MetLife 2008 Annual Report Download - page 95

Download and view the complete annual report

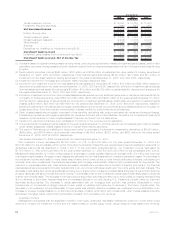

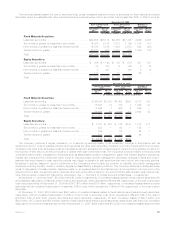

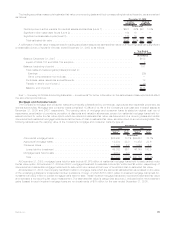

Please find page 95 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.maturity securities and equity securities, respectively, with an unrealized loss position of 20% or more of cost or amortized cost, which

represented 28% and 31% of the cost or amortized cost of such fixed maturity securities and equity securities, respectively. Of such

unrealized losses of $402 million and $133 million, $383 million and $133 million related to fixed maturity securities and equity securities,

respectively, that were in an unrealized loss position for a period of less than six months.

The Company held 699 fixed maturity securities and 33 equity securities, each with a gross unrealized loss at December 31, 2008 of

greater than $10 million. These 699 fixed maturity securities represented 50%, or $14.5 billion in the aggregate, of the gross unrealized

loss on fixed maturity securities. These 33 equity securities represented 71%, or $699 million in the aggregate, of the gross unrealized loss

on equity securities. The Company held 23 fixed maturity securities and six equity securities, each with a gross unrealized loss at

December 31, 2007 of greater than $10 million. These 23 fixed maturity securities represented 8%, or $357 million in the aggregate, of the

gross unrealized loss on fixed maturity securities. These six equity securities represented 20%, or $90 million in the aggregate, of the gross

unrealized loss on equity securities. The fixed maturity and equity securities, each with a gross unrealized loss greater than $10 million,

increased $14.7 billion during the year ended December 31, 2008. These securities were included in the regular evaluation of whether

such securities are other-than-temporarily impaired. Based upon the Company’s current evaluation of these securities in accordance with

its impairment policy, the cause of the decline being primarily attributable to a rise in market yields caused principally by an extensive

widening of credit spreads which resulted from a lack of market liquidity and a short-term market dislocation versus a long-term

deterioration in credit quality, and the Company’s current intent and ability to hold the fixed maturity and equity securities with unrealized

losses for a period of time sufficient for them to recover, the Company has concluded that these securities are not other-than-temporarily

impaired.

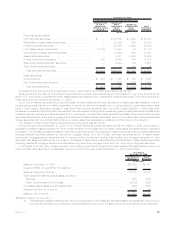

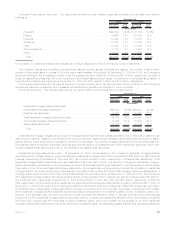

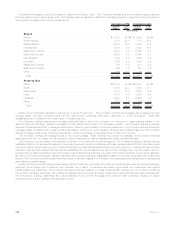

In the Company’s impairment review process, the duration of, and severity of, an unrealized loss position, such as unrealized losses of

20% or more for equity securities, which was $903 million and $133 million at December 31, 2008 and 2007, respectively, is given greater

weight and consideration, than for fixed maturity securities. An extended and severe unrealized loss position on a fixed maturity security

maynothaveanyimpactontheabilityoftheissuertoserviceallscheduled interest and principal payments and the Company’s evaluation

of recoverability of all contractual cash flows, as well as the Company’s ability and intent to hold the security, including holding the security

until the earlier of a recovery in value, or until maturity. In contrast, for an equity security, greater weight and consideration is given by the

Company to a decline in market value and the likelihood such market value decline will recover.

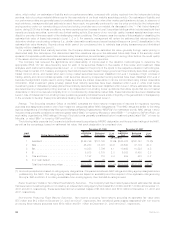

Equity securities with an unrealized loss of 20% or more for six months or greater was $384 million at December 31, 2008, of which,

$382 million of the unrealized losses, or 99%, are for non-redeemable preferred securities, of which $377 million of the unrealized losses,

or 99%, are for investment grade non-redeemable preferred securities. Of the $377 million of unrealized losses for investment grade non-

redeemable preferred securities, $372 million of the unrealized losses, or 99%, was comprised of unrealized losses on investment grade

financial services industry non-redeemable preferred securities, of which 85% are rated A or higher.

Equity securities with an unrealized loss of 20% or more for less than six months was $519 million at December 31, 2008 of which

$427 million of the unrealized losses, or 82%, are for non-redeemable preferred securities, of which $421 million of the unrealized losses,

or 98% are for investment grade non-redeemable preferred securities. Of the $421 million of unrealized losses for investment grade non-

redeemable preferred securities, $417 million of the unrealized losses, or 99%, was comprised of unrealized losses on investment grade

financial services industry non-redeemable preferred securities, of which 81% are rated A or higher.

There were no equity securities with an unrealized loss of 20% or more for twelve months or greater.

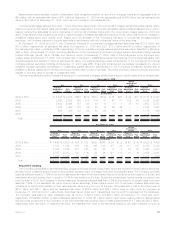

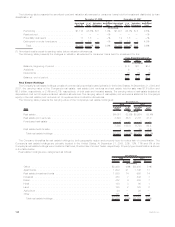

In connection with the equity securities impairment review process during 2008, the Company evaluated its holdings in non-redeemable

preferred securities, particularly those of financial services industry companies. The Company considered several factors including

whether there has been any deterioration in credit of the issuer and the likelihood of recovery in value of non-redeemable preferred

securities with a severe or an extended unrealized loss. With respect to common stock holdings, the Company considered the duration

and severity of the securities in an unrealized loss position of 20% or more; and the duration of the securities in an unrealized loss position

of 20% or less with an extended unrealized loss position (i.e. 12 months or more).

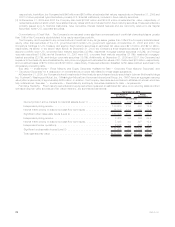

At December 31, 2008, there are $903 million of equity securities with an unrealized losses of 20% or more, of which $809 million of the

unrealized losses, or 90%, were for non-redeemable preferred securities. Through December 31, 2008, $798 million of the unrealized

losses of 20% or more, or 99%, of the non-redeemable preferred securities were investment grade securities, of which, $789 million of the

unrealized losses of 20% or more, or 99%, are investment grade financial services industry non-redeemable preferred securities; and all

non-redeemable preferred securities with unrealized losses of 20% or more, regardless of rating, have not deferred any dividend payments.

Also, the Company believes the unrealized loss position is not necessarily predictive of the ultimate performance of these securities,

and with respect to fixed maturity securities, it has the ability and intent to hold until the earlier of the recovery in value, or until maturity, and

with respect to equity securities, it has the ability and intent to hold until the recovery in value.

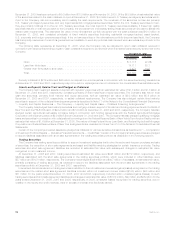

Future other-than-temporary impairments will depend primarily on economic fundamentals, issuer performance, changes in collateral

valuation, changes in interest rates, and changes in credit spreads. If economic fundamentals and other of the above factors continue to

deteriorate, additional other-than-temporary impairments may be incurred in upcoming quarters. See also “— Investments — Fixed

Maturity and Equity Securities Available-for-Sale — Impairments.”

92 MetLife, Inc.