MetLife 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

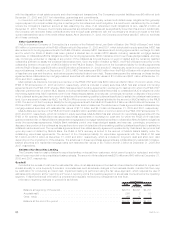

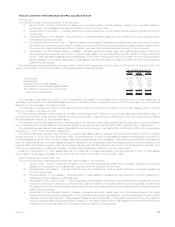

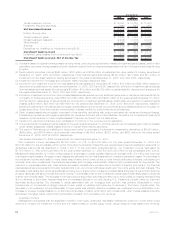

Gross other postretirement benefit payments for the next ten years, which reflect expected future service where appropriate, and gross

subsidies to be received under the Prescription Drug Act are expected to be as follows:

Gross Prescription

Drug Subsidies Net

(In millions)

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $135 $ (15) $120

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $140 $ (16) $124

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $146 $ (16) $130

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $150 $ (17) $133

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $154 $ (18) $136

2014-2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $847 $(107) $740

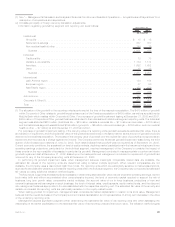

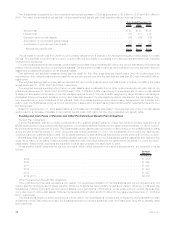

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by

impaired, insolvent or failed insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular

state on the basis of the proportionate share of the premiums written by member insurers in the lines of business in which the impaired,

insolvent or failed insurer engaged. Some states permit member insurers to recover assessments paid through full or partial premium tax

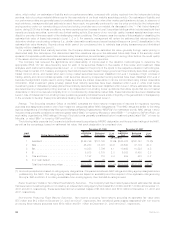

offsets. Assets and liabilities held for insolvency assessments are as follows:

2008 2007

December 31,

(In millions)

Other Assets:

Premiumtaxoffsetforfutureundiscountedassessments............................... $50 $40

Premiumtaxoffsetscurrentlyavailableforpaidassessments............................ 7 6

Receivableforreimbursementofpaidassessments(1) ................................ 7 7

$64 $53

Other Liabilities:

Insolvencyassessments.................................................... $83 $74

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

Assessments levied against the Company were $2 million, ($1) million and $2 million for the years ended December 31, 2008, 2007 and

2006, respectively.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as

inflation may affect interest rates.

Inflation in the United States has remained contained and been in a general downtrend for an extended period. However, in light of

recent and ongoing aggressive fiscal and monetary stimulus measures by the U.S. federal government and foreign governments, it is

possible that inflation could increase in the future. An increase in inflation could affect our business in several ways. During inflationary

periods, the value of fixed income investments falls which could increase realized and unrealized losses. Inflation also increases expenses

for labor and other materials, potentially putting pressure on profitability if such costs can not be passed through in our product prices.

Inflation could also lead to increased costs for losses and loss adjustment expenses in our Auto & Home business, which could require us

to adjust our pricing to reflect our expectations for future inflation. If actual inflation exceeds the expectations we use in pricing our policies,

the profitability of our Auto & Home business would be adversely affected. Prolonged and elevated inflation could adversely affect the

financial markets and the economy generally, and dispelling it may require governments to pursue a restrictive fiscal and monetary policy,

which could constrain overall economic activity, inhibit revenue growth and reduce the number of attractive investment opportunities.

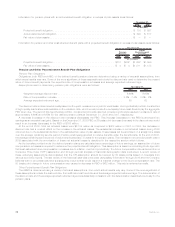

Adoption of New Accounting Pronouncements

Fair Value

Effective January 1, 2008, the Company adopted SFAS No. 157, Fair Value Measurements. SFAS 157 which defines fair value,

establishes a consistent framework for measuring fair value, establishes a fair value hierarchy based on the observability of inputs used to

measure fair value, and requires enhanced disclosures about fair value measurements and applied the provisions of the statement

prospectively to assets and liabilities measured at fair value. The adoption of SFAS 157 changed the valuation of certain freestanding

derivatives by moving from a mid to bid pricing convention as it relates to certain volatility inputs as well as the addition of liquidity

adjustments and adjustments for risks inherent in a particular input or valuation technique. The adoption of SFAS 157 also changed the

valuation of the Company’s embedded derivatives, most significantly the valuation of embedded derivatives associated with certain riders

on variable annuity contracts. The change in valuation of embedded derivatives associated with riders on annuity contracts resulted from

the incorporation of risk margins associated with non capital market inputs and the inclusion of the Company’s own credit standing in their

valuation. At January 1, 2008, the impact of adopting SFAS 157 on assets and liabilities measured at estimated fair value was $30 million

($19 million, net of income tax) and was recognized as a change in estimate in the accompanying consolidated statement of income where

it was presented in the respective income statement caption to which the item measured at estimated fair value is presented. There were

no significant changes in estimated fair value of items measured at fair value and reflected in accumulated other comprehensive income

(loss). The addition of risk margins and the Company’s own credit spread in the valuation of embedded derivatives associated with annuity

contracts may result in significant volatility in the Company’s consolidated net income in future periods. Note 24 of the Notes to the

77MetLife, Inc.