MetLife 2008 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

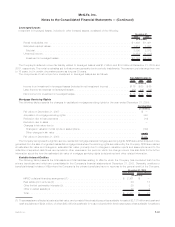

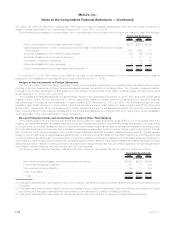

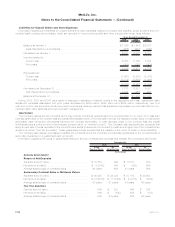

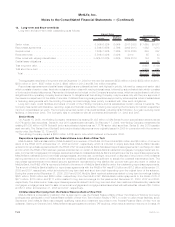

6. Goodwill

Goodwill is the excess of cost over the estimated fair value of net assets acquired. Information regarding goodwill is as follows:

2008 2007 2006

December 31,

(In millions)

Balanceatbeginningoftheperiod..................................... $4,814 $4,801 $4,701

Acquisitions(1).................................................. 256 2 93

Other,net(2) ................................................... (62) 11 7

Balanceattheendoftheperiod ...................................... $5,008 $4,814 $4,801

(1) See Note 2 for a description of acquisitions and dispositions.

(2) Consisting principally of foreign currency translation adjustments.

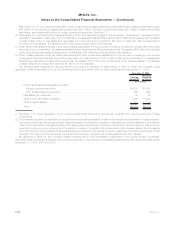

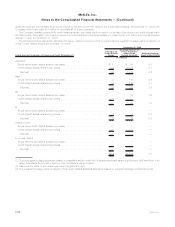

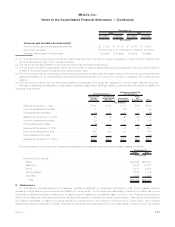

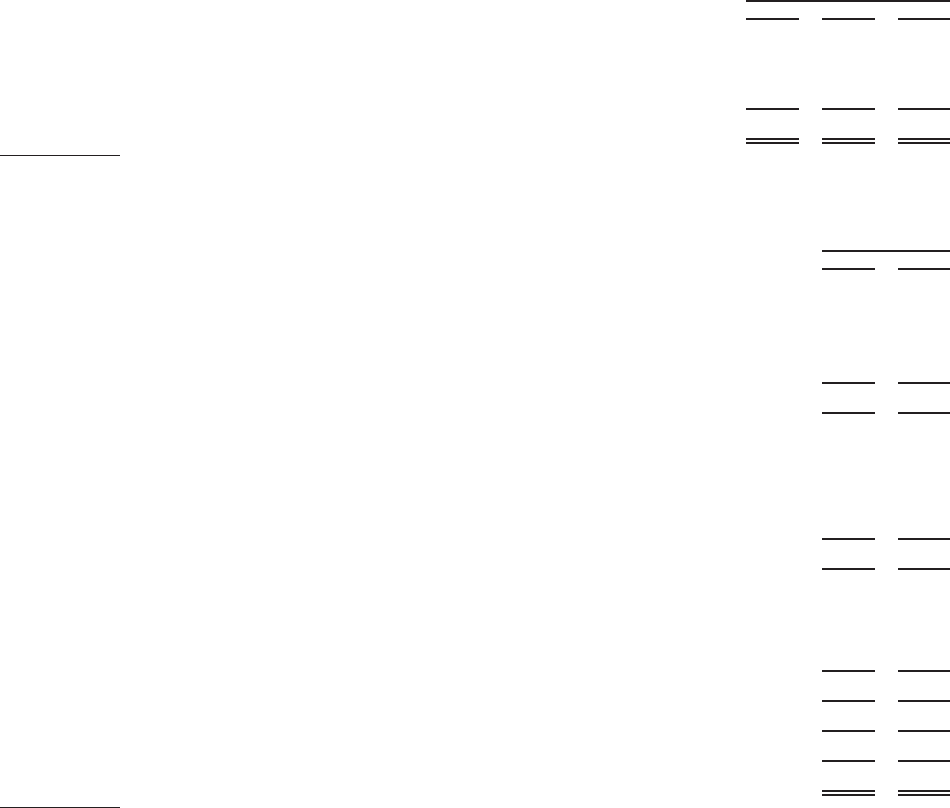

Information regarding goodwill by segment and reporting unit is as follows:

2008 2007

December 31,

(In millions)

Institutional:

Grouplife .......................................................... $ 15 $ 15

Retirement&savings................................................... 887 887

Non-medicalhealth&other............................................... 149 76

Subtotal.......................................................... 1,051 978

Individual:

Traditionallife........................................................ 73 73

Variable&universallife.................................................. 1,174 1,174

Annuities........................................................... 1,692 1,692

Other ............................................................. 18 18

Subtotal.......................................................... 2,957 2,957

International:

LatinAmericaregion ................................................... 184 104

Europeanregion ...................................................... 37 50

AsiaPacificregion..................................................... 152 159

Subtotal.......................................................... 373 313

Auto&Home.......................................................... 157 157

Corporate&Other(1)..................................................... 470 409

Total ............................................................... $5,008 $4,814

(1) The allocation of the goodwill to the reporting units was performed at the time of the respective acquisition. The $470 million of goodwill

within Corporate & Other relates to goodwill acquired as a part of the Travelers acquisition of $405 million, as well as acquisitions by

MetLife Bank which resides within Corporate & Other. For purposes of goodwill impairment testing at December 31, 2008 and 2007, the

$405 million of Corporate & Other goodwill has been attributed to the Individual and Institutional segment reporting units. The Individual

segment was attributed $210 million, (traditional life — $23 million, variable & universal life — $11 million and annuities — $176 million)

and the Institutional segment was attributed $195 million, (group life — $2 million, retirement & savings — $186 million, and non-medical

health & other — $7 million) at both December 31, 2008 and 2007.

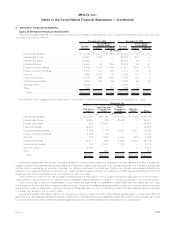

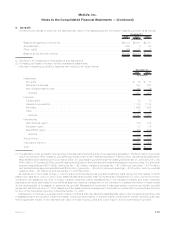

As described in more detail in Note 1, the Company performed its annual goodwill impairment tests during the third quarter of 2008

based upon data as of June 30, 2008. Such tests indicated that goodwill was not impaired as of September 30, 2008. Current economic

conditions, the sustained low level of equity markets, declining market capitalizations in the insurance industry and lower operating

earnings projections, particularly for the Individual segment, required management of the Company to consider the impact of these events

on the recoverability of its assets, in particular its goodwill. Management concluded it was appropriate to perform an interim goodwill

impairment test at December 31, 2008. Based upon the tests performed management concluded no impairment of goodwill had occurred

for any of the Company’s reporting units at December 31, 2008.

Management continues to evaluate current market conditions that may affect the estimated fair value of the Company’s reporting units

to assess whether any goodwill impairment exists. Continued deteriorating or adverse market conditions for certain reporting units may

have a significant impact on the estimated fair value of these reporting units and could result in future impairments of goodwill.

F-53MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)