MetLife 2008 Annual Report Download - page 233

Download and view the complete annual report

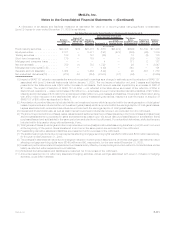

Please find page 233 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company has categorized its assets and liabilities into the three-level fair value hierarchy, as defined in Note 1, based upon the

priority of the inputs to the respective valuation technique. The following summarizes the types of assets and liabilities included within the

three-level fair value hierarchy presented in the preceding table.

Level 1 This category includes certain U.S. Treasury and agency fixed maturity securities, certain foreign government fixed maturity

securities; exchange-traded common stock; and certain short-term money market securities. As it relates to derivatives, this

level includes financial futures including exchange-traded equity and interest rate futures, as well as financial forwards to sell

residential mortgage-backed securities. Separate account assets classified within this level principally include mutual funds.

Also included are assets held within separate accounts which are similar in nature to those classified in this level for the general

account.

Level 2 This category includes fixed maturity and equity securities priced principally by independent pricing services using observable

inputs. These fixed maturity securities include most U.S. Treasury and agency securities as well as the majority of U.S. and

foreign corporate securities, residential mortgage-backed securities, commercial mortgage-backed securities, state and

political subdivision securities, foreign government securities, and asset-backed securities. Equity securities classified as

Level 2 securities consist principally of non-redeemable preferred stock and certain equity securities where market quotes are

available but are not considered actively traded. Short-term investments and trading securities included within Level 2 are of a

similar nature to these fixed maturity and equity securities. Mortgage and consumer loans included in Level 2 include residential

mortgage loans held-for-sale for which there is readily available observable pricing for similar loans or securities backed by

similar loans and the unobservable adjustments to such prices are insignificant. As it relates to derivatives, this level includes all

types of derivative instruments utilized by the Company with the exception of exchange-traded futures and financial forwards to

sell residential mortgage-backed securities included within Level 1 and those derivative instruments with unobservable inputs

as described in Level 3. Separate account assets classified within this level are generally similar to those classified within this

level for the general account. Hedge funds owned by separate accounts are also included within this level. Embedded

derivatives classified within this level include embedded equity derivatives contained in certain guaranteed investment

contracts.

Level 3 This category includes fixed maturity securities priced principally through independent broker quotations or market standard

valuation methodologies using inputs that are not market observableorcannotbederivedprincipallyfromorcorroboratedby

observable market data. This level consists of less liquid fixed maturity securities with very limited trading activity or where less

price transparency exists around the inputs to the valuation methodologies including: U.S. and foreign corporate securities —

including below investment grade private placements; residential mortgage-backed securities; asset-backed securities —

including all of those supported by sub-prime mortgage loans; and other fixed maturity securities such as structured securities.

Equity securities classified as Level 3 securities consist principally of common stock of privately held companies and non-

redeemable preferred stock where there has been very limited trading activity or where less price transparency exists around

the inputs to the valuation. Short-term investments and trading securities included within Level 3 are of a similar nature to these

fixed maturity and equity securities. Mortgage and consumer loans included in Level 3 include residential mortgage loans held-

for-sale for which pricing for similar loans or securities backed by similar loans is not observable and the estimate of fair value is

determined using unobservable broker quotes. As it relates to derivatives this category includes: financial forwards including

swap spread locks with maturities which extend beyond observable periods; interest rate lock commitments with certain

unobservable inputs, including pull-through rates; equity variance swaps with unobservable volatility inputs or that are priced

via independent broker quotations; foreign currency swaps which are cancelable and priced through independent broker

quotations; interest rate swaps with maturities which extend beyond the observable portion of the yield curve; credit default

swaps based upon baskets of credits having unobservable credit correlations as well as credit default swaps with maturities

which extend beyond the observable portion of the credit curves and credit default swaps priced through independent broker

quotes; foreign currency forwards priced via independent broker quotations or with liquidity adjustments; equity options with

unobservable volatility inputs; and interest rate caps and floors referencing unobservable yield curves and/or which include

liquidity and volatility adjustments. Separate account assets classified within this level are generally similar to those classified

within this level for the general account; however, they also include mortgage loans, and other limited partnership interests.

Embedded derivatives classified within this level include embedded derivatives associated with certain variable annuity riders.

This category also includes mortgage servicing rights which are carried at estimated fair value and have multiple significant

unobservable inputs including discount rates, estimates of loan prepayments and servicing costs.

F-110 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)