MetLife 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

estimated gross profits and margins. Policy fees from variable life and annuity and investment-type products are typically calculated as a

percentage of the average assets in policyholder accounts. The value of these assets can fluctuate depending on equity performance.

Net investment income increased by $162 million. Net investment income from the general account portion of investment-type products

and other businesses increased by $47 million and $115 million, respectively. Management attributes $109 million of this increase to an

increase in yields, primarily due to higher returns on other limited partnership interests. Additionally, management attributes $53 million to

growth in the average asset base across various investment types.

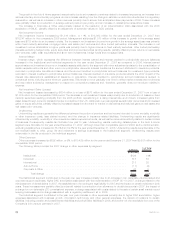

Expenses

Total expenses increased by $862 million, or 7%, to $13,396 million for the year ended December 31, 2007 from $12,534 million for

2006.

Policyholder benefits and claims increased by $330 million primarily due to an increase in the closed block-related policyholder dividend

obligation of $115 million which was primarily driven by net investment gains. Unfavorable mortality in the life products, as well as revisions

to policyholder benefits in both years, contributed $199 million to this increase. Included in this increase was $72 million of unfavorable

mortality in the closed block and a prior year net increase of $15 million in the excess mortality liability on specific blocks of life insurance

policies. Higher amortization of sales inducements resulting from business growth and revisions to management’s assumptions used to

determine estimated gross profits and margins, partially offset by lower costs of guaranteed annuity benefit riders and related hedging

increased annuity benefits by $37 million. Partially offsetting these increases, policyholder benefits and claims decreased by $21 million

commensurate with the decrease in premiums discussed above.

Interest credited to policyholder account balances decreased by $5 million. Interest credited on the general account portion of

investment-type products and other businesses decreased by $16 million and $9 million, respectively. Of the $16 million decrease on the

general account portion of investment-type products, management attributed $67 million to higher crediting rates, more than offset by

$83 million due to lower average policyholder account balances. Partially offsetting these decreases was lower amortization of the excess

interest reserves on acquired annuity and universal life blocks of business of $20 million primarily driven by lower lapses in 2007.

Policyholder dividends increased by $19 million due to growth in the business.

Higher other expenses of $518 million include higher DAC amortization of $315 million resulting from business growth, lower net

investment losses and revisions to management’s assumptions used to determine estimated gross profits and margins. The remaining

increase in other expenses of $203 million was comprised of $172 million associated with business growth, information technology and

other general expenses, $7 million due to the impact of revisions to certain liabilities including pension and postretirement liabilities and

policyholder liabilities in 2006, and $24 million associated with the write-off of a receivable from one of the Company’s joint venture

partners in 2007.

International

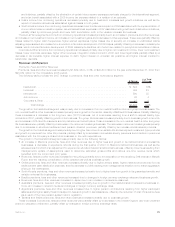

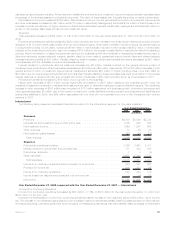

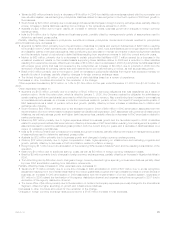

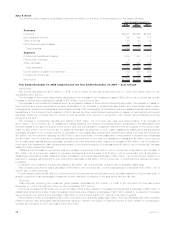

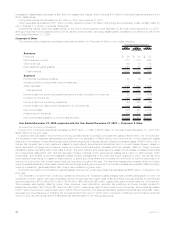

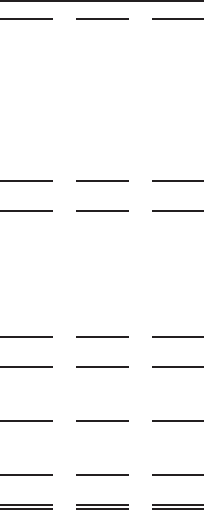

The following table presents consolidated financial information for the International segment for the years indicated:

2008 2007 2006

Years Ended December 31,

(In millions)

Revenues

Premiums..................................................... $3,470 $3,096 $2,722

Universallifeandinvestment-typeproductpolicyfees ........................ 1,095 995 805

Netinvestmentincome............................................. 1,249 1,247 949

Otherrevenues ................................................. 18 24 28

Netinvestmentgains(losses) ........................................ 167 56 (10)

Totalrevenues................................................. 5,999 5,418 4,494

Expenses

Policyholderbenefitsandclaims ...................................... 3,166 2,460 2,411

Interestcreditedtopolicyholderaccountbalances........................... 171 354 288

Policyholderdividends............................................. 7 4 (3)

Otherexpenses ................................................. 1,671 1,749 1,531

Totalexpenses ................................................ 5,015 4,567 4,227

Incomefromcontinuingoperationsbeforeprovisionforincometax ................ 984 851 267

Provisionforincometax............................................ 404 207 95

Incomefromcontinuingoperations..................................... 580 644 172

Income(loss)fromdiscontinuedoperations,netofincometax ................... — (9) 28

Netincome.................................................... $ 580 $ 635 $ 200

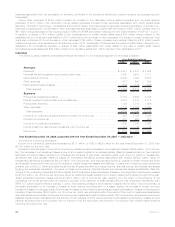

Year Ended December 31, 2008 compared with the Year Ended December 31, 2007 — International

Income from Continuing Operations

Income from continuing operations decreased by $64 million, or 10%, to $580 million for the year ended December 31, 2008 from

$644 million for the prior year.

Included in this decrease in income from continuing operations was an increase in net investment gains of $39 million, net of income

tax. The increase in net investment gains was due to an increase in gains on derivatives partially offset by losses primarily on fixed maturity

and equity securities. Derivative gains were driven by gains on freestanding derivatives that were partially offset by losses on embedded

35MetLife, Inc.