MetLife 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

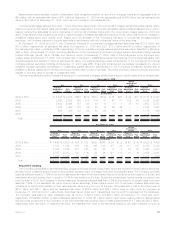

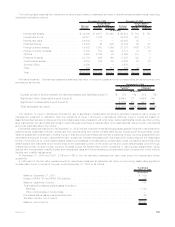

See “— Summary of Critical Accounting Estimates — Derivative Financial Instruments” for further information on the estimates and

assumptions that affect the amounts reported above.

Credit Risk. The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative

financial instruments. Generally, the current credit exposure of the Company’s derivative contracts is limited to the net positive estimated

fair value of derivative contracts at the reporting date after taking into consideration the existence of netting agreements and any collateral

received pursuant to credit support annexes.

The Company manages its credit risk related to over-the-counter derivatives by entering into transactions with creditworthy counter-

parties, maintaining collateral arrangements and through the use of master agreements that provide for a single net payment to be made by

one counterparty to another at each due date and upon termination. Because exchange-traded futures are effected through regulated

exchanges, and positions are marked to market on a daily basis, the Company has minimal exposure to credit-related losses in the event of

nonperformance by counterparties to such derivative instruments.

The Company enters into various collateral arrangements, which require both the pledging and accepting of collateral in connection

with its derivative instruments. At December 31, 2008 and 2007, the Company was obligated to return cash collateral under its control of

$7,758 million and $833 million, respectively. This unrestricted cash collateral is included in cash and cash equivalents or in short-term

investments and the obligation to return it is included in payables for collateral under securities loaned and other transactions. At

December 31, 2008 and 2007, the Company had also accepted collateral consisting of various securities with an estimated fair value of

$1,249 million and $678 million, respectively, which are held in separate custodial accounts. The Company is permitted by contract to sell

or repledge this collateral, but at December 31, 2008 and 2007, none of the collateral had been sold or repledged.

At December 31, 2008 and 2007, the Company provided securities collateral for various arrangements in connection with derivative

instruments of $776 million and $162 million, respectively, which is included in fixed maturity securities. The counterparties are permitted

by contract to sell or repledge this collateral. In addition, the Company has exchange-traded futures, which require the pledging of

collateral. At December 31, 2008 and 2007, the Company pledged securities collateral for exchange-traded futures of $282 million and

$167 million, respectively, which is included in fixed maturity securities. The counterparties are permitted by contract to sell or repledge this

collateral. At December 31, 2008 and 2007, the Company provided cash collateral for exchange-traded futures of $686 million and

$102 million, respectively, which is included in premiums and other receivables.

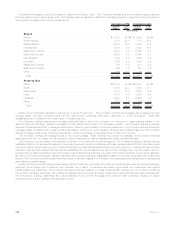

In connection with synthetically created investment transactions and credit default swaps held in relation to the trading portfolio, the

Company writes credit default swaps for which it receives a premium to insure credit risk. If a credit event, as defined by the contract,

occurs generally the contract will require the Company to pay the counterparty the specified swap notional amount in exchange for the

delivery of par quantities of the referenced credit obligation. The Company’s maximum amount at risk, assuming the value of all referenced

credit obligations is zero, was $1,875 million at December 31, 2008. However, the Company believes that any actual future losses will be

significantly lower than this amount. Additionally, the Company can terminate these contracts at any time through cash settlement with the

counterparty at an amount equal to the then current estimated fair value of the credit default swaps. At December 31, 2008, the Company

would have paid $37 million to terminate all of these contracts.

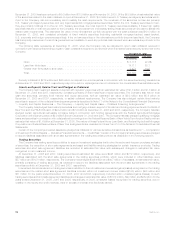

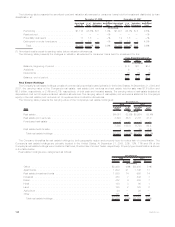

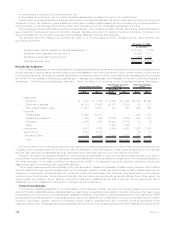

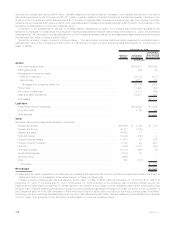

Embedded Derivatives. The embedded derivatives measured at estimated fair value on a recurring basis and their corresponding fair

value hierarchy, are summarized as follows:

Asset Host

Contracts Liability Host

Contracts

Net Embedded Derivatives Within

December 31, 2008

(In millions)

Quoted prices in active markets for identical assets and liabilities (Level 1) . . . . $ — —% $ — —%

Significantotherobservableinputs(Level2)........................ — — (83) (3)

Significantunobservableinputs(Level3).......................... 205 100 3,134 103

Totalestimatedfairvalue .................................... $205 100% $3,051 100%

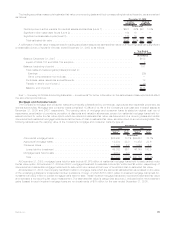

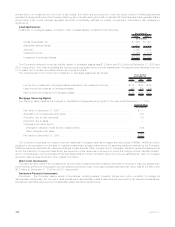

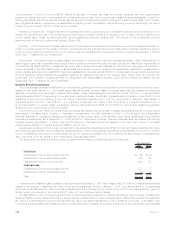

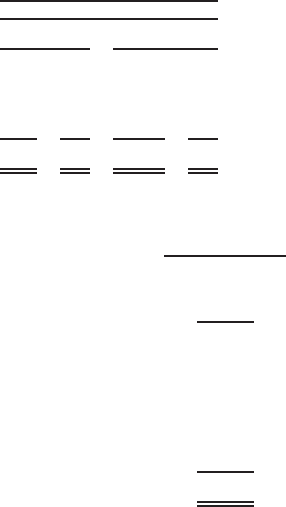

A rollforward of the fair value measurements for embedded derivatives measured at estimated fair value on a recurring basis using

significant unobservable (Level 3) inputs for the year ended December 31, 2008 is as follows:

Year Ended

December 31, 2008

(In millions)

Balance, December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (278)

ImpactofSFAS157andSFAS159adoption...................................... 24

Balance,beginningofperiod................................................ (254)

Total realized/unrealized gains (losses) included in:

Earnings............................................................ (2,500)

Othercomprehensiveincome(loss) .......................................... (81)

Purchases,sales,issuancesandsettlements ..................................... (94)

Transferinand/oroutofLevel3.............................................. —

Balance,endofperiod.................................................... $(2,929)

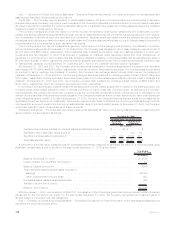

Effective January 1, 2008, upon adoption of SFAS 157, the valuation of the Company’s guaranteed minimum benefit riders includes an

adjustment for the Company’s own credit. For the year ended December 31, 2008, the Company recognized net investment gains of

$2,994 million in connection with this adjustment.

See “— Summary of Critical Accounting Estimates — Embedded Derivatives” for further information on the estimates and assumptions

that affect the amounts reported above.

106 MetLife, Inc.