MetLife 2008 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

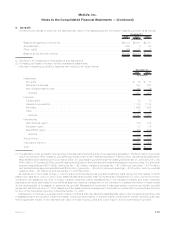

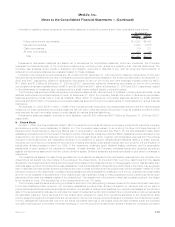

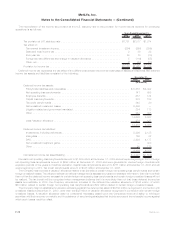

10. Long-term and Short-term Debt

Long-term and short-term debt outstanding is as follows:

Range Weighted

Average Maturity 2008 2007

December 31,

Interest Rates

(In millions)

Senior notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.00%-6.82% 6.04% 2011-2035 $ 7,660 $7,017

Repurchase agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.54%-5.65% 3.76% 2009-2013 1,062 1,213

Surplus notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.63%-7.88% 7.86% 2015-2025 698 697

Fixedratenotes .................................... 5.50%-8.02% 8.02% 2010 65 43

Other notes with varying interest rates . . . . . . . . . . . . . . . . . . . . . . 3.44%-12.00% 3.65% 2009-2016 134 75

Capitalleaseobligations............................... 48 55

Totallong-termdebt.................................. 9,667 9,100

Totalshort-termdebt ................................. 2,659 667

Total .......................................... $12,326 $9,767

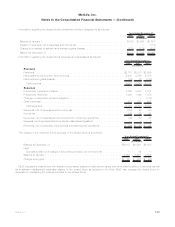

The aggregate maturities of long-term debt at December 31, 2008 for the next five years are $528 million in 2009, $352 million in 2010,

$850 million in 2011, $597 million in 2012, $600 million in 2013 and $6,740 million thereafter.

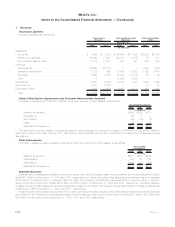

Repurchase agreements and capital lease obligations are collateralized and rank highest in priority, followed by unsecured senior debt

which consists of senior notes, fixed rate notes and other notes with varying interest rates, followed by subordinated debt which consists

of junior subordinated debentures. Payments of interest and principal on the Company’s surplus notes, which are subordinate to all other

obligations at the operating company level and senior to obligations at the Holding Company, may be made only with the prior approval of

the insurance department of the state of domicile. Collateral financing arrangements are supported by either surplus notes of subsidiaries

or financing arrangements with the Holding Company and accordingly have priority consistent with other such obligations.

Long-term debt, credit facilities and letters of credit of the Holding Company and its subsidiaries contain various covenants. The

Company has certain administrative, reporting, legal and financial covenants, including one requiring the Company to maintain a specified

minimum consolidated net worth. The Company amended certain of its credit facilities, including its $2.85 billion, five-year revolving credit

facilities, in December 2008. The Company was in compliance with all covenants at December 31, 2008 and 2007.

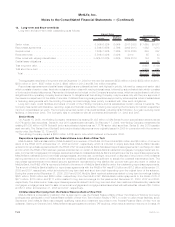

Senior Notes

On August 15, 2008, the Holding Company remarketed its existing $1,035 million 4.82% Series A junior subordinated debentures as

6.817% senior debt securities, Series A, due 2018 payable semi-annually. On February 17, 2009, the Holding Company remarketed its

existing $1,035 million 4.91% Series B junior subordinated debentures as 7.717% senior debt securities, Series B, due 2019 payable

semi-annually. The Series A and Series B junior subordinated debentures were originally issued in 2005 in connection with the common

equity units. See Notes 12, 13 and 25.

The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006.

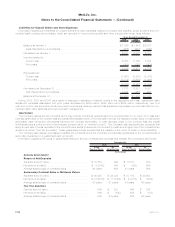

Repurchase Agreements with the Federal Home Loan Bank of New York

MetLife Bank, National Association (“MetLife Bank”) is a member of the FHLB of NY and holds $89 million and $64 million of common

stock of the FHLB of NY at December 31, 2008 and 2007, respectively, which is included in equity securities. MetLife Bank has also

entered into repurchase agreements with the FHLB of NY whereby MetLife Bank has issued repurchase agreements in exchange for cash

and for which the FHLB of NY has been granted a blanket lien on certain of MetLife Bank’s residential mortgages, mortgage loans held-for-

sale, commercial mortgages and mortgage-backed securities to collateralize MetLife Bank’s obligations under the repurchase agreements.

MetLife Bank maintains control over these pledged assets, and may use, commingle, encumber or dispose of any portion of the collateral

as long as there is no event of default and the remaining qualified collateral is sufficient to satisfy the collateral maintenance level. The

repurchase agreements and the related security agreement represented by this blanket lien provide that upon any event of default by

MetLife Bank, the FHLB of NY’s recovery is limited to the amount of MetLife Bank’s liability under the outstanding repurchase agreements.

The amount of MetLife Bank’s liability for repurchase agreements with the FHLB of NY was $1.8 billion and $1.2 billion at December 31,

2008 and 2007, respectively, which is included in long-term debt and short-term debt depending upon the original tenor of the advance.

During the years ended December 31, 2008, 2007 and 2006, MetLife Bank received advances related to long-term borrowings totaling

$220 million, $390 million and $260 million, respectively, from the FHLB of NY. MetLife Bank made repayments to the FHLB of NY of

$371 million, $175 million and $117 million related to long-term borrowings for the years ended December 31, 2008, 2007 and 2006,

respectively. The advances on these repurchase agreements related to both long-term and short-term debt are collateralized by residential

mortgages, mortgage loans held-for-sale, commercial mortgages and mortgage-backed securities with estimated fair values of $3.1 billion

and $1.3 billion at December 31, 2008 and 2007, respectively.

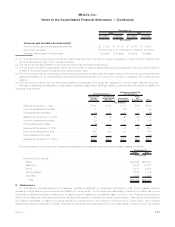

Collateralized Borrowing from the Federal Reserve Bank of New York

MetLife Bank is a depository institution that is approved to use the Federal Reserve Bank of New York Discount Window borrowing

privileges and participate in the Federal Reserve Bank of New York Term Auction Facility (“TAF”). In order to utilize these facilities, since

September 2008 MetLife Bank has pledged qualifying loans and investment securities to the Federal Reserve Bank of New York as

collateral. Starting in October 2008, MetLife Bank has participated in periodic TAF auctions, which have a maximum maturity of 84 days. At

F-62 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)