MetLife 2008 Annual Report Download - page 198

Download and view the complete annual report

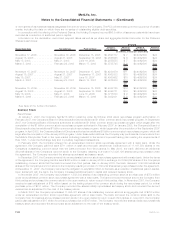

Please find page 198 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Travelers Ins. Co., et al. v. Banc of America Securities LLC (S.D.N.Y., filed December 13, 2001). On January 6, 2009, after a jury trial,

the district court entered a judgment in favor of The Travelers Insurance Company, now known as MetLife Insurance Company of

Connecticut, in the amount of approximately $42 million in connection with securities and common law claims against the defendant. The

defendant has filed a post judgment motion seeking a judgment in its favor or, in the alternative, a new trial. If this motion is denied, the

defendant will likely file an appeal. As it is possible that the judgment could be affected during the post judgment motion practice or upon

appeal, and the Company has not collected any portion of the judgment, the Company has not recognized any award amount in its

consolidated financial statements.

Shipley v. St. Paul Fire and Marine Ins. Co. and Metropolitan Property and Casualty Ins. Co. (Ill. Cir. Ct., Madison County, filed February

26 and July 2, 2003). Two putative nationwide class actions have been filed against Metropolitan Property and Casualty Insurance

Company in Illinois. One suit claims breach of contract and fraud due to the alleged underpayment of medical claims arising from the use of

a purportedly biased provider fee pricing system. The second suit currently alleges breach of contract arising from the alleged use of

preferred provider organizations to reduce medical provider fees covered by the medical claims portion of the insurance policy. Motions for

class certification have been filed and briefed in both cases. A third putative nationwide class action relating to the payment of medical

providers, Innovative Physical Therapy, Inc. v. MetLife Auto & Home, et ano (D. N.J., filed November 12, 2007), was filed against

Metropolitan Property and Casualty Insurance Company in federal court in New Jersey. The court granted the defendants’ motion to

dismiss, and plaintiff appealed the dismissal. The Company is vigorously defending against the claims in these matters.

The American Dental Association, et al. v. MetLife Inc., et al. (S.D. Fla., filed May 19, 2003). The American Dental Association and

three individual providers have sued the Holding Company, MLIC and other non-affiliated insurance companies in a putative class action

lawsuit. The plaintiffs purport to represent a nationwide class of in-network providers who allege that their claims are being wrongfully

reduced by downcoding, bundling, and the improper use and programming of software. The complaint alleges federal racketeering and

various state law theories of liability. On February 10, 2009, the district court granted the Company’s motion to dismiss plaintiffs’ second

amended complaint, dismissing all of plaintiffs’ claims except for breach of contract claims. Plaintiffs have been provided with an

opportunity to re-plead the dismissed claims by February 26, 2009.

In Re Ins. Brokerage Antitrust Litig. (D. N.J., filed February 24, 2005). In this multi-district class action proceeding, plaintiffs’ complaint

alleged that the Holding Company, MLIC, several non-affiliated insurance companies and several insurance brokers violated the Racketeer

Influenced and Corrupt Organizations Act (“RICO”), the Employee Retirement Income Security Act of 1974 (“ERISA”), and antitrust laws and

committed other misconduct in the context of providing insurance to employee benefit plans and to persons who participate in such

employee benefit plans. In August and September 2007 and January 2008, the court issued orders granting defendants’ motions to

dismiss with prejudice the federal antitrust, the RICO, and the ERISA claims. In February 2008, the court dismissed the remaining state law

claims on jurisdictional grounds. Plaintiffs’ appeal from the orders dismissing their RICO and federal antitrust claims is pending with the

U.S. Court of Appeals for the Third Circuit. A putative class action alleging that the Holding Company and other non-affiliated defendants

violated state laws was transferred to the District of New Jersey but was not consolidated with other related actions. Plaintiffs’ motion to

remand this action to state court in Florida is pending.

MetLife v. Park Avenue Securities, et. al. (FINRA Arbitration, filed May 2006). MetLife commenced an action against Park Avenue

Securities LLC., a registered investment adviser and broker-dealer that is an indirect wholly-owned subsidiary of The Guardian Life

Insurance Company of America, alleging misappropriation of confidential and proprietary information and use of prohibited methods to

solicit MetLife customers and recruit MetLife financial services representatives. On February 12, 2009, a Financial Industry Regulatory

Authority (“FINRA”) arbitration panel awarded MetLife $21 million in damages, including punitive damages and attorneys fees. Park Avenue

Securities may appeal the award.

Thomas, et al. v. Metropolitan Life Ins. Co., et al. (W.D. Okla., filed January 31, 2007). A putative class action complaint was filed

against MLIC and MSI. Plaintiffs assert legal theories of violations of the federal securities laws and violations of state laws with respect to

the sale of certain proprietary products by the Company’s agency distribution group. Plaintiffs seek rescission, compensatory damages,

interest, punitive damages and attorneys’ fees and expenses. In January and May 2008, the court issued orders granting the defendants’

motion to dismiss in part, dismissing all of plaintiffs’ claims except for claims under the Investment Advisers Act. Defendants’ motion to

dismiss claims under the Investment Advisers Act was denied. The Company will vigorously defend against the remaining claims in this

matter.

Sales Practices Claims. Over the past several years, MLIC, New England, GALIC, Walnut Street Securities and MSI have faced

numerous claims, including class action lawsuits, alleging improper marketing or sales of individual life insurance policies, annuities, mutual

funds or other products. Some of the current cases seek substantial damages, including punitive and treble damages and attorneys’ fees.

At December 31, 2008, there were approximately 125 sales practices litigation matters pending against the Company. The Company

continues to vigorously defend against the claims in these matters. The Company believes adequate provision has been made in its

consolidated financial statements for all probable and reasonably estimable losses for sales practices claims against MLIC, New England,

GALIC, MSI and Walnut Street Securities.

F-75MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)