MetLife 2008 Annual Report Download - page 150

Download and view the complete annual report

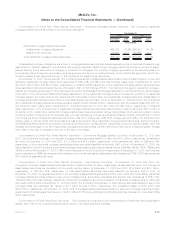

Please find page 150 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interim periods beginning after November 15, 2008. The Company will provide all of the material required disclosures in the appropriate

future interim and annual periods.

Other Pronouncements

In December 2008, the FASB issued FSP No. FAS 132(r)-1, Employers’ Disclosures about Postretirement Benefit Plan Assets

(“FSP 132(r)-1”). FSP 132(r)-1 amends SFAS No. 132(r), Employers’ Disclosures about Pensions and Other Postretirement Benefits to

enhance the transparency surrounding the types of assets and associated risks in an employer’s defined benefit pension or other

postretirement plan. The FSP requires an employer to disclose information about the valuation of plan assets similar to that required under

SFAS 157. FSP 132(r)-1 is effective for fiscal years ending after December 15, 2009. The Company will provide all of the material required

disclosures in the appropriate future annual period.

In September 2008, the FASB ratified the consensus on EITF Issue No. 08-5, Issuer’s Accounting for Liabilities Measured at Fair Value

with a Third-Party Credit Enhancement (“EITF 08-5”). EITF 08-5 concludes that an issuer of a liability with a third-party credit enhancement

should not include the effect of the credit enhancement in the fair value measurement of the liability. In addition, EITF 08-5 requires

disclosures about the existence of any third-party credit enhancement related to liabilities that are measured at fair value. EITF 08-5 is

effective beginning in the first reporting period after December 15, 2008 and will be applied prospectively, with the effect of initial

application included in the change in fair value of the liability in the period of adoption. The Company does not expect the adoption of

EITF 08-5 to have a material impact on the Company’s consolidated financial statements.

In June 2008, the FASB ratified the consensus on EITF Issue No. 07-5, Determining Whether an Instrument (or Embedded Feature) Is

Indexed to an Entity’s Own Stock (“EITF 07-5”). EITF 07-5 provides a framework for evaluating the terms of a particular instrument and

whether such terms qualify the instrument as being indexed to an entity’s own stock. EITF 07-5 is effective for financial statements issued

for fiscal years beginning after December 15, 2008 and must be applied by recording a cumulative effect adjustment to the opening

balance of retained earnings at the date of adoption. The Company does not expect the adoption of EITF 07-5 to have a material impact on

its consolidated financial statements.

In February 2008, the FASB issued FSP No. FAS 140-3, Accounting for Transfers of Financial Assets and Repurchase Financing

Transactions (“FSP 140-3”). FSP 140-3 provides guidance for evaluating whether to account for a transfer of a financial asset and

repurchase financing as a single transaction or as two separate transactions. FSP 140-3 is effective prospectively for financial statements

issued for fiscal years beginning after November 15, 2008. The Company does not expect the adoption of FSP 140-3 to have a material

impact on its consolidated financial statements.

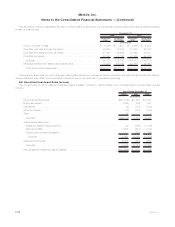

2. Acquisitions and Dispositions

Disposition of Reinsurance Group of America, Incorporated

On September 12, 2008, the Company completed a tax-free split-off of its majority-owned subsidiary, Reinsurance Group of America,

Incorporated (“RGA”). The Company and RGA entered into a recapitalization and distribution agreement, pursuant to which the Company

agreed to divest substantially all of its 52% interest in RGA to the Company’s stockholders. The split-off was effected through the following:

• A recapitalization of RGA common stock into two classes of common stock — RGA Class A common stock and RGA Class B

common stock. Pursuant to the terms of the recapitalization, each outstanding share of RGA common stock, including the

32,243,539 shares of RGA common stock beneficially owned by the Company and its subsidiaries, was reclassified as one share

of RGA Class A common stock. Immediately thereafter, the Company and its subsidiaries exchanged 29,243,539 shares of its RGA

Class A common stock — which represented all of the RGA Class A common stock beneficially owned by the Company and its

subsidiaries other than 3,000,000 shares of RGA Class A common stock — with RGA for 29,243,539 shares of RGA Class B

common stock.

• An exchange offer, pursuant to which the Company offered to acquire MetLife common stock from its stockholders in exchange for all

of its 29,243,539 shares of RGA Class B common stock. The exchange ratio was determined based upon a ratio — as more

specifically described in the exchange offering document — of the value of the MetLife and RGA shares during the three-day period

prior to the closing of the exchange offer. The 3,000,000 shares of the RGA Class A common stock were not subject to the tax-free

exchange.

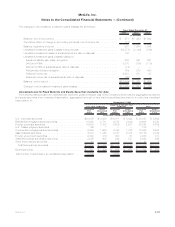

As a result of completion of the recapitalization and exchange offer, the Company received from MetLife stockholders

23,093,689 shares of the Company’s common stock with a market value of $1,318 million and, in exchange, delivered 29,243,539 shares

of RGA’s Class B common stock with a net book value of $1,716 million. The resulting loss on disposition, inclusive of transaction costs of

$60 million, was $458 million. The 3,000,000 shares of RGA Class A common stock retained by the Company are marketable equity

securities which do not constitute significant continuing involvement in the operations of RGA; accordingly, they have been classified within

equity securities in the consolidated financial statements of the Company at a cost basis of $157 million which is equivalent to the net book

value of the shares. The cost basis will be adjusted to fair value at each subsequent reporting date. The Company has agreed to dispose of

the remaining shares of RGA within the next five years. In connection with the Company’s agreement to dispose of the remaining shares,

the Company also recognized, in its provision for income tax on continuing operations, a deferred tax liability of $16 million which

represents the difference between the book and taxable basis of the remaining investment in RGA.

The impact of the disposition of the Company’s investment in RGA is reflected in the Company’s consolidated financial statements as

discontinued operations. The disposition of RGA results in the elimination of the Company’s Reinsurance segment. The Reinsurance

segment was comprised of the results of RGA, which at disposition became discontinued operations of Corporate & Other, and the interest

on economic capital, which has been reclassified to the continuing operations of Corporate & Other. See Note 23 for reclassifications

related to discontinued operations and Note 22 for segment information.

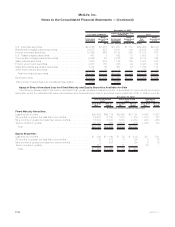

F-27MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)