MetLife 2008 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

earnings of the closed block is greater than the expected cumulative earnings of the closed block, the Company will pay the excess of the

actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders as additional

policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the

expected cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual

cumulative earnings of the closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only

the actual earnings in income. However, the Company may change policyholder dividend scales in the future, which would be intended to

increase future actual earnings until the actual cumulative earnings equal the expected cumulative earnings.

Recent experience within the closed block, in particular mortality and investment yields, as well as realized and unrealized losses, has

resulted in a reduction of the policyholder dividend obligation to zero during the year ended December 31, 2008. The reduction of the

policyholder dividend obligation to zero and the Company’s decision to revise the expected policyholder dividend scales, which are based

upon statutory results, has resulted in reduction to both actual and expected cumulative earnings of the closed block. This change in the

timing of the expected cumulative earnings of the closed block combined with a policyholder dividend obligation of zero has resulted in a

reduction in the DAC associated with closed block, which resides outside of the closed block, and a corresponding decrease in the

Company’s net income of $127 million, net of income tax, for the year ended December 31, 2008. Amortization of the closed block DAC

will be based upon actual cumulative earnings rather than expected cumulative earnings of the closed block until such time as the actual

cumulative earnings of the closed block exceed the expected cumulative earnings, at which time the policyholder dividend obligation will

be reestablished. Actual cumulative earnings less than expected cumulative earnings will result in future reductions to DAC and net income

of the Company and increase sensitivity of the Company’s net income to movements in closed block results. See also Note 5 for further

information regarding DAC.

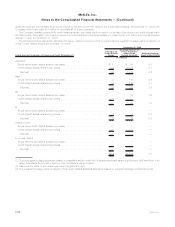

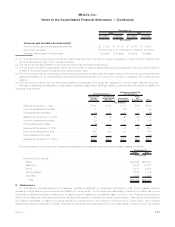

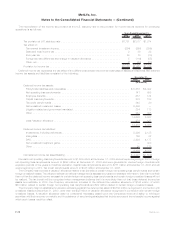

Information regarding the closed block liabilities and assets designated to the closed block is as follows:

2008 2007

December 31,

(In millions)

Closed Block Liabilities

Futurepolicybenefits............................................................. $43,520 $43,362

Otherpolicyholderfunds........................................................... 315 323

Policyholderdividendspayable....................................................... 711 709

Policyholderdividendobligation ...................................................... — 789

Payablesforcollateralundersecuritiesloanedandothertransactions.............................. 2,852 5,610

Otherliabilities ................................................................. 254 290

Totalclosedblockliabilities........................................................ 47,652 51,083

Assets Designated to the Closed Block

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $27,947 and $29,631,

respectively)................................................................ 26,205 30,481

Equity securities available-for-sale, at estimated fair value (cost: $280 and $1,555, respectively) . . . . . . . . . . . 210 1,875

Mortgageloansonrealestate...................................................... 7,243 7,472

Policyloans.................................................................. 4,426 4,290

Realestateandrealestatejointventuresheld-for-investment.................................. 381 297

Short-terminvestments .......................................................... 52 14

Otherinvestedassets ........................................................... 952 829

Totalinvestments............................................................. 39,469 45,258

Cashandcashequivalents ......................................................... 262 333

Accruedinvestmentincome......................................................... 484 485

Deferredincometaxassets......................................................... 1,632 640

Premiumsandotherreceivables...................................................... 98 151

Totalassetsdesignatedtotheclosedblock............................................. 41,945 46,867

Excessofclosedblockliabilitiesoverassetsdesignatedtotheclosedblock......................... 5,707 4,216

Amounts included in accumulated other comprehensive income (loss):

Unrealized investment gains (losses), net of income tax of ($633) and $424, respectively . . . . . . . . . . . . . . . . (1,174) 751

Unrealized gains (losses) on derivative instruments, net of income tax of ($8) and ($19), respectively . . . . . . . . (15) (33)

Allocated $284, net of income tax, to policyholder dividend obligation at December 31, 2007. . . . . . . . . . . . . — (505)

Totalamountsincludedinaccumulatedothercomprehensiveincome(loss) ........................ (1,189) 213

Maximumfutureearningstoberecognizedfromclosedblockassetsandliabilities ..................... $ 4,518 $ 4,429

F-60 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)