MetLife 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

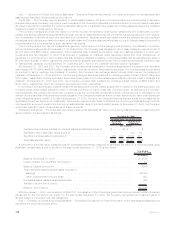

Asset-backed securities also include collateralized debt obligations backed by sub-prime mortgage loans at an aggregate cost of

$20 million with an estimated fair value of $10 million at December 31, 2008 and an aggregate cost of $63 million with an estimated fair

value of $47 million at December 31, 2007, which are not included in the tables above.

Commercial Mortgage-Backed Securities. There have been disruptions in the commercial mortgage-backed securities market due to

market perceptions that default rates will increase in part due weakness in commercial real estate market fundamentals and due in part to

relaxed underwriting standards by some originators of commercial mortgage loans within the more recent vintage years (i.e. 2006 and

later). These factors have caused a pull-back in market liquidity, increased spreads and repricing of risk, which has led to an increase in

unrealized losses since third quarter 2008. Based upon the analysis of the Company’s exposure to commercial mortgage-backed

securities, the Company expects to receive payments in accordance with the contractual terms of the securities.

At December 31, 2008 and 2007, the Company’s holdings in commercial mortgage-backed securities was $12.6 billion and

$17.0 billion, respectively, at estimated fair value. At December 31, 2008 and 2007, $11.8 billion and $14.9 billion, respectively, of

the estimated fair value, or 93% and 88%, respectively, of the commercial mortgage-backed securities were rated Aaa/AAA by Moody’s,

S&P, or Fitch. At December 31, 2008, the rating distribution of the Company’s commercial mortgage-backed securities holdings was as

follows: 93% Aaa, 4% Aa, 1% A, 1% Baa, and 1% Ba or below. At December 31, 2008, 84% of the holdings are in the 2005 and prior

vintage years. At December 31, 2008, the Company had no exposure to CMBX securities and its holdings of commercial real estate debt

obligations securities was $121 million at estimated fair value. The weighted average credit enhancement of the Company’s commercial

mortgage-backed securities holdings at December 31, 2008 was 26%. This credit enhancement percentage represents the current

weighted average estimated percentage of outstanding capital structure subordinated to the Company’s investment holding that is

available to absorb losses before the security incurs the first dollar of loss of principal. The credit protection does not include any equity

interest or property value in excess of outstanding debt.

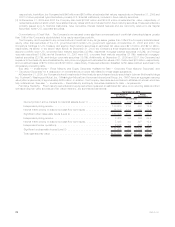

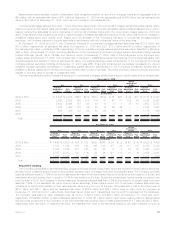

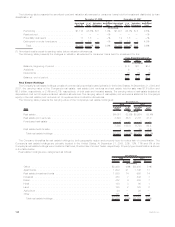

The following table shows the Company’s exposure to commercial mortgage-backed securities by credit quality and by vintage year:

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2008

(In millions)

2003 & Prior . . . . . . . . . . . . . . $ 5,428 $ 4,975 $424 $272 $213 $124 $ 51 $24 $ 42 $17 $ 6,158 $ 5,412

2004 . . . . . . . . . . . . . . . . . . 2,630 2,255 205 100 114 41 47 11 102 50 3,098 2,457

2005 . . . . . . . . . . . . . . . . . . 3,403 2,664 187 49 40 13 5 1 18 10 3,653 2,737

2006 . . . . . . . . . . . . . . . . . . 1,825 1,348 110 39 25 14 94 36 — — 2,054 1,437

2007 . . . . . . . . . . . . . . . . . . 999 535 43 28 63 28 10 9 — — 1,115 600

2008 . . . . . . . . . . . . . . . . . . 1 1 — — — — — — — — 1 1

Total . . . . . . . . . . . . . . . . . $14,286 $11,778 $969 $488 $455 $220 $207 $81 $162 $77 $16,079 $12,644

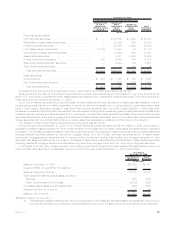

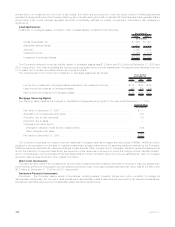

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2007

(In millions)

2003 & Prior . . . . . . . . . . . . $ 5,442 $ 5,500 $ 504 $ 512 $339 $342 $ 94 $ 92 $ 42 $ 43 $ 6,421 $ 6,489

2004 . . . . . . . . . . . . . . . . . 1,738 1,749 156 148 106 100 47 34 111 101 2,158 2,132

2005 . . . . . . . . . . . . . . . . . 3,154 3,166 212 198 50 48 5 4 76 61 3,497 3,477

2006 . . . . . . . . . . . . . . . . . 2,767 2,813 120 116 34 34 121 118 10 10 3,052 3,091

2007 . . . . . . . . . . . . . . . . . 1,680 1,672 91 87 37 36 10 9 — — 1,818 1,804

Total . . . . . . . . . . . . . . . . $14,781 $14,900 $1,083 $1,061 $566 $560 $277 $257 $239 $215 $16,946 $16,993

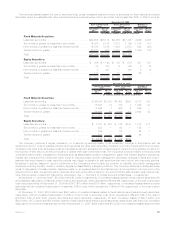

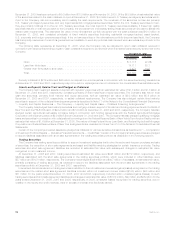

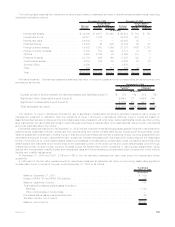

Securities Lending

The Company participates in securities lending programs whereby blocks of securities, which are included in fixed maturity securities,

and short-term investments are loaned to third parties, primarily major brokerage firms and commercial banks. The Company generally

requires collateral equal to 102% of the current estimated fair value of the loaned securities to be obtained at the inception of a loan, and

maintained at a level greater than or equal to 100% for the duration of the loan. During the extraordinary market events occurring in the

fourth quarter of 2008, the Company, in limited instances, accepted collateral less than 102% at the inception of certain loans, but never

less than 100%, of the estimated fair value of such loaned securities. These loans involved U.S. Government Treasury Bills which are

considered to have limited variation in their estimated fair value during the term of the loan. Securities with a cost or amortized cost of

$20.8 billion and $41.1 billion and an estimated fair value of $22.9 billion and $42.1 billion were on loan under the program at

December 31, 2008 and 2007, respectively. Securities loaned under such transactions may be sold or repledged by the transferee.

The Company was liable for cash collateral under its control of $23.3 billion and $43.3 billion at December 31, 2008 and 2007,

respectively. Of this $23.3 billion of cash collateral at December 31, 2008, $5.1 billion was on open terms, meaning that the related loaned

security could be returned to the Company on the next business day requiring return of cash collateral and $14.7 billion and $3.5 billion,

respectively were due within 30 days and 60 days. The estimated fair value of the securities related to the cash collateral on open at

97MetLife, Inc.