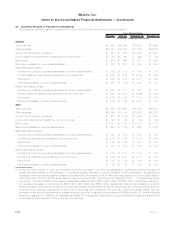

MetLife 2008 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2006, the Company repurchased 3,993,024 shares of its outstanding common stock at an aggregate cost of $232 million

under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock sold to the

Company from third parties and purchased the common stock in the open market to return to such third parties. In February 2007, the

Company paid a cash adjustment of $8 million for a final purchase price of $240 million. The Company recorded the shares initially

repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of the treasury stock.

During the years ended December 31, 2008 and 2007, the Company repurchased 1,550,000 shares and 3,171,700 shares,

respectively, through open market purchases for $88 million and $200 million, respectively.

The Company repurchased 21,266,418 and 26,626,824 shares of its common stock for $1,250 million and $1,705 million, respec-

tively, during the years ended December 31, 2008 and 2007, respectively. At December 31, 2008, an aggregate of $1,261 million remains

available under the Company’s January 2008 and April 2008 common stock repurchase programs. The Company does not intend to make

any purchases under the common stock repurchase program in 2009.

In connection with the split-off of RGA as described in Note 2, the Company received from MetLife stockholders 23,093,689 shares of

the Company’s common stock with a market value of $1,318 million and, in exchange, delivered 29,243,539 shares of RGA Class B

common stock with a net book value of $1,716 million resulting in a loss on disposition, including transaction costs, of $458 million.

Future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its financial

strength and credit ratings, general market conditions and the price of the Company’s common stock.

Issuances

As described in Note 13, in August 2008, the Company delivered 20,244,549 shares of its common stock from treasury stock for

$1,035 million in connection with the initial settlement of the stock purchase contracts issued as part of the common equity units sold in

June 2005. Also, as described in Notes 13 and 25, the Company subsequently delivered 24,343,154 shares of its newly issued common

stock on February 17, 2009 at a value of $1,035 million to settle the remaining stock purchase contracts issued as part of the common

equity units sold in June 2005. In the aggregate, the Company issued 44,587,703 shares of common stock to settle the stock purchase

contracts.

In October 2008, the Company issued 86,250,000 shares of its common stock at a price of $26.50 per share for gross proceeds of

$2,286 million. Of the shares issued, 75,000,000 shares, with a value of $4,040 million were issued from treasury stock for consideration

of $1,988 million. In connection with the offering of common stock, the Company incurred $60.1 million of issuance costs which have been

recorded as a reduction of additional paid-in capital.

During the years ended December 31, 2008 and 2007, 97,515,737 and 3,864,894 shares of common stock were issued from treasury

stock for $5,221 million and $172 million, respectively.

Dividends

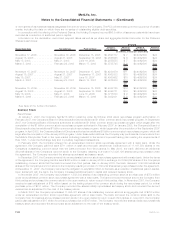

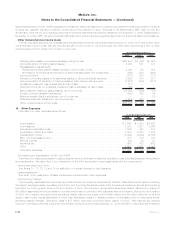

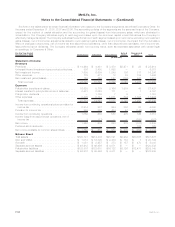

The table below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the

common stock:

Declaration Date Record Date Payment Date Per Share Aggregate

Dividend

(In millions,

except per share data)

October 28, 2008 . . . . . . . . . . November 10, 2008 December 15, 2008 $0.74 $592

October 23, 2007 . . . . . . . . . . November 6, 2007 December 14, 2007 $0.74 $541

October 24, 2006 . . . . . . . . . . November 6, 2006 December 15, 2006 $0.59 $450

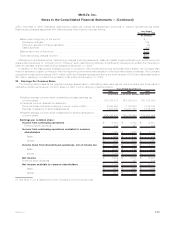

Stock-BasedCompensationPlans

Overview

As described more fully in Note 1, effective January 1, 2006, the Company adopted SFAS 123(r), using the modified prospective

transition method. The adoption of SFAS 123(r) did not have a significant impact on the Company’s financial position or results of

operations.

Description of Plans

The MetLife, Inc. 2000 Stock Incentive Plan, as amended (the “Stock Incentive Plan”), authorized the granting of awards in the form of

options to buy shares of the Company’s common stock (“Stock Options”) that either qualify as incentive Stock Options under Section 422A

of the Internal Revenue Code or are non-qualified. The MetLife, Inc. 2000 Directors Stock Plan, as amended (the “Directors Stock Plan”),

authorized the granting of awards in the form of the Company’s common stock, non-qualified Stock Options, or a combination of the

foregoing to outside Directors of the Company. Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan, as amended (the

“2005 Stock Plan”), awards granted may be in the form of Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock

Units, Performance Shares or Performance Share Units, Cash-Based Awards, and Stock-Based Awards (each as defined in the 2005

Stock Plan). Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the “2005 Directors Stock Plan”), awards

granted may be in the form of non-qualified Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, or

Stock-Based Awards (each as defined in the 2005 Directors Stock Plan). The Stock Incentive Plan, Directors Stock Plan, 2005 Stock Plan,

the 2005 Directors Stock Plan and the LTPCP, as described below, are hereinafter collectively referred to as the “Incentive Plans.”

The aggregate number of shares reserved for issuance under the 2005 Stock Plan and the LTPCP is 68,000,000, plus those shares

available but not utilized under the Stock Incentive Plan and those shares utilized under the Stock Incentive Plan that are recovered due to

forfeiture of Stock Options. Additional shares carried forward from the Stock Incentive Plan and available for issuance under the 2005

Stock Plan were 12,584,119 at December 31, 2008. There were no shares carried forward from the Directors Stock Plan. Each share

issued under the 2005 Stock Plan in connection with a Stock Option or Stock Appreciation Right reduces the number of shares remaining

F-85MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)