MetLife 2008 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or more series of its indebtedness as designated from time to time by the Company. The RCC will terminate upon the occurrence of certain

events, including the date on which there are no series of outstanding eligible debt securities.

In connection with the offering of the Preferred Shares, the Holding Company incurred $56.8 million of issuance costs which have been

recorded as a reduction of additional paid-in capital.

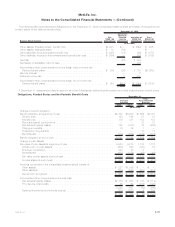

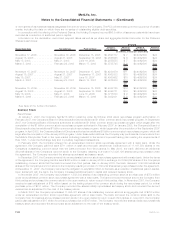

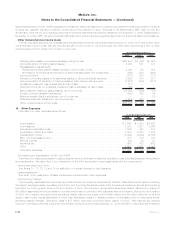

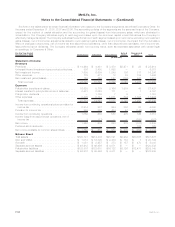

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Preferred

Shares is as follows:

Declaration Date Record Date Payment Date Series A

Per Share Series A

Aggregate Series B

Per Share Series B

Aggregate

Dividend

(In millions, except per share data)

November 17, 2008 . . . . . . . . . . November 30, 2008 December 15, 2008 $0.2527777 $ 7 $0.4062500 $24

August 15, 2008 . . . . . . . . . . . . August 31, 2008 September 15, 2008 $0.2555555 $ 6 $0.4062500 $24

May 15, 2008. . . . . . . . . . . . . . May 31, 2008 June 16, 2008 $0.2555555 $ 7 $0.4062500 $24

March 5, 2008 . . . . . . . . . . . . . February 29, 2008 March 17, 2008 $0.3785745 $ 9 $0.4062500 $24

$29 $96

November 15, 2007 . . . . . . . . . . November 30, 2007 December 17, 2007 $0.4230476 $11 $0.4062500 $24

August 15, 2007 . . . . . . . . . . . . August 31, 2007 September 17, 2007 $0.4063333 $10 $0.4062500 $24

May 15, 2007. . . . . . . . . . . . . . May 31, 2007 June 15, 2007 $0.4060062 $10 $0.4062500 $24

March 5, 2007 . . . . . . . . . . . . . February 28, 2007 March 15, 2007 $0.3975000 $10 $0.4062500 $24

$41 $96

November 15, 2006 . . . . . . . . . . November 30, 2006 December 15, 2006 $0.4038125 $10 $0.4062500 $24

August 15, 2006 . . . . . . . . . . . . August 31, 2006 September 15, 2006 $0.4043771 $10 $0.4062500 $24

May 16, 2006. . . . . . . . . . . . . . May 31, 2006 June 15, 2006 $0.3775833 $ 9 $0.4062500 $24

March 6, 2006 . . . . . . . . . . . . . February 28, 2006 March 15, 2006 $0.3432031 $ 9 $0.4062500 $24

$38 $96

See Note 25 for further information.

Common Stock

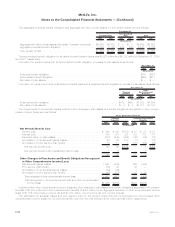

Repurchases

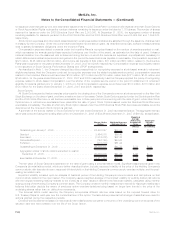

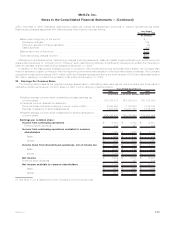

At January 1, 2007, the Company had $216 million remaining under its October 2004 stock repurchase program authorization. In

February 2007, the Company’s Board of Directors authorized an additional $1 billion common stock repurchase program. In September

2007, the Company’s Board of Directors authorized an additional $1 billion common stock repurchase program which began after the

completion of the $1 billion common stock repurchase program authorized in February 2007. In January 2008, the Company’s Board of

Directors authorized an additional $1 billion common stock repurchase program, which began after the completion of the September 2007

program. In April 2008, the Company’s Board of Directors authorized an additional $1 billion common stock repurchase program, which will

begin after the completion of the January 2008 program. Under these authorizations, the Company may purchase its common stock from

the MetLife Policyholder Trust, in the open market (including pursuant to the terms of a pre-set trading plan meeting the requirements of

Rule 10b5-1 under the Exchange Act) and in privately negotiated transactions.

In February 2008, the Company entered into an accelerated common stock repurchase agreement with a major bank. Under the

agreement, the Company paid the bank $711 million in cash and the bank delivered an initial amount of 11,161,550 shares of the

Company’s outstanding common stock that the bank borrowed from third parties. In May 2008, the bank delivered an additional

864,646 shares of the Company’s common stock to the Company resulting in a total of 12,026,196 shares being repurchased under

the agreement. The Company recorded the shares repurchased as treasury stock.

In December 2007, the Company entered into an accelerated common stock repurchase agreement with a major bank. Under the terms

of the agreement, the Company paid the bank $450 million in cash in January 2008 in exchange for 6,646,692 shares of the Company’s

outstanding common stock that the bank borrowed from third parties. Also in January 2008, the bank delivered 1,043,530 additional

shares of the Company’s common stock to the Company resulting in a total of 7,690,222 shares being repurchased under the agreement.

At December 31, 2007, the Company recorded the obligation to pay $450 million to the bank as a reduction of additional paid-in capital.

Upon settlement with the bank, the Company increased additional paid-in capital and reduced treasury stock.

In November 2007, the Company repurchased 11,559,803 shares of its outstanding common stock at an initial cost of $750 million

under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the stock sold to the Company from

third parties and purchased the common stock in the open market to return to such third parties. Also, in November 2007, the Company

received a cash adjustment of $19 million based on the trading prices of the common stock during the repurchase period, for a final

purchase price of $731 million. The Company recorded the shares initially repurchased as treasury stock and recorded the amount

received as an adjustment to the cost of the treasury stock.

In March 2007, the Company repurchased 11,895,321 shares of its outstanding common stock at an aggregate cost of $750 million

under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock sold to the

Company from third parties and purchased common stock in the open market to return to such third parties. In June 2007, the Company

paid a cash adjustment of $17 million for a final purchase price of $767 million. The Company recorded the shares initially repurchased as

treasury stock and recorded the amount paid as an adjustment to the cost of the treasury stock.

F-84 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)