MetLife 2008 Annual Report Download - page 132

Download and view the complete annual report

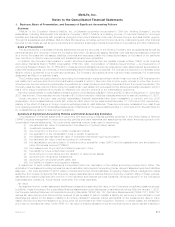

Please find page 132 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and principal payments and the Company’s evaluation of recoverability of all contractual cash flows, as well as the Company’s ability

and intent to hold the security, including holding the security until the earlier of a recovery in value, or until maturity. In contrast, for

certain equity securities, greater weight and consideration are given by the Company to a decline in market value and the likelihood

such market value decline will recover. See also Note 3.

Additionally, management considers a wide range of factors about the security issuer and uses its best judgment in evaluating

the cause of the decline in the estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in

management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its future earnings

potential. Considerations used by the Company in the impairment evaluation process include, but are not limited to: (i) the length of

time and the extent to which the market value has been below cost or amortized cost; (ii) the potential for impairments of securities

when the issuer is experiencing significant financial difficulties; (iii) the potential for impairments in an entire industry sector or sub-

sector; (iv) the potential for impairments in certain economically depressed geographic locations; (v) the potential for impairments of

securities where the issuer, series of issuers or industry has suffered a catastrophic type of loss or has exhausted natural resources;

(vi) the Company’s ability and intent to hold the security for a period of time sufficient to allow for the recovery of its value to an amount

equal to or greater than cost or amortized cost (See also Note 3); (vii) unfavorable changes in forecasted cash flows on mortgage-

backed and asset-backed securities; and (viii) other subjective factors, including concentrations and information obtained from

regulators and rating agencies.

In periods subsequent to the recognition of an other-than-temporary impairment on a debt security, the Company accounts for

the impaired security as if it had been purchased on the measurement date of the impairment. Accordingly, the discount (or reduced

premium) based on the new cost basis is accreted into net investment income over the remaining term of the debt security in a

prospective manner based on the amount and timing of estimated future cash flows.

The Company purchases and receives beneficial interests in special purpose entities (“SPEs”), which enhance the Company’s

total return on its investment portfolio principally by providing equity-based returns on debt securities. These investments are

generally made through structured notes and similar instruments (collectively, “Structured Investment Transactions”). The Company

has not guaranteed the performance, liquidity or obligations of the SPEs and its exposure to loss is limited to its carrying value of the

beneficial interests in the SPEs. The Company does not consolidate such SPEs as it has determined it is not the primary beneficiary.

These Structured Investment Transactions are included in fixed maturity securities and their income is generally recognized using the

retrospective interest method. Impairments of these investments are included in net investment gains (losses).

Trading Securities. The Company’s trading securities portfolio, principally consisting of fixed maturity and equity securities,

supports investment strategies that involve the active and frequent purchase and sale of securities and the execution of short sale

agreements, and supports asset and liability matching strategies for certain insurance products. Trading securities and short sale

agreement liabilities are recorded at estimated fair value with subsequent changes in estimated fair value recognized in net

investment income. Related dividends and investment income are also included in net investment income.

Securities Lending. Securities loaned transactions, whereby blocks of securities, which are included in fixed maturity and

equity securities, are loaned to third parties, are treated as financing arrangements and the associated liability is recorded at the

amount of cash received. The Company generally obtains collateral in an amount equal to 102% of the estimated fair value of the

securities loaned. The Company monitors the estimated fair value of the securities loaned on a daily basis with additional collateral

obtained as necessary. Substantially all of the Company’s securities loaned transactions are with large brokerage firms and

commercial banks. Income and expenses associated with securities loaned transactions are reported as investment income and

investment expense, respectively, within net investment income.

Mortgage and Consumer Loans. Mortgage and consumer loans held-for-investment are stated at unpaid principal balance,

adjusted for any unamortized premium or discount, deferred fees or expenses, net of valuation allowances. Interest income is

accrued on the principal amount of the loan based on the loan’s contractual interest rate. Amortization of premiums and discounts is

recorded using the effective yield method. Interest income, amortization of premiums and discounts, and prepayment fees are

reported in net investment income. Loans are considered to be impaired when it is probable that, based upon current information and

events, the Company will be unable to collect all amounts due under the contractual terms of the loan agreement. Based on the facts

and circumstances of the individual loans being impaired, valuation allowances are established for the excess carrying value of the

loan over either (i) the present value of expected future cash flows discounted at the loan’s original effective interest rate, (ii) the

estimated fair value of the loan’s underlying collateral if the loan is in the process of foreclosure or otherwise collateral dependent, or

(iii) the loan’s estimated fair value. The Company also establishes allowances for loan losses when a loss contingency exists for pools

of loans with similar characteristics, such as mortgage loans based on similar property types or loan to value risk factors. A loss

contingency exists when the likelihood that a future event will occur is probable based on past events. Interest income earned on

impaired loans is accrued on the principal amount of the loan based on the loan’s contractual interest rate. However, interest ceases

to be accrued for loans on which interest is generally more than 60 days past due and/or when the collection of interest is not

considered probable. Cash receipts on such impaired loans are recorded as a reduction of the recorded investment. Gains and

losses from the sale of loans and changes in valuation allowances are reported in net investment gains (losses).

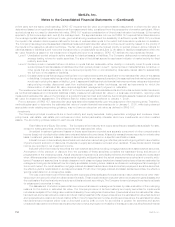

Mortgage loans held-for-sale primarily include residential mortgages which are originated with the intent to sell and for which the

fair value option was elected. These loans are stated at estimated fair value with subsequent changes in estimated fair value

recognized in other revenue. Certain other mortgage loans previously designated as held-for-investment have been designated as

held-for-sale to reflect a change in the Company’s intention as it relates to holding such loans. At the time of transfer, such loans are

F-9MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)