MetLife 2008 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

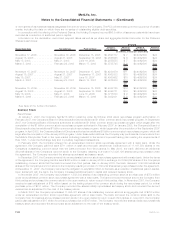

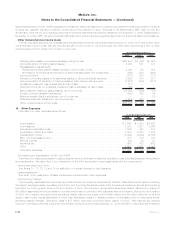

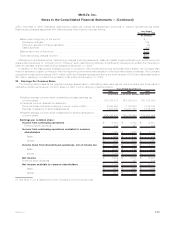

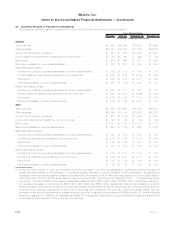

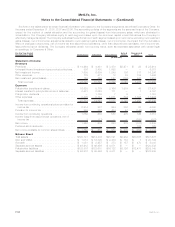

21. Quarterly Results of Operations (Unaudited)

The unaudited quarterly results of operations for 2008 and 2007 are summarized in the table below:

March 31, June 30, September 30, December 31,

Three Months Ended

(In millions, except per share data)

2008(1)

Totalrevenues ............................................. $11,626 $12,048 $13,353 $13,962

Totalexpenses............................................. $10,788 $10,824 $11,763 $12,524

Incomefromcontinuingoperations................................ $ 628 $ 883 $ 1,058 $ 941

Income (loss) from discontinued operations, net of income tax . . . . . . . . . . . . . . $ 20 $ 63 $ (428) $ 44

Netincome............................................... $ 648 $ 946 $ 630 $ 985

Netincomeavailabletocommonshareholders ........................ $ 615 $ 915 $ 600 $ 954

Basic earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 0.82 $ 1.19 $ 1.44 $ 1.15

Income (loss) from discontinued operations, net of income tax . . . . . . . . . . . . . $ 0.03 $ 0.09 $ (0.60) $ 0.06

Netincome.............................................. $ 0.90 $ 1.33 $ 0.88 $ 1.25

Netincomeavailabletocommonshareholders....................... $ 0.85 $ 1.28 $ 0.84 $ 1.21

Diluted earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 0.81 $ 1.17 $ 1.42 $ 1.14

Income (loss) from discontinued operations, net of income tax . . . . . . . . . . . . . $ 0.03 $ 0.09 $ (0.59) $ 0.06

Netincome.............................................. $ 0.88 $ 1.30 $ 0.88 $ 1.25

Netincomeavailabletocommonshareholders....................... $ 0.84 $ 1.26 $ 0.83 $ 1.20

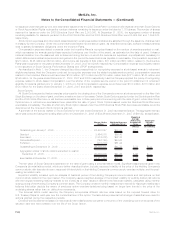

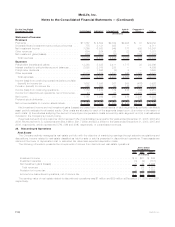

2007

Totalrevenues ............................................. $11,505 $11,699 $11,646 $12,308

Totalexpenses............................................. $10,149 $10,141 $10,328 $10,778

Incomefromcontinuingoperations................................ $ 970 $ 1,109 $ 940 $ 1,083

Incomefromdiscontinuedoperations,netofincometax.................. $ 47 $ 54 $ 79 $ 35

Netincome............................................... $ 1,017 $ 1,163 $ 1,019 $ 1,118

Netincomeavailabletocommonshareholders ........................ $ 983 $ 1,129 $ 985 $ 1,083

Basic earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 1.24 $ 1.44 $ 1.22 $ 1.42

Income from discontinued operations, net of income tax . . . . . . . . . . . . . . . . . $ 0.07 $ 0.08 $ 0.10 $ 0.05

Netincome.............................................. $ 1.35 $ 1.56 $ 1.37 $ 1.52

Netincomeavailabletocommonshareholders....................... $ 1.31 $ 1.52 $ 1.32 $ 1.47

Diluted earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 1.22 $ 1.41 $ 1.19 $ 1.39

Income from discontinued operations, net of income tax . . . . . . . . . . . . . . . . . $ 0.06 $ 0.07 $ 0.10 $ 0.05

Netincome.............................................. $ 1.32 $ 1.52 $ 1.34 $ 1.48

Netincomeavailabletocommonshareholders....................... $ 1.28 $ 1.48 $ 1.29 $ 1.44

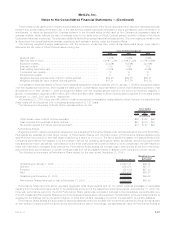

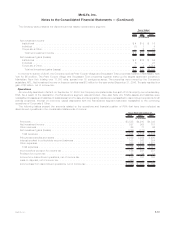

(1) During the fourth quarter of 2008, the Company recorded a cumulative out-of-period adjustment in connection with the exclusion of

certain derivative gains from the estimation of cumulative gross profits used in the determination of DAC amortization. The adjustment

decreased deferred policy acquisition costs and increased DAC amortization by $124 million and decreased net income by $80 million in

the fourth quarter of 2008. Had the amounts been reflected during the first, second and third quarters of 2008 — in the periods in which

they arose — DAC amortization would have increased (decreased) by $100 million, ($61) million, and $85 million, respectively, resulting in

an increase (decrease) of net income by ($65) million, $40 million and ($55) million, respectively. Net income available to common

shareholders per diluted common share would have been higher (lower) by ($0.09), $0.06, ($0.08) and $0.10 during the first, second,

third and fourth quarters, respectively, of 2008 had the amounts been reflected in the periods in which they arose. Based upon an

evaluation of all relevant quantitative and qualitative factors, and after considering the provisions of APB Opinion No. 28, Interim Financial

Reporting, paragraph 29, SAB No. 99, Materiality, and SAB 108, management believes this correcting adjustment was not material to the

Company’s full year results for 2008 or the trend of earnings.

F-92 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)