MetLife 2008 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

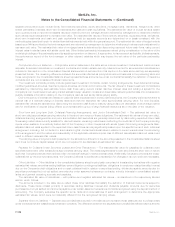

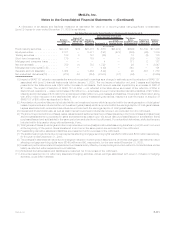

Assets and Liabilities Measured at Fair Value

Recurring Fair Value Measurements

The assets and liabilities measured at estimated fair value on a recurring basis, including those items for which the Company has

elected the fair value option, are determined as described in the preceding section. These estimated fair values and their corresponding

fair value hierarchy are summarized as follows:

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair Value

Fair Value Measurements at

Reporting Date Using

December 31, 2008

(In millions)

Assets

Fixed maturity securities:

U.S.corporatesecurities...................................... $ — $ 55,805 $ 7,498 $ 63,303

Residentialmortgage-backedsecurities ............................ — 35,433 595 36,028

Foreigncorporatesecurities.................................... — 23,735 5,944 29,679

U.S.Treasury/agencysecurities ................................. 10,132 11,090 88 21,310

Commercialmortgage-backedsecurities ........................... — 12,384 260 12,644

Asset-backedsecurities ...................................... — 8,071 2,452 10,523

Foreigngovernmentsecurities .................................. 282 9,463 408 10,153

Stateandpoliticalsubdivisionsecurities............................ — 4,434 123 4,557

Otherfixedmaturitysecurities................................... — 14 40 54

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,414 160,429 17,408 188,251

Equity securities:

Commonstock............................................ 413 1,167 105 1,685

Non-redeemablepreferredstock................................. — 238 1,274 1,512

Totalequitysecurities ...................................... 413 1,405 1,379 3,197

Tradingsecurities........................................... 587 184 175 946

Short-terminvestments(1) ..................................... 10,549 2,913 100 13,562

Mortgageandconsumerloans(2) ................................ — 1,798 177 1,975

Derivativeassets(3) ......................................... 55 9,483 2,768 12,306

Netembeddedderivativeswithinassethostcontracts(4) ................. — — 205 205

Mortgageservicingrights(5).................................... — — 191 191

Separateaccountassets(6).................................... 85,886 33,195 1,758 120,839

Totalassets............................................. $107,904 $209,407 $24,161 $341,472

Liabilities

Derivativeliabilities(3) ........................................ $ 273 $ 3,548 $ 221 $ 4,042

Net embedded derivatives within liability host contracts(4) . . . . . . . . . . . . . . . . — (83) 3,134 3,051

Tradingliabilities(7).......................................... 57 — — 57

Totalliabilities............................................ $ 330 $ 3,465 $ 3,355 $ 7,150

(1) Short-term investments as presented in the table above differ from the amounts presented in the consolidated balance sheet because

certain short-term investments are not measured at estimated fair value (e.g. time deposits, money market funds, etc.).

(2) Mortgage and consumer loans as presented in the table above differ from the amount presented in the consolidated balance sheet as this

table only includes residential mortgage loans held-for-sale measured at estimated fair value on a recurring basis.

(3) Derivative assets are presented within other invested assets and derivatives liabilities are presented within other liabilities. The amounts

are presented gross in the table above to reflect the presentation in the consolidated balance sheet, but are presented net for purposes of

the rollforward in the following tables.

(4) Net embedded derivatives within asset host contracts are presented within premiums and other receivables. Net embedded derivatives

within liability host contracts are presented within policyholder account balances. Equity securities also includes embedded derivatives of

($173) million.

(5) Mortgage servicing rights are presented within other invested assets.

(6) Separate account assets are measured at estimated fair value. Investment performance related to separate account assets is fully offset

by corresponding amounts credited to contractholders whose liability is reflected within separate account liabilities. Separate account

liabilities are set equal to the estimated fair value of separate account assets as prescribed by SOP 03-1.

(7) Trading liabilities are presented within other liabilities.

F-109MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)