219

SyntheticGICs.......................... 4,260 — — — 4,260

Other................................ — 250 — — 250

Total............................... $67,527 $51,113 $67,049 $12,399 $198,088

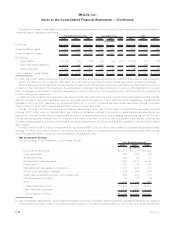

Interest rate swaps are used by the Company primarily to reduce market risks from changes in interest rates and to alter interest rate

exposure arising from mismatches between assets and liabilities (duration mismatches). In an interest rate swap, the Company agrees with

another party to exchange, at specified intervals, the difference between fixed rate and floating rate interest amounts as calculated by

reference to an agreed notional principal amount. These transactions are entered into pursuant to master agreements that provide for a

single net payment to be made by the counterparty at each due date.

The Company commenced the use of inflation swaps during the first quarter of 2008. Inflation swaps are used as an economic hedge to

reduce inflation risk generated from inflation-indexed liabilities. Inflation swaps are included in interest rate swaps in the preceding table.

The Company also enters into basis swaps to better match the cash flows from assets and related liabilities. In a basis swap, both legs

of the swap are floating with each based on a different index. Generally, no cash is exchanged at the outset of the contract and no principal

payments are made by either party. A single net payment is usually made by one counterparty at each due date. Basis swaps are included

in interest rate swaps in the preceding table.

Interest rate caps and floors are used by the Company primarily to protect its floating rate liabilities against rises in interest rates above a

specified level, and against interest rate exposure arising from mismatches between assets and liabilities (duration mismatches), as well as

to protect its minimum rate guarantee liabilities against declines in interest rates below a specified level, respectively.

F-45MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)