MetLife 2008 Annual Report Download - page 97

Download and view the complete annual report

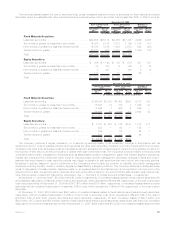

Please find page 97 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company sold or disposed of fixed maturity and equity securities at a loss that had an estimated fair value of $29.9 billion,

$47.1 billion and $69.2 billion during the years ended December 31, 2008, 2007 and 2006, respectively. Gross losses excluding

impairments for fixed maturity and equity securities were $1.8 billion, $1.1 billion and $1.5 billion for the years ended December 31, 2008,

2007 and 2006, respectively.

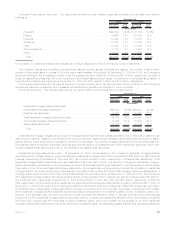

2008 — Financial Institutions, Individually Significant and Trust Preferred Security Impairments. Of the fixed maturity and equity

securities impairments of $1.7 billion for the year ended December 31, 2008, $1,014 million were concentrated in the Company’s

financial services industry securities holdings and were comprised of $673 million in impairments on fixed maturity securities and

$341 million in impairments on equity securities. The circumstances that gave rise to these impairments were financial restructurings,

bankruptcy filings or difficult underlying operating environments for the entities concerned. A significant portion of the impairments were

concentrated in three particular financial institutions that entered bankruptcy, were subject to Federal Deposit Insurance Corporation

(“FDIC”) receivership or received federal government capital infusions as described further below:

•Lehman — In connection with the filing on September 15, 2008 by Lehman of a Chapter 11 bankruptcy petition, the Company

recorded in 2008, impairments totaling $372 million (i.e., $329 million fixed maturity securities and $43 million equity securities) as

follows related to Lehman — $256 million of Lehman senior unsecured debt and subordinated debt, $73 million of debt instruments

issued by a special-purpose entity backed by Lehman obligations, and $43 million of Lehman non-redeemable preferred securities.

The Company has also made secured loans to affiliates of Lehman which are fully collateralized; accordingly, no impairment charge

has been recorded.

•Washington Mutual — In connection with the September 25, 2008 acquisition of Washington Mutual’s banking operation by JP

Morgan Chase & Co. relating to the FDIC receivership of its bank subsidiaries, which transaction excluded the assumption of any

senior unsecured debt, subordinated debt, and preferred securities of Washington Mutual and its bank subsidiaries, the Company

recorded impairments in 2008, totaling $197 million (i.e., $125 million fixed maturity securities and $72 million equity securities) as

follows — $125 million of Washington Mutual subordinated debt, $71 million of Washington Mutual non-redeemable preferred

securities, and less than $1 million of Washington Mutual common stock holdings. These impairments were partially offset by a

$17 million realized gain on credit default swaps purchased on Washington Mutual debt.

•AIG — In connection with the September 23, 2008 definitive agreement between AIG and the Federal Reserve Bank of New York for a

two-year revolving credit facility and issuance of preferred stock that granted 79.9% common stock voting power to the United States

Treasury, the Company recorded impairments on securities for the year ended December 31, 2008 totaling $37 million (i.e.,

$35 million fixed maturity securities and $2 million equity securities) as follows — $35 million of AIG unsecured subordinated debt

holdings, and $2 million of AIG common stock. Additionally, a $2 million impairment was recorded on an AIG affiliate-managed other

limited partnership investment for the year ended December 31, 2008, for a total AIG impairment of $37 million for the year ended

December 31, 2008.

Overall, impairments related to these three counterparties accounted for impairments on fixed maturity and equity securities of

$489 million and $117 million, respectively, for a total of $606 million for the year ended December 31, 2008. These three counterparties

account for substantial portion, $489 million, of the financial institution related fixed maturity security impairments of $673 million; however,

at $117 million, they do not account for the majority of the financial institution related equity security impairments of $341 million which are

nearly all related to writedowns of non-redeemable preferred securities, included in non-redeemable preferred stock.

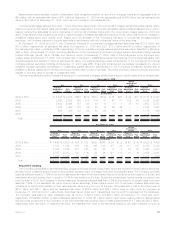

2008 Impairments — Summary of Fixed Maturity Security Impairments. Overall impairments of fixed maturity securities were $1.3 billion

for the year ended December 31, 2008. This substantial increase over the prior year was driven by impairments of: 1) $673 million on

financial services industry fixed maturity security holdings as described previously; 2) $241 million were on communication and consumer

industries holdings; 3) $164 million on asset-backed (substantially all are backed by or exposed to sub-prime mortgage loans) and below

investment grade commercial mortgage-backed holdings; and 4) $218 million in fixed maturity security holdings that the Company either

lacked the intent to hold, or due to extensive credit spread widening, the Company was uncertain of its intent to hold these fixed maturity

securities for a period of time sufficient to allow for recovery of the market value decline Overall, $1.1 billion of the impairments were

considered to be credit-related and are included in the $1.2 billion of credit-related impairments of fixed maturities and equity securities

described previously.

2008 Impairments — Summary of Equity Security Impairments. Equity security impairments recorded in 2008 totaled $430 million.

Included within the $430 million of impairments on equity securities in 2008 are $341 million related to the financial services industry

holdings, (of which, $90 million related to the financial services industry non-redeemable preferred securities) and $89 million across

several industries including consumer, communications, industrial and utility. As described previously, $117 million of these equity security

impairments related to Lehman, Washington Mutual and AIG. As a result of the Company’s equity securities impairment review process,

which included a review of the duration of, and or the severity of the unrealized loss position of its equity securities holdings, additional

other-than-temporary impairment charges totaling $313 million were recorded for the year ended December 31, 2008. These additional

impairments were principally related to impairments on non-redeemable trust preferred securities holdings of financial services industry

securities holdings that had either been in an unrealized loss position for an extended duration (i.e., 12 months or more), or were in a

severe unrealized loss position. In fourth quarter of 2008, the Company not only considered the severity and duration of unrealized losses

on its non-redeemable preferred security holdings, but placed greater weight and emphasis on whether there has been any credit

deterioration in the issuer of these holdings in accordance with recent published guidance. Overall, $90 million of the impairments were

considered to be credit related and are included in the $1.2 billion of credit related impairments of fixed maturity and equity securities

described previously.

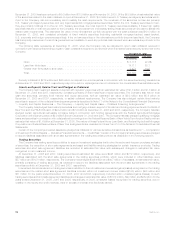

Future Impairments. Future other-than-temporary impairments will depend primarily on economic fundamentals, issuer performance,

changes in collateral valuation, changes in interest rates, and changes in credit spreads. If economic fundamentals and other of the above

factors continue to deteriorate, additional other-than-temporary impairments may be incurred in upcoming periods. See also “ —

Investments — Fixed Maturity and Equity Securities Available-for-Sale — Net Unrealized Investment Gains (Losses).”

94 MetLife, Inc.