MetLife 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

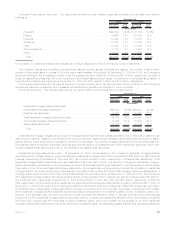

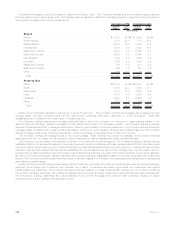

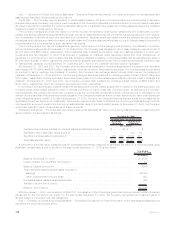

The following table presents the amortized cost and valuation allowances for consumer loans held-for-investment distributed by loan

classification at:

Amortized

Cost (1) %of

Total Valuation

Allowance

%of

Amortized

Cost Amortized

Cost (1) %of

Total Valuation

Allowance

%of

Amortized

Cost

December 31, 2008 December 31, 2007

(In millions)

Performing ....................... $1,116 95.8% $11 1.0% $1,001 95.7% $5 0.5%

Restructured...................... — — — —% — — — —%

Potentiallydelinquent ................ 17 1.5 — —% 19 1.8 — —%

Delinquent or under foreclosure . . . . . . . . . 31 2.7 — —% 26 2.5 1 4.0%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $1,164 100.0% $11 0.9% $1,046 100.0% $ 6 0.6%

(1) Amortized cost is equal to carrying value before valuation allowances.

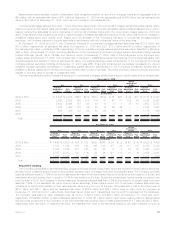

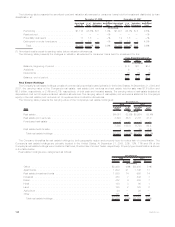

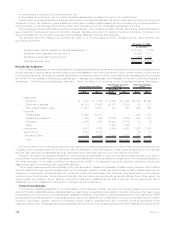

The following table presents the changes in valuation allowances for consumer loans held-for-investment for the:

2008 2007 2006

Years Ended December 31,

(In millions)

Balance,beginningofperiod.......................................... $ 6 $11 $14

Additions ...................................................... 6 — 1

Deductions ..................................................... (1) (5) (4)

Balance,endofperiod.............................................. $11 $ 6 $11

Real Estate Holdings

The Company’s real estate holdings consist of commercial properties located primarily in the United States. At December 31, 2008 and

2007, the carrying value of the Company’s real estate, real estate joint ventures and real estate held-for-sale was $7.6 billion and

$6.8 billion, respectively, or 2.4% and 2.1%, respectively, of total cash and invested assets. The carrying value of real estate is stated at

depreciated cost net of impairments and valuation allowances. The carrying value of real estate joint ventures is stated at the Company’s

equity in the real estate joint ventures net of impairments and valuation allowances.

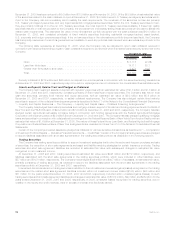

The following table presents the carrying value of the Company’s real estate holdings at:

Type Carrying

Value %of

Total Carrying

Value %of

Total

2008 2007

(In millions)

December 31,

Realestate............................................... $4,061 53.5% $3,954 58.4%

Realestatejointventures ..................................... 3,522 46.5 2,771 41.0

Foreclosedrealestate ....................................... 2 — 3 —

7,585 100.0 6,728 99.4

Realestateheld-for-sale...................................... 1 — 39 0.6

Total real estate holdings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $7,586 100.0% $6,767 100.0%

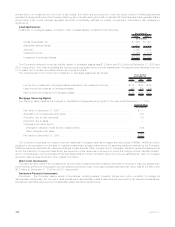

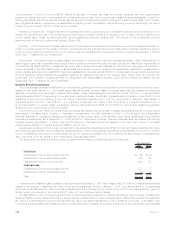

The Company diversifies its real estate holdings by both geographic region and property type to reduce risk of concentration. The

Company’s real estate holdings are primarily located in the United States. At December 31, 2008, 22%, 13%, 11% and 8% of the

Company’s real estate holdings were located in California, Florida, New York and Texas, respectively. Property type diversification is shown

in the table below.

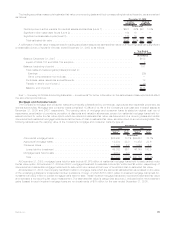

Real estate holdings were categorized as follows:

Amount Percent Amount Percent

2008 2007

December 31,

(In millions)

Office ................................................. $3,489 46% $3,480 51%

Apartments.............................................. 1,602 21 1,148 17

Realestateinvestmentfunds .................................. 1,080 14 950 14

Industrial ............................................... 483 7 443 7

Retail.................................................. 472 6 455 7

Hotel.................................................. 180 3 60 1

Land.................................................. 155 2 125 2

Agriculture .............................................. 24 — 29 —

Other.................................................. 101 1 77 1

Totalrealestateholdings.................................... $7,586 100% $6,767 100%

102 MetLife, Inc.