MetLife 2008 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

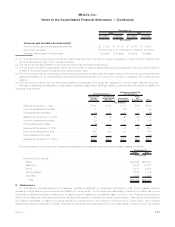

December 31, 2008, MetLife Bank’s liability for advances from the Federal Reserve Bank of New York was $950 million, which is included in

short-term debt. The estimated fair value of loan and investment security collateral pledged by MetLife Bank to the Federal Reserve Bank of

New York at December 31, 2008 was $1.6 billion. For the year ended December 31, 2008, the weighted average interest rate on the TAF

advances was 0.8% and the average daily balance was $145 million. TAF advances were outstanding for an average of 41 days during the

year ended December 31, 2008.

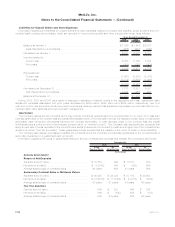

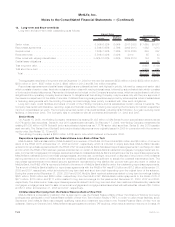

Short-term Debt

Short-term debt was $2,659 million and $667 million at December 31, 2008 and 2007, respectively. At December 31, 2008, short-term

debt consisted of $714 million of commercial paper, $950 million related to the aforementioned collateralized borrowing from the Federal

Reserve Bank of New York, $695 million related to MetLife Bank’s liability under the aforementioned repurchase agreements with the FHLB

of NY with original maturities of less than one year and $300 million related to MICC’s liability for borrowings from the FHLB of Boston with

original maturities of less than one year. Short-term debt at December 31, 2007 consisted entirely of commercial paper. During the years

ended December 31, 2008, 2007 and 2006, the weighted average interest rate on short-term debt was 2.4%, 5.0% and 5.2%,

respectively. During the years ended December 31, 2008, 2007 and 2006, the average daily balance of short-term debt was $1.3 billion,

$1.6 billion and $1.9 billion, respectively and short-term debt was outstanding for an average of 25 days, 30 days and 39 days,

respectively.

Interest Expense

Interest expense related to the Company’s indebtedness included in other expenses was $554 million, $600 million and $642 million for

the years ended December 31, 2008, 2007 and 2006, respectively, and does not include interest expense on collateral financing

arrangements, junior subordinated debt securities, common equity units or shares subject to mandatory redemption. See Notes 11, 12, 13

and 14.

Credit and Committed Facilities and Letters of Credit

Credit Facilities. The Company maintains committed and unsecured credit facilities aggregating $3.2 billion at December 31, 2008.

When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements as specified below. The

facilities can be used for general corporate purposes and, at December 31, 2008, $2.9 billion of the facilities also served as back-up lines

of credit for the Company’s commercial paper programs. These agreements contain various administrative, reporting, legal and financial

covenants, including one requiring the Company to maintain a specified minimum consolidated net worth. Management has no reason to

believe that its lending counterparties are unable to fulfill their respective contractual obligations.

Total fees associated with these credit facilities were $17 million, of which $11 million related to deferred amendment fees, for the year

ended December 31, 2008. Information on these credit facilities at December 31, 2008 is as follows:

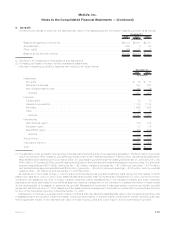

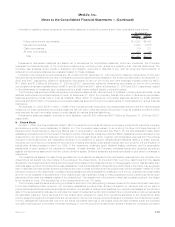

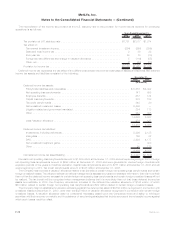

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . June 2012(1) $2,850 $2,313 $ — $537

MetLife Bank, N.A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . July 2009 (2) 300 — 100 200

Total................................................. $3,150 $2,313 $100 $737

(1) In December 2008, the Holding Company and MetLife Funding, Inc. entered into an amended and restated $2.85 billion credit agreement

with various financial institutions. The agreement amended and restated the $3.0 billion credit agreement entered into in June 2007.

Proceeds are available to be used for general corporate purposes, to support their commercial paper programs and for the issuance of

letters of credit. All borrowings under the credit agreement must be repaid by June 2012, except that letters of credit outstanding upon

termination may remain outstanding until June 2013. The borrowers and the lenders under this facility may agree to extend the term of all or

part of the facility to no later than June 2014, except that letters of credit outstanding upon termination may remain outstanding until June

2015. Fees for this agreement include a 0.25% facility fee, 0.075% fronting fee, a letter of credit fee between 1% and 5% based on certain

market rates and a 0.05% utilization fee, as applicable, and may vary based on MetLife, Inc.’s senior unsecured ratings. The Holding

Company and MetLife Funding, Inc. incurred amendment costs of $11 million related to the $2,850 million amended and restated credit

agreement, which have been capitalized and included in other assets. These costs will be amortized over the term of the agreement. The

Holding Company did not have any deferred financing costs associated with the original June 2007 credit agreement.

(2) In July 2008, the facility was increased by $100 million and its maturity extended for one year to July 2009. Fees for this agreement include

a commitment fee of $10,000 and a margin of Federal Funds plus 0.11%, as applicable.

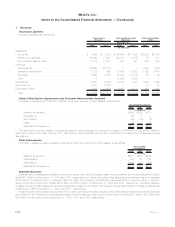

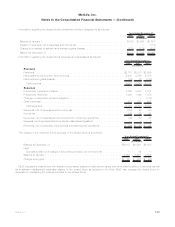

Committed Facilities. The Company maintains committed facilities aggregating $11.5 billion at December 31, 2008. When drawn

upon, these facilities bear interest at varying rates in accordance with the respective agreements as specified below. The facilities are used

for collateral for certain of the Company’s reinsurance reserves. These facilities contain various administrative, reporting, legal and financial

covenants, including one requiring the Company to maintain a specified minimum consolidated net worth. Management has no reason to

believe that its lending counterparties are unable to fulfill their respective contractual obligations.

F-63MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)