MetLife 2008 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

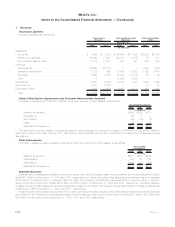

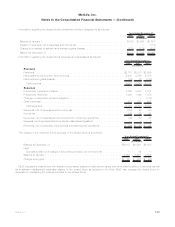

Total fees associated with these committed facilities were $35 million, of which $13 million related to deferred amendment fees, for the year ended

December 31, 2008. Information on committed facilities at December 31, 2008 is as follows:

Account Party/Borrower(s) Expiration Capacity Drawdowns

Letter of

Credit

Issuances

Unused

Commitments

Maturity

(Years)

(In millions)

MetLife, Inc. . . . . . . . . . . . . . . . . . . . . August 2009 (1) $ 500 $ — $ 500 $ — —

Exeter Reassurance Company Ltd.,

MetLife, Inc., & Missouri Reinsurance

(Barbados), Inc. . . . . . . . . . . . . . . . . . June 2016 (3) 500 — 490 10 7

Exeter Reassurance Company Ltd. . . . . . . December 2027 (2),(4) 650 — 410 240 19

MetLife Reinsurance Company of South

Carolina & MetLife, Inc. . . . . . . . . . . . . June 2037 (5) 3,500 2,692 — 808 29

MetLife Reinsurance Company of

Vermont & MetLife, Inc. . . . . . . . . . . . . December 2037 (2),(6) 2,896 — 1,359 1,537 29

MetLife Reinsurance Company of

Vermont & MetLife, Inc. . . . . . . . . . . . . September 2038(2),(7) 3,500 — 1,500 2,000 29

Total ........................ $11,546 $2,692 $4,259 $4,595

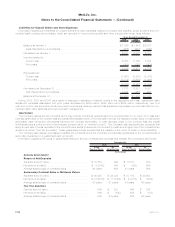

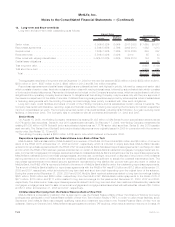

(1) In December 2008, the Holding Company entered into an amended and restated one year $500 million letter of credit facility (dated as of

August 2008 and amended and restated at December 31, 2008) with an unaffiliated financial institution. Exeter Reassurance Company,

Ltd. (“Exeter”) is a co-applicant under this letter of credit facility. This letter of credit facility matures in August 2009, except that letters of

credit outstanding upon termination may remain outstanding until August 2010. Fees for this agreement include a margin of 2.25% and a

utilization fee of 0.05%, as applicable. The Holding Company incurred amendment costs of $1.3 million related to the $500 million

amended and restated letter of credit facility, which have been capitalized and included in other assets. These costs will be amortized over

the term of the agreement.

(2) The Holding Company is a guarantor under this agreement.

(3) Letters of credit and replacements or renewals thereof issued under this facility of $280 million, $10 million and $200 million are set to

expire no later than December 2015, March 2016 and June 2016, respectively.

(4) In December 2008, Exeter, as borrower, and the Holding Company, as guarantor, entered into an amendment of an existing credit

agreement with an unaffiliated financial institution. Issuances under this facility are set to expire in December 2027. Exeter incurred

amendment costs of $1.6 million related to the amendment of the existing credit agreement, which have been capitalized and included in

other assets. These costs will be amortized over the term of the agreement.

(5) In May 2007, MetLife Reinsurance Company of South Carolina (“MRSC”), a wholly-owned subsidiary of the Company, terminated the

$2.0 billion amended and restated five-year letter of credit and reimbursement agreement entered into among the Holding Company,

MRSC and various financial institutions on April 25, 2005. In its place, the Company entered into a 30-year collateral financing

arrangement as described in Note 11, which may be extended by agreement of the Company and the financial institution on each

anniversary of the closing of the facility for an additional one-year period. At December 31, 2008, $2.7 billion had been drawn upon under

the collateral financing arrangement.

(6) In December 2007, Exeter Reassurance Company Ltd. terminated four letters of credit, with expirations from March 2025 through

December 2026, which were issued under a letter of credit facility with an unaffiliated financial institution in an aggregate amount of

$1.7 billion. The letters of credit had served as collateral for Exeter’s obligations under a reinsurance agreement that was recaptured by

MLI-USA in December 2007. MLI-USA immediately thereafter entered into a new reinsurance agreement with MetLife Reinsurance

Company of Vermont (“MRV”). To collateralize its reinsurance obligations, MRV and the Holding Company entered into a 30-year,

$2.9 billion letter of credit facility with an unaffiliated financial institution.

(7) In September 2008, MRV and the Holding Company entered into a 30-year, $3.5 billion letter of credit facility with an unaffiliated financial

institution. These letters of credit serve as collateral for MRV’s obligations under a reinsurance agreement.

Letters of Credit. At December 31, 2008, the Company had outstanding $6.6 billion in letters of credit from various financial

institutions of which $4.3 billion and $2.3 billion, were part of committed and credit facilities, respectively. As commitments associated with

letters of credit and financing arrangements may expire unused, these amounts do not necessarily reflect the Company’s actual future cash

funding requirements.

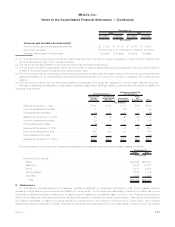

11. Collateral Financing Arrangements

Associated with the Closed Block

In December 2007, MLIC reinsured a portion of its closed block liabilities to MetLife Reinsurance Company of Charleston (“MRC”), a

wholly-owned subsidiary of the Company. In connection with this transaction, MRC issued, to investors placed by an unaffiliated financial

institution, $2.5 billion of 35-year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the

surplus notes accrues at an annual rate of 3-month LIBOR plus 0.55%, payable quarterly. The ability of MRC to make interest and principal

payments on the surplus notes is contingent upon South Carolina regulatory approval. At both December 31, 2008 and 2007, surplus

notes outstanding were $2.5 billion.

F-64 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)