MetLife 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

common stock to satisfy its obligation. In connection with the issuance of the debentures, the Holding Company entered into a RCC. As

part of the RCC, the Holding Company agreed that it will not repay, redeem, or purchase the debentures on or before December 15, 2056,

unless, subject to certain limitations, it has received proceeds from the sale of specified capital securities. The RCC will terminate upon the

occurrence of certain events, including an acceleration of the debentures due to the occurrence of an event of default. The RCC is not

intended for the benefit of holders of the debentures and may not be enforced by them. The RCC is for the benefit of holders of one or more

other designated series of its indebtedness (which will initially be its 5.70% senior notes due June 15, 2035). The Holding Company also

entered into a replacement capital obligation which will commence in 2036 and under which the Holding Company must use reasonable

commercial efforts to raise replacement capital through the issuance of certain qualifying capital securities. Issuance costs associated with

the offering of the debentures of $13 million have been capitalized, are included in other assets, and are amortized using the effective

interest method over the period from the issuance date of the debentures until their scheduled redemption. Interest expense on the

debentures was $80 million, $80 million and $2 million for the years ended December 31, 2008, 2007 and 2006, respectively.

MetLife Bank has entered into several repurchase agreements with the FHLB of NY whereby MetLife Bank has issued repurchase

agreements in exchange for cash and for which the FHLB of NY has been granted a blanket lien on MetLife Bank’s residential mortgages

and mortgage-backed securities to collateralize MetLife Bank’s obligations under the repurchase agreements. The repurchase agreements

and the related security agreement represented by this blanket lien provide that upon any event of default by MetLife Bank, the FHLB of

NY’s recovery is limited to the amount of MetLife Bank’s liability under the outstanding repurchase agreements. During the years ended

December 31, 2008, 2007, and 2006, MetLife Bank received advances totaling $220 million, $390 million and $260 million, respectively,

from the FHLB of NY, which were included in long-term debt. MetLife Bank also made repayments of $371 million, $175 million and

$117 million to the FHLB of NY during the years ended December 31, 2008, 2007 and 2006, respectively. In addition, in 2008 following the

acquisition of a mortgage origination and servicing business, MetLife Bank began a program of taking short-term advances from the FHLB

of NY. The amount of the Company’s liability for repurchase agreements with the FHLB of NY that is included in long-term debt was

$1.1 billion and $1.2 billion at December 31, 2008 and 2007, respectively and the amount that is included in short-term debt was

$695 million at December 31, 2008.

MetLife Funding, Inc. (“MetLife Funding”), a subsidiary of MLIC, serves as a centralized finance unit for the Company. Pursuant to a

support agreement, MLIC has agreed to cause MetLife Funding to have a tangible net worth of at least one dollar. At both December 31,

2008 and 2007, MetLife Funding had a tangible net worth of $12 million. MetLife Funding raises cash from various funding sources and

uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of MLIC, to the Holding Company, MLIC and other

affiliates. MetLife Funding manages its funding sources to enhance the financial flexibility and liquidity of MLIC and other affiliated

companies. At December 31, 2008 and 2007, MetLife Funding had total outstanding liabilities, including accrued interest payable, of

$414 million and $358 million, respectively, consisting primarily of commercial paper.

The Company is participating in certain economic stabilization programs established by various government institutions, including the

CPFF and the FDIC program, as described above.

Credit Facilities. The Company maintains committed and unsecured credit facilities aggregating $3.2 billion at December 31, 2008.

When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements as specified below. The

facilities can be used for general corporate purposes and, at December 31, 2008, $2.9 billion of the facilities also served as back-up lines

of credit for the Company’s commercial paper programs. Management has no reason to believe that its lending counterparties are unable

to fulfill their respective contractual obligations.

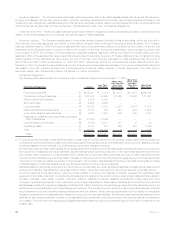

Total fees associated with these credit facilities were $17 million, of which $11 million related to deferred amendment fees for the year

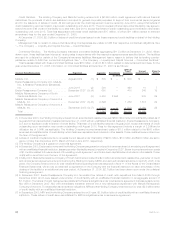

ended December 31, 2008. Information on these credit facilities at December 31, 2008 is as follows:

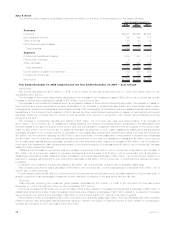

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . . June 2012(1) $2,850 $2,313 $ — $537

MetLife Bank, N.A . . . . . . . . . . . . . . . . . . . . . . . . July 2009 (2) 300 — 100 200

Total ............................... $3,150 $2,313 $100 $737

(1) In December 2008, the Holding Company and MetLife Funding, Inc. entered into an amended and restated $2.85 billion credit agreement

with various financial institutions. The agreement amended and restated the $3.0 billion credit agreement entered into in June 2007.

Proceeds are available to be used for general corporate purposes, to support their commercial paper programs and for the issuance of

letters of credit. The Company limits its commercial paper outstanding relative to the amount of unused commitments under this facility. All

borrowings under the credit agreement must be repaid by June 2012, except that letters of credit outstanding upon termination may

remain outstanding until June 2013. The borrowers and the lenders under this facility may agree to extend the term of all or part of the

facility to no later than June 2014, except that letters of credit outstanding upon termination may remain outstanding until June 2015. Fees

for this agreement include a 0.25% facility fee, 0.075% fronting fee, a letter of credit fee between 1% and 5% based on certain market rates

and a 0.05% utilization fee, as applicable, and may vary based on MetLife, Inc.’s senior unsecured ratings. The Holding Company and

MetLife Funding, Inc. incurred amendment costs of $11 million related to the $2,850 million amended and restated credit agreement,

which have been capitalized and included in other assets. These costs will be amortized over the term of the agreement. The Holding

Company did not have any deferred financing costs associated with the original June 2007 credit agreement.

(2) In July 2008, the facility was increased by $100 million and its maturity extended for one year to July 2009. Fees for this agreement include

a commitment fee of $10,000 and a margin of Federal Funds plus 0.11%, as applicable.

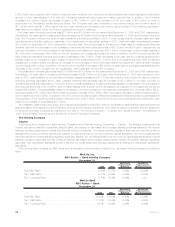

Committed Facilities. The Company maintains committed facilities aggregating $11.5 billion at December 31, 2008. When drawn

upon, these facilities bear interest at varying rates in accordance with the respective agreements as specified below. The facilities are used

52 MetLife, Inc.