MetLife 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) See “— Management’s Discussion and Analysis of Financial Condition and Results of Operations — Acquisitions and Dispositions” for a

description of acquisitions and dispositions.

(2) Consists principally of foreign currency translation adjustments.

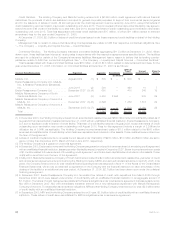

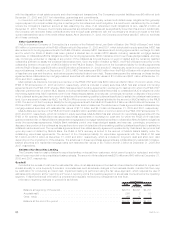

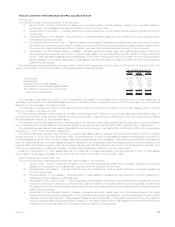

Information regarding goodwill by segment and reporting unit is as follows:

2008 2007

December 31,

(In millions)

Institutional:

Grouplife .......................................................... $ 15 $ 15

Retirement&savings................................................... 887 887

Non-medicalhealth&other............................................... 149 76

Subtotal.......................................................... 1,051 978

Individual:

Traditionallife........................................................ 73 73

Variable&universallife.................................................. 1,174 1,174

Annuities........................................................... 1,692 1,692

Other ............................................................. 18 18

Subtotal.......................................................... 2,957 2,957

International:

LatinAmericaregion ................................................... 184 104

Europeanregion ...................................................... 37 50

AsiaPacificregion..................................................... 152 159

Subtotal.......................................................... 373 313

Auto&Home.......................................................... 157 157

Corporate&Other(1)..................................................... 470 409

Total ............................................................... $5,008 $4,814

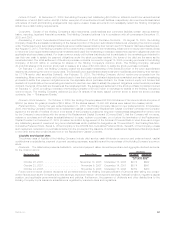

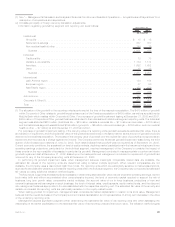

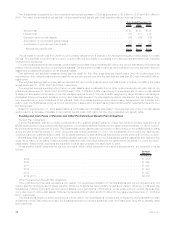

(1) The allocation of the goodwill to the reporting units is performed at the time of the respective acquisition. The $470 million of goodwill

within Corporate & Other relates to goodwill acquired as a part of the Travelers acquisition of $405 million, as well as acquisitions by

MetLife Bank which resides within Corporate & Other. For purposes of goodwill impairment testing at December 31, 2008 and 2007,

$405 million of Corporate & Other goodwill has been attributed to the Individual and Institutional segment reporting units. The Individual

segment was attributed $210 million, (traditional life — $23 million, variable & universal life — $11 million and annuities — $176 million)

and the Institutional segment was attributed $195 million, (group life — $2 million, retirement & savings — $186 million, and non-medical

health & other — $7 million) at both December 31, 2008 and 2007.

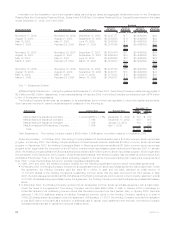

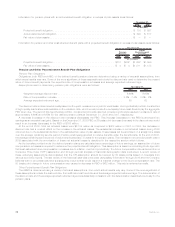

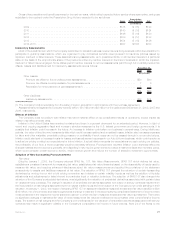

For purposes of goodwill impairment testing, if the carrying value of a reporting unit’s goodwill exceeds its estimated fair value, there is

an indication of impairment, and the implied fair value of the goodwill is determined in the same manner as the amount of goodwill would be

determined in a business acquisition. The excess of the carrying value of goodwill over the implied fair value of goodwill is recognized as an

impairment and recorded as a charge against net income. The Company performed its annual goodwill impairment tests during the third

quarter of 2008 based upon data as of June 30, 2008. Such tests indicated that goodwill was not impaired as of September 30, 2008.

Current economic conditions, the sustained low level of equity markets, declining market capitalizations in the insurance industry and lower

operating earnings projections, particularly for the Individual segment, required management of the Company to consider the impact of

these events on the recoverability of its assets, in particular its goodwill. Management concluded it was appropriate to perform an interim

goodwill impairment test at December 31, 2008. Based upon the tests performed management concluded no impairment of goodwill had

occurred for any of the Company’s reporting units at December 31, 2008.

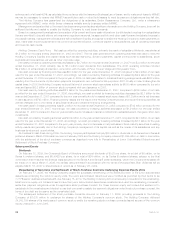

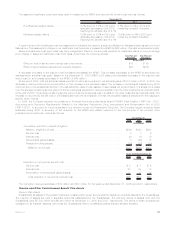

In performing its goodwill impairment tests, when management believes meaningful comparable market data are available, the

estimated fair values of the reporting units are determined using a market multiple approach. When relevant comparables are not

available, the Company uses a discounted cash flow model. For reporting units which are particularly sensitive to market assumptions,

such as the annuities and variable & universal life reporting units within the Individual segment, the Company may corroborate its estimated

fair values by using additional valuation methodologies.

The key inputs, judgments and assumptions necessary in determining estimated fair value include projected operating earnings, current

book value (with and without accumulated other comprehensive income), the level of economic capital required to support the mix of

business, long term growth rates, comparative market multiples, the account value of our in-force business, projections of new and

renewal business as well as margins on such business, the level of interest rates, credit spreads, equity market levels, and the discount

rate management believes appropriate to the risk associated with the respective reporting unit. The estimated fair value of the annuity and

variable & universal life reporting units are particularly sensitive to the equity market levels.

When testing goodwill for impairment, management also considers its market capitalization in relation to its book value. Management

believes that the overall decrease in the Company’s current market capitalization is not representative of a long-term decrease in the value

of the underlying reporting units.

Management applies significant judgment when determining the estimated fair value of its reporting units and when assessing the

relationship of its market capitalization to the estimated fair value of its reporting units and their book value. The valuation methodologies

69MetLife, Inc.