MetLife 2008 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reinsurance; however, under the new retention guidelines, the Company reinsures up to 90% of the mortality risk in excess of $1 million for

most new individual life insurance policies that it writes through its various franchises and for certain individual life policies the retention

limits remained unchanged. On a case by case basis, the Company may retain up to $20 million per life and reinsure 100% of amounts in

excess of the Company’s retention limits. The Company evaluates its reinsurance programs routinely and may increase or decrease its

retention at any time. In addition, the Company reinsures a significant portion of the mortality risk on its individual universal life policies

issued since 1983. Placement of reinsurance is done primarily on an automatic basis and also on a facultative basis for risks with specific

characteristics.

The Company’s Individual segment also reinsures a portion of the living and death benefit riders issued in connection with its variable

annuities. Under these reinsurance agreements, the Company pays a reinsurance premium generally based on rider fees collected from

policyholders and receives reimbursements for benefits paid or accrued in excess of account values, subject to certain limitations. The

Company enters into similar agreements for new or in-force business depending on market conditions.

The Institutional segment generally retains most of its risks and does not significantly utilize reinsurance. The Company may, on certain

client arrangements, cede particular risks to reinsurers.

The Auto & Home segment purchases reinsurance to control its exposure to large losses (primarily catastrophe losses) and to protect

statutory surplus. Auto & Home cedes to reinsurers a portion of losses and cedes premiums based upon the risk and exposure of the

policies subject to reinsurance. To control exposure to large property and casualty losses, Auto & Home utilizes property catastrophe,

casualty, and property per risk excess of loss agreements.

The Company also reinsures through 100% quota-share reinsurance agreements certain long-term care and workers’ compensation

business written by MICC prior to the Company’s acquisition of MICC. These run-off businesses have been included within Corporate &

Other since the acquisition of MICC.

In addition to reinsuring mortality risk as described previously, the Company reinsures other risks, as well as specific coverages. The

Company routinely reinsures certain classes of risks in order to limit its exposure to particular travel, avocation and lifestyle hazards. The

Company has exposure to catastrophes, which could contribute to significant fluctuations in the Company’s results of operations. The

Company uses excess of retention and quota share reinsurance arrangements to provide greater diversification of risk and minimize

exposure to larger risks.

The Company reinsures its business through a diversified group of reinsurers. In the event that reinsurers do not meet their obligations

to the Company under the terms of the reinsurance agreements, reinsurance balances recoverable could become uncollectible. Cessions

under reinsurance arrangements do not discharge the Company’s obligations as the primary insurer.

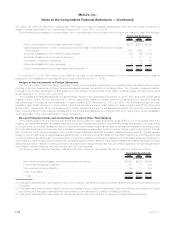

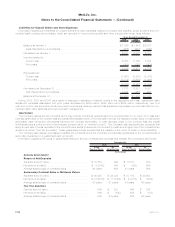

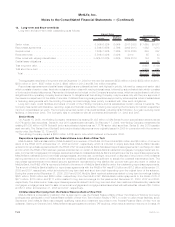

The amounts in the consolidated statements of income are presented net of reinsurance ceded. Information regarding the effect of

reinsurance is as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Premiums:

Directpremiums............................................. $27,058 $24,149 $23,308

Reinsuranceassumed......................................... 1,466 1,192 928

Reinsuranceceded........................................... (2,610) (2,371) (2,184)

Netpremiums............................................. $25,914 $22,970 $22,052

Universal life and investment-type product policy fees:

Directuniversallifeandinvestment-typeproductpolicyfees ................ $ 5,909 $ 5,686 $ 5,146

Reinsuranceassumed......................................... 79 54 20

Reinsuranceceded........................................... (607) (502) (455)

Netuniversallifeandinvestment-typeproductpolicyfees................. $ 5,381 $ 5,238 $ 4,711

Policyholder benefits and claims:

Directpolicyholderbenefitsandclaims .............................. $29,772 $25,507 $24,649

Reinsuranceassumed......................................... 1,235 804 847

Reinsuranceceded........................................... (3,570) (2,528) (2,627)

Netpolicyholderbenefitsandclaims .............................. $27,437 $23,783 $22,869

F-58 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)