MetLife 2008 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

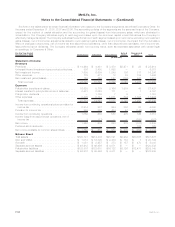

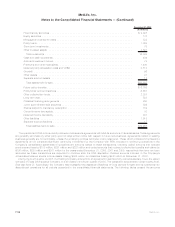

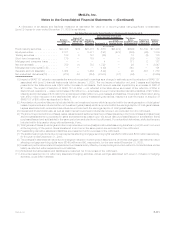

December 31, 2008 Notional

Amount Carrying

Value Estimated

Fair Value

(In millions)

Assets:

Fixedmaturitysecurities ............................................... $188,251 $188,251

Equitysecurities..................................................... $ 3,197 $ 3,197

Tradingsecurities.................................................... $ 946 $ 946

Mortgage and consumer loans:

Held-for-investment................................................. $ 49,352 $ 48,133

Held-for-sale ..................................................... $ 2,012 $ 2,010

Mortgageandconsumerloans,net ..................................... $ 51,364 $ 50,143

Policyloans ....................................................... $ 9,802 $ 11,952

Realestatejointventures(1)............................................. $ 163 $ 176

Otherlimitedpartnershipinterests(1) ....................................... $ 1,900 $ 2,269

Short-terminvestments................................................ $ 13,878 $ 13,878

Other invested assets:(1)

Derivativeassets................................................... $133,565 $ 12,306 $ 12,306

Mortgageservicingrights ............................................. $ 191 $ 191

Other .......................................................... $ 801 $ 900

Cashandcashequivalents.............................................. $ 24,207 $ 24,207

Accruedinvestmentincome............................................. $ 3,061 $ 3,061

Premiumsandotherreceivables(1)......................................... $ 2,995 $ 3,473

Otherassets(1) ..................................................... $ 800 $ 629

Assetsofsubsidiariesheld-for-sale(1)....................................... $ 630 $ 649

Separateaccountassets............................................... $120,839 $120,839

Netembeddedderivativeswithinassethostcontracts(2) .......................... $ 205 $ 205

Liabilities:

Policyholderaccountbalances(1).......................................... $110,174 $102,902

Short-termdebt..................................................... $ 2,659 $ 2,659

Long-termdebt(1) ................................................... $ 9,619 $ 8,155

Collateralfinancingarrangements ......................................... $ 5,192 $ 1,880

Juniorsubordinateddebtsecurities ........................................ $ 3,758 $ 2,606

Payablesforcollateralundersecuritiesloanedandothertransactions.................. $ 31,059 $ 31,059

Otherliabilities:(1)....................................................

Derivativeliabilities.................................................. $ 64,523 $ 4,042 $ 4,042

Tradingliabilities ................................................... $ 57 $ 57

Other .......................................................... $ 638 $ 638

Liabilitiesofsubsidiariesheld-for-sale(1) ..................................... $ 50 $ 49

Separateaccountliabilities(1)............................................ $ 28,862 $ 28,862

Netembeddedderivativeswithinliabilityhostcontracts(2).......................... $ 3,051 $ 3,051

Commitments:(3)

Mortgageloancommitments............................................. $ 2,690 $ — $ (129)

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments...................................................... $ 979 $ — $ (105)

(1) Carrying values presented herein differ from those presented on the consolidated balance sheet because certain items within the

respective financial statement caption are not considered financial instruments. Financial statement captions omitted from the table

above are not considered financial instruments.

(2) Net embedded derivatives within asset host contracts are presented within premiums and other receivables. Net embedded derivatives

within liability host contracts are presented within policyholder account balances. Equity securities also include embedded derivatives of

($173) million.

(3) Commitments are off-balance sheet obligations. Negative estimated fair values represent off-balance sheet liabilities.

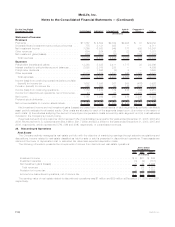

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

Fixed Maturity Securities, Equity Securities and Trading Securities — When available, the estimated fair value of the Company’s fixed

maturity, equity and trading securities are based on quoted prices in active markets that are readily and regularly obtainable. Generally,

these are the most liquid of the Company’s securities holdings and valuation of these securities does not involve management judgment.

F-103MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)